Headline: Experience the Surge: Conquering Nasdaq 100 with QQQ Option Strategies

Introduction

In the bustling arena of financial markets, options trading stands out as a captivating opportunity for strategic investors. Among the vast selection of options, QQQ options have emerged as a gateway to harnessing the dynamic Nasdaq 100 Index. This guide unveils the intricate world of QQQ options, empowering you with the knowledge to unlock their transformative potential.

Image: investorplace.com

QQQ options represent a derivative contract that grants investors the right, but not the obligation, to buy (call option) or sell (put option) the Invesco QQQ Trust. This ETF tracks the Nasdaq 100 Index, a collective of 100 of the world’s most innovative and influential non-financial companies. By leveraging QQQ options, traders can amplify their exposure to the Nasdaq 100’s growth trajectory or protect their portfolios against market downturns.

Delving into QQQ Option Basics

Understanding the fundamentals of QQQ options is paramount to navigating the complexities of this market. Each option contract represents 100 shares of QQQ, with a defined expiration date and strike price. The strike price denotes the price at which the underlying QQQ shares can be bought (for a call option) or sold (for a put option).

The premium, or price you pay for an option contract, is influenced by several factors, including the market’s perception of future volatility, the time until expiration, and the current price of QQQ shares. Options premiums can fluctuate significantly based on these variables, creating a dynamic and challenging trading environment.

Mastering QQQ Option Strategies

The spectrum of QQQ option strategies is vast, each tailored to specific trading objectives. Whether you seek to maximize gains in rising markets or hedge against potential losses, QQQ options offer a flexible toolkit for navigating diverse market conditions.

Call Options:

Call options allow investors to benefit from a predicted increase in QQQ share prices. By purchasing a call option, you gain the right to buy shares at the strike price, regardless of the market price at expiration. If QQQ shares rise above the strike price, you can exercise your option to purchase shares at a lower price, generating a profit.

Put Options:

Put options, on the other hand, provide a safeguard against declining QQQ share prices. You can purchase a put option to gain the right to sell shares at the strike price, even if the market price has plummeted. If QQQ shares fall below the strike price, you can exercise your option to sell shares at a higher price, mitigating your losses.

Real-World Applications of QQQ Options

QQQ options find practical applications in a multitude of investment scenarios:

Bullish Market Bets:

In anticipation of a sustained upward trend in the Nasdaq 100 Index, investors can employ call options to leverage their exposure to the upside potential. By purchasing a call option with a higher strike price above the current QQQ price, they have the potential to amplify their gains if the market continues to surge.

Bearish Market Protection:

When economic headwinds threaten to erode market confidence, investors can use put options to hedge against potential losses. By purchasing a put option with a lower strike price below the current QQQ price, they can limit their downside risk if the Nasdaq 100 Index takes a downturn.

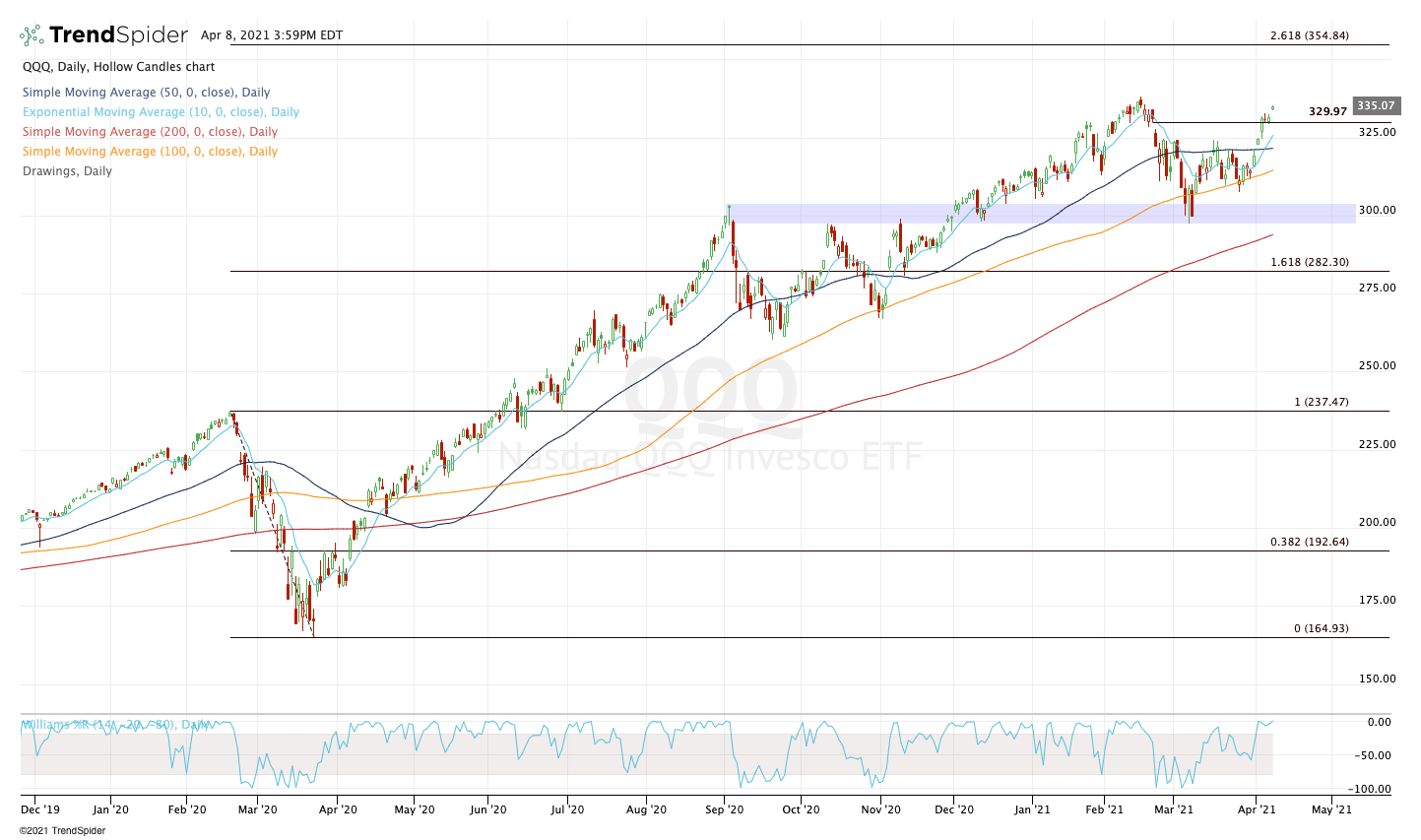

Image: rightsideofthechart.com

Evolving Trends in QQQ Option Trading

The QQQ option market is constantly evolving, with new strategies and innovations emerging to meet the ever-changing needs of investors. One notable trend is the rise of binary options, which offer a simpler, albeit potentially riskier, way to speculate on QQQ’s price action.

Another trend is the increasing adoption of algorithmic trading, where sophisticated algorithms automate option trades based on pre-defined parameters. This approach can enhance trading efficiency but also requires a deep understanding of market dynamics.

Qqq Option Trading Only

Image: thesteadytrader.com

Conclusion

QQQ options have revolutionized the way investors participate in the growth of the Nasdaq 100 Index. By providing a flexible and potentially lucrative toolset, QQQ options empower traders to tailor strategies to their individual objectives and risk tolerance.

This comprehensive guide has delved into the intricate world of QQQ options, equipping you with the knowledge to navigate its complexities and harness its transformative potential. Embrace this journey of financial empowerment and discover the art of dominating Nasdaq 100 with QQQ options.