Spy Options Trading Blogs: Uncovering Secrets and Strategy

Image: www.tradingview.com

Introduction:

In the cloak-and-dagger world of finance, spy options trading blogs have emerged as stealthy portals offering a glimpse into the enigmatic realm of financial intelligence. These platforms delve into the intricate maneuvers of options trading, revealing strategies and insights that can empower investors seeking to outsmart the market. Whether you’re a seasoned trader or an aspiring detective, embarking on a journey through these covert online labs will arm you with the necessary intel.

What is Spy Options Trading?

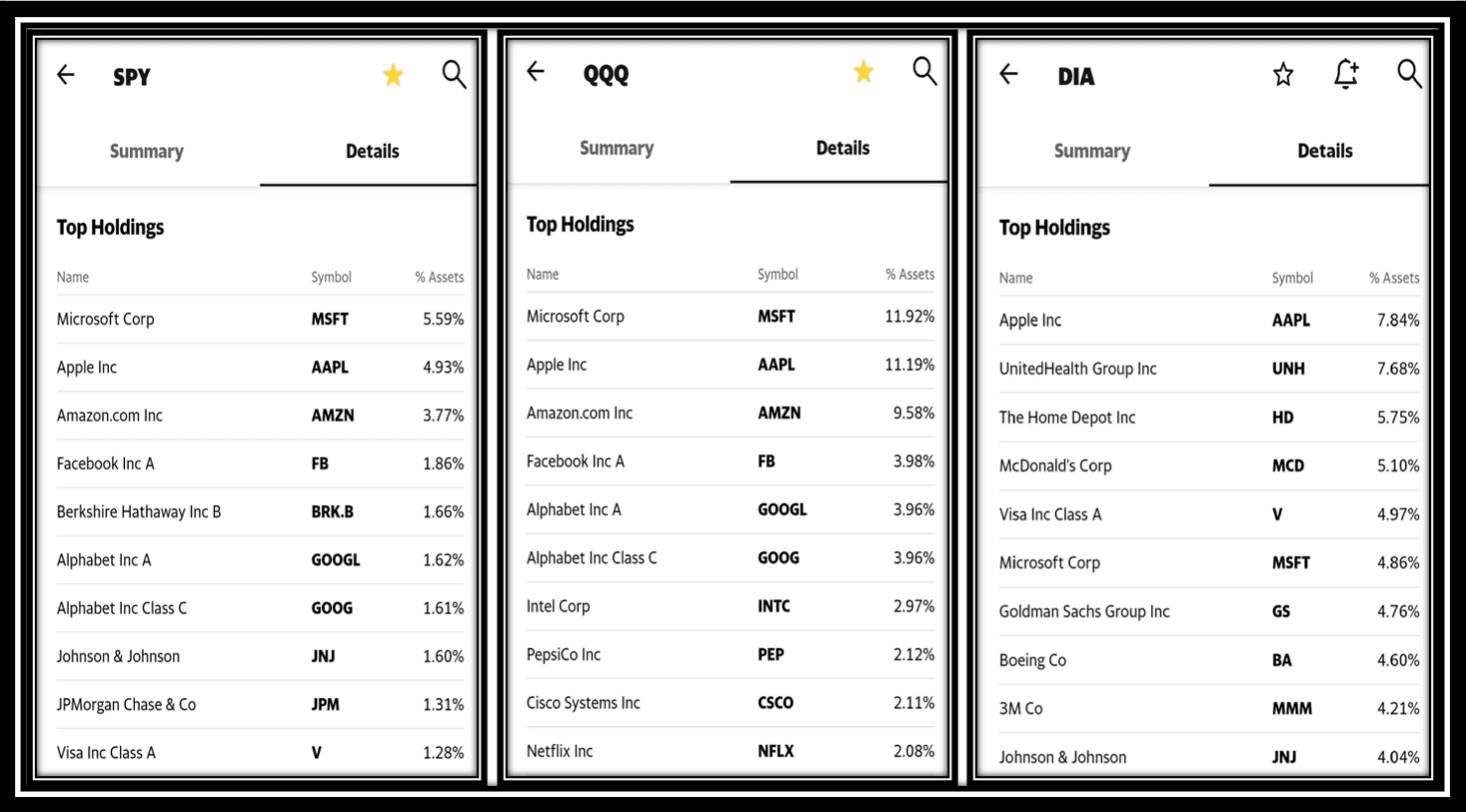

Spy options trading, in essence, involves using options contracts to gain exposure to the performance of underlying assets, known as “spies.” These spies typically comprise baskets of stocks representing major market indices, such as the S&P 500 or Nasdaq 100. Options contracts grant the holder the right to buy or sell the underlying asset at a predetermined price on a set date. Spy options trading allows investors to capitalize on perceived market movements without the need to directly purchase or sell the underlying assets.

The Value of Spy Options Trading Blogs:

Navigating the labyrinth of spy options trading requires comprehensive knowledge and astute strategy. Spy options trading blogs play a vital role in equipping investors with the necessary acumen. These platforms offer:

-

Expert Insights: Conduits for seasoned traders, spies, and analysts to share their first-hand experiences, successful strategies, and insights into market trends.

-

Trading Strategies: Comprehensive guides covering various trading strategies employed in the spy options arena, from simple to advanced, tailored to different risk profiles and market conditions.

-

Market Analysis: In-depth market commentary that deciphers economic indicators, technical patterns, and geopolitical events that influence spy options trading.

-

Educational Resources: A treasure trove of educational articles, webinars, and tutorials designed to empower aspiring traders with the fundamentals of spy options trading.

Essential Considerations:

Before venturing into the world of spy options trading, several essential considerations must be taken into account:

-

Risk Tolerance: Options trading involves leverage, which can amplify both potential profits and losses. Determine your risk appetite and trade accordingly.

-

Volatility: Spy options are particularly sensitive to market volatility. Understand the impact of volatility on option premiums and make informed decisions.

-

Trading Strategies: Explore various trading strategies and select those that align with your investment goals and risk tolerance.

-

Research and Education: Continuously expand your knowledge base by reading books, attending webinars, and seeking mentorship from experienced traders.

Conclusion:

Spy options trading blogs serve as clandestine allies in the quest for financial intelligence. By delving into these platforms, investors can gather expert insights, unravel trading strategies, track market analysis, and gain the necessary knowledge to navigate the enigmatic waters of spy options trading. Remember, financial markets are akin to a chessboard where knowledge and strategy are the winning moves. Harness the power of spy options trading blogs to become the master of your financial destiny.

Image: successfultradings.com

Spy Options Trading Blogs

Image: www.youtube.com