Options Trading: An Introduction

Options trading is a powerful financial tool that allows investors to speculate on the future price of an underlying asset, such as a stock, index, or commodity, without having to own the asset itself. Options contracts provide a versatile way to potentially profit from market movements, both up and down. The profits run strategy is a specific technique used in options trading to capitalize on anticipated changes in an underlying asset’s price.

Image: www.pinterest.com

The Profits Run Strategy Explained

At its core, the profits run strategy involves buying an option with a lower strike price than the current market price, known as an “in-the-money” (ITM) option. The investor aims to hold the option until its expiration date, leveraging the potential for the underlying asset’s price to continue its upward trend and push the option further ITM. This strategy is particularly well-suited for markets expected to experience sustained bull runs or steady increases in asset value.

Implementing the Profits Run Strategy

To implement the profits run strategy, investors typically follow these steps:

- Select an Underlying Asset: Identify a stock, index, or commodity that is anticipated to show positive price momentum. Technical analysis, fundamental analysis, or a combination of both can aid in asset selection.

- Choose an Option: Once the underlying asset is determined, select an ITM option with a strike price slightly below the current market price. The option should have sufficient time to expiration (several weeks or months) to allow for the intended price movement.

- Determine Position Size: Calculate the number of options contracts to buy based on the investor’s risk tolerance and financial objectives. It is crucial to manage risk by investing only what is affordable to lose.

- Monitor and Adjust: Throughout the holding period, monitor the underlying asset’s price closely. If the price moves significantly against the investor’s favored direction, consider adjusting positions to limit potential losses.

Advantages of the Profits Run Strategy

The profits run strategy offers several potential advantages for traders:

- Leverage: Options trading provides leverage, allowing investors to control a significant amount of the underlying asset with a relatively small initial investment compared to directly purchasing the asset.

- Profit Potential: The strategy can generate substantial profits if the underlying asset price continues to rise as anticipated.

- Limited Risk: Unlike purchasing the actual asset, ITM options limit the potential financial loss to the premium paid for the option contract.

- Diversification: Options trading can add diversification to an investment portfolio, reducing overall market risk.

Image: www.tradingsim.com

Considerations and Cautions

While the profits run strategy can be lucrative, it is essential to acknowledge its potential drawbacks:

- Time Decay: Options have a limited lifespan, and their value decays over time, even if the underlying asset price remains unchanged.

- Market Volatility: Unexpected market events or volatility can significantly impact option pricing, potentially leading to losses.

- Margin Requirements: Brokers may require traders to meet margin requirements when trading options, which can tie up capital.

- Emotional Trading: Options trading can evoke strong emotions. Investors should maintain discipline and avoid making rash decisions based on fear or greed.

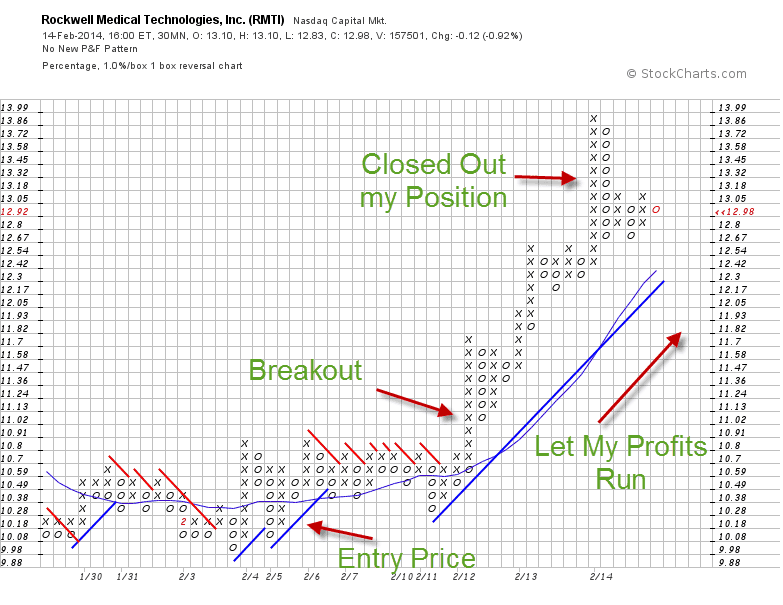

Profits Run Option Trading

Image: www.youtube.com

Conclusion

The profits run strategy offers a viable approach for investors seeking to benefit from anticipated bull runs in the financial markets. It provides leverage, profit potential, and limited risk, making it an attractive option for experienced traders. However, it is crucial to understand the strategy’s complexities, manage risk, and exercise caution before implementing it in an investment portfolio. By thoroughly researching, conducting due diligence, and adhering to sound trading practices, investors can harness the potential of the profits run strategy while mitigating associated risks.