The Allure of Options Trading

Picture yourself standing at the edge of a sprawling field, the wind whispering secrets in your ears. You’re an explorer at the dawn of a new frontier, ready to embark on an adventure into the realm of options trading. Like any untamed territory, it holds both promise and peril, and mastering its intricacies is paramount to navigating its complexities.

Image: www.stockmarkethindi.in

Options trading grants you the power to harness the volatility of the financial markets, potentially amplifying your returns or safeguarding your investments. But remember, with great power comes great responsibility. Delving into options trading without a firm grasp of its rules and nuances is akin to venturing into a labyrinth without a compass.

Deciphering the Options Trading Landscape

Definition and Anatomy of Options Contracts

An option contract is a tradable agreement that bestows upon you the right, but not the obligation, to buy (call option) or sell (put option) an underlying asset (such as a stock, index, or commodity) at a predetermined price (strike price) on or before a specified date (expiration date).

Types of Options Contracts

The options trading landscape comprises two primary types of contracts: calls and puts. Call options provide you with the right to buy an asset at the strike price, while put options give you the right to sell. Each comes with its own set of strategies and nuances, catering to diverse investment objectives.

Image: pathfinderstraining.com

Risks and Rewards of Options Trading

The world of options trading is intertwined with both opportunities and risks. While options can magnify your profits, they amplify your potential losses too. Understanding the potential risks and rewards associated with each strategy is imperative for making informed decisions.

Understanding Market Movements

The dance of financial markets is a complex symphony, with prices fluctuating constantly. Options traders must possess an eagle-eye for market trends and an unwavering grasp of how external factors influence asset prices. This knowledge forms the backbone of successful options trading.

Navigating the Options Market with Expertise

Mastering Options Strategies

Within the vast realm of options trading lie a myriad of strategies, each catering to specific market scenarios and investment goals. Mastering these strategies, from simple to complex, empowers traders to tackle market fluctuations with poise and precision.

Leveraging Technical Analysis

Technical analysis is the art of deciphering market patterns by studying price movements and volume data. By harnessing this skill, options traders gain invaluable insights into potential trading opportunities and risk management strategies.

Expert Insights and Practical Tips

Tips for Aspiring Options Traders

- Educate yourself: Knowledge is the cornerstone of success in options trading. Devour books, articles, and online resources to equip yourself with a firm understanding of the subject matter.

- Start small: Dip your toes into the waters of options trading gradually. Begin with small trades until you gain confidence and experience.

- Set realistic expectations: The road to options trading mastery is paved with both wins and losses. Set realistic profit targets and embrace a long-term perspective.

Advice from Seasoned Professionals

- Manage risk: Risk management is paramount in options trading. Utilize stop-loss orders and other risk-mitigating strategies to protect your capital from excessive losses.

- Stay informed: The financial markets are ever-evolving. Stay abreast of news, economic indicators, and market trends to make informed trading decisions.

- Seek mentorship: Connect with experienced options traders or join online forums to learn from those who have navigated the market’s complexities.

Frequently Asked Questions (FAQs)

- Q: What is the difference between a call and a put option?

A: A call option grants you the right to buy an asset, while a put option grants you the right to sell.

- Q: How do I determine the value of an option contract?

A: Option value is influenced by several factors, including the asset’s price, volatility, time until expiration, and interest rates.

- Q: What are the risks involved in options trading?

A: Options trading entails the risk of losing the entire investment, especially in short-term strategies.

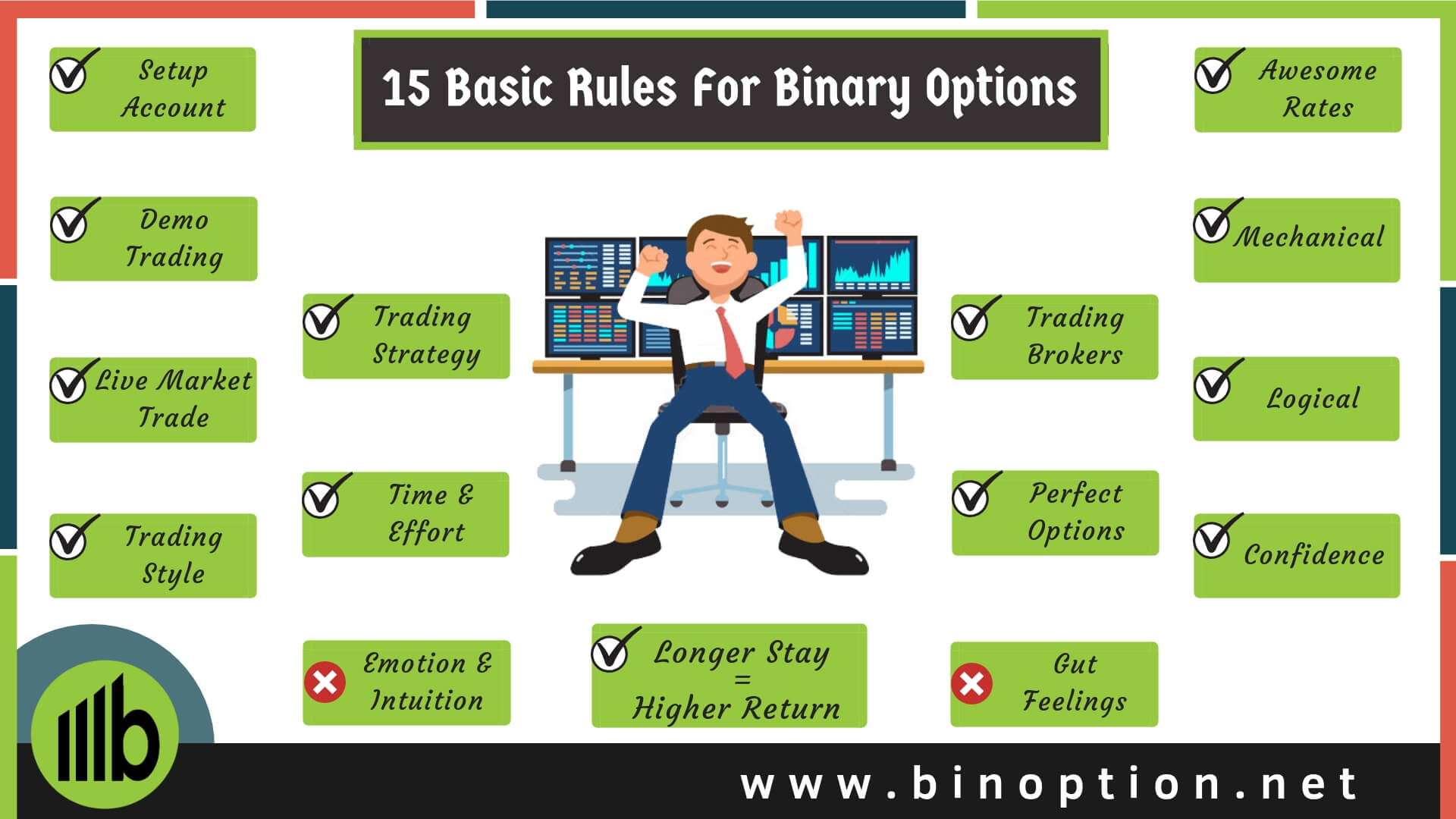

Rules Of Options Trading

Image: www.binoption.net

Conclusion

Options trading offers a tantalizing blend of risk and reward, empowering traders to potentially amplify their returns or mitigate losses. However, venturing into this realm without a deep understanding of its rules and complexities is a recipe for setbacks. Embrace the principles outlined in this guide, seek knowledge relentlessly, and approach the market with a measured and informed mindset. The path to options trading mastery is paved with challenges, but it is also laden with the potential for boundless opportunities.

As you embark on your options trading journey, ask yourself: Is this a world you wish to conquer? The choice is yours. Dive into the depths of this captivating realm and unveil its secrets for yourself.