In the world of finance, options trading is a powerful tool that allows investors to navigate complex markets and potentially profit from both rising and falling asset prices. At the heart of options trading lies the underlying asset, which serves as the foundation upon which these contracts are built. Understanding this crucial element is essential for informed decision-making and successful trading.

Image: www.usedhomeremodeling.com

What is the Underlying Asset in Options Trading?

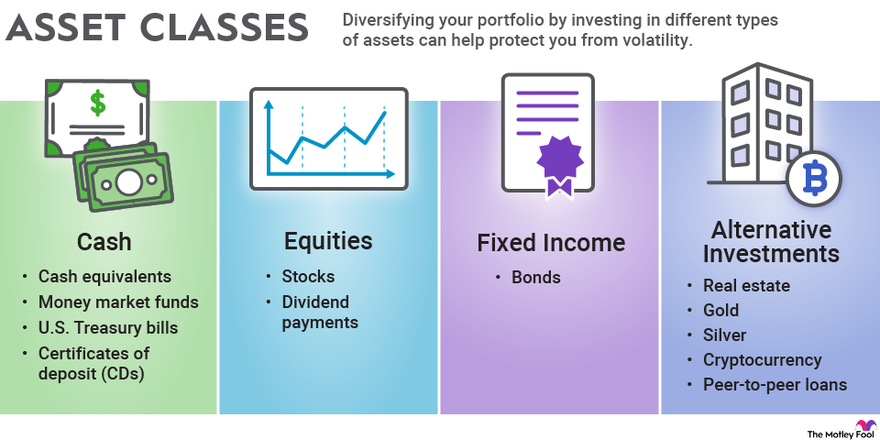

Simply put, the underlying asset in options trading refers to the security or financial instrument that is being traded. This underlying asset can take various forms, such as stocks, bonds, commodities, currencies, and indices. When an investor purchases an option contract, they are essentially acquiring the right, but not the obligation, to buy or sell the underlying asset at a specified price within a certain time frame. Therefore, the performance and value of the underlying asset directly influence the value of the option contract itself.

Understanding the Role of the Underlying Asset

The underlying asset plays a multi-faceted role in options trading:

-

Price Determination: The price of an option contract is determined by several factors, including the strike price, time to expiration, volatility, and supply and demand. However, the underlying asset’s price heavily influences these factors.

-

Expiration Date: Option contracts have a predefined expiration date, after which they become worthless. The underlying asset’s performance until that date significantly determines the option’s value.

-

Trading Strategies: Options traders employ various strategies, such as buying calls or writing puts, based on their expectations about the underlying asset’s future price movements. The underlying asset provides the framework for implementing these strategies.

-

Hedging and Speculation: Options can be used for both hedging and speculative purposes. Hedgers use options to reduce the risk associated with their portfolio, while speculators seek to profit from price fluctuations in the underlying asset.

Importance of Understanding the Underlying Asset

A thorough understanding of the underlying asset is crucial for successful options trading:

-

Informed Trading Decisions: Knowing the underlying asset’s historical performance, fundamentals, and industry dynamics enables traders to make educated decisions about option contracts.

-

Risk Management: Understanding the underlying asset’s volatility and potential price movements helps traders effectively manage risk and minimize potential losses.

-

Profitable Opportunities: Identifying opportunities in the underlying asset’s price movements allows traders to exploit market inefficiencies and potentially generate substantial profits.

Image: www.tradethetechnicals.com

Options Trading Underlying Asset

Image: www.fool.com

Conclusion

In the realm of options trading, the underlying asset serves as the cornerstone of every transaction. By comprehending the nature, role, and significance of the underlying asset, traders can unlock the full potential of this powerful financial instrument. Thorough research, coupled with a keen understanding of the underlying asset, is essential for making informed decisions, managing risk, and ultimately achieving success in options trading.