Introduction

In the thrilling realm of options trading, a world of possibilities awaits. As a seasoned investor, I’ve witnessed firsthand the transformative power of options strategies in optimizing portfolios and navigating market volatility. Let’s embark on a journey into the world of options trading, exploring its intricacies and unlocking its potential.

Image: ar.inspiredpencil.com

Understanding the Options Market

Options contracts, financial instruments that convey the right but not the obligation to buy (calls) or sell (puts) underlying assets at a predetermined price on a specific date, offer traders a versatile tool for managing risk and enhancing returns. The options market operates like a sophisticated chess game where traders make calculated moves to profit from market movements.

The underlying assets in options trading encompass stocks, indices, commodities, and even currencies, allowing traders to speculate on price fluctuations across various markets. By leveraging these contracts, traders can hedge against losses, speculate on market trends, generate income, and customize investment strategies.

Covered Calls: Enhancing Returns with Downside Protection

Covered calls involve selling calls against a stock position that you already own. This strategy allows you to generate additional income from the sale of the call while simultaneously limiting your downside risk. In a neutral market, you can earn the call premium without affecting your original investment. However, if the stock price rises above the strike price, you may lose the potential upside, but you have offset this risk with the premium earned.

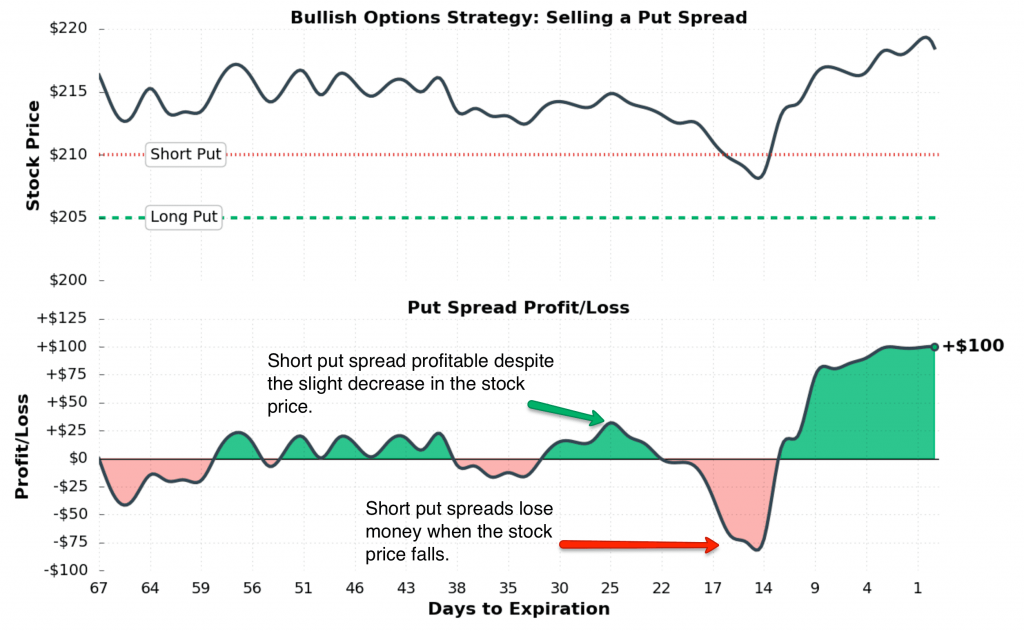

Bullish Put Spread: Betting on Growth with Limited Risk

A bullish put spread is appropriate when you expect an underlying asset to rise in value. The strategy involves buying a lower strike price put option and simultaneously selling a higher strike price put option. As the stock price rises, the value of the long put increases, potentially offsetting the cost of the short put, providing you with a limited-risk opportunity to profit from the expected growth.

Image: www.pinterest.co.uk

Bearish Collar: Yield Enhancement and Downside Protection

A bearish collar involves selling a higher strike price call and buying a lower strike price put option. This strategy provides a yield enhancement while limiting your downside risk. The premium earned from selling the call can offset the cost of purchasing the put, creating a net credit. If the stock price declines significantly, the put option provides downside protection by giving you the right to sell at a predetermined price.

Tips and Expert Advice

Navigating options trading requires knowledge and a disciplined approach. Here are some tips to enhance your strategy:

- Research and Understand: Thoroughly understand the underlying assets, options contracts, and market dynamics before trading.

- Risk Management: Implement risk management techniques such as position sizing, stop-loss orders, and diversification to mitigate potential losses.

- Timely Adjustments: Monitor market conditions and adjust your options strategies as necessary to maximize profits and minimize risks.

- Technical Analysis: Utilize technical analysis tools to identify potential trends and trading opportunities.

FAQs on Options Trading

- Q: What are the risks involved in options trading?

A: Options trading involves the risk of losing capital, including the premium paid for the options contracts and potential losses on the underlying assets. - Q: How much capital is required to start options trading?

A: The amount of capital required varies depending on the options contracts being traded and the risk tolerance of the trader. - Q: Is options trading suitable for all investors?

A: Options trading is a complex and sophisticated investment strategy that may not be suitable for all investors. It is essential to have a deep understanding of financial markets and investment principles before engaging in options trading.

Potential Options Trading Strategies

Image: www.projectoption.com

Conclusion

Embracing options trading strategies empowers investors to optimize their portfolios, manage risk, and seek enhanced returns. While it requires knowledge and a disciplined approach, the potential rewards can be substantial. By leveraging the concepts explored in this article, you can unlock the power of options trading and navigate the financial markets with greater confidence and strategy.

Are you ready to delve deeper into the world of options trading? Join the community and engage in further discussions on strategies, insights, and market trends. Your journey to financial empowerment starts here.