Delving into the world of options trading can be exhilarating, yet understanding its tax implications is crucial for UK traders. This comprehensive guide will equip you with the knowledge you need to navigate the intricacies of options trading taxes in the UK, ensuring you optimize your financial returns and stay compliant with regulations.

Image: www.youtube.com

Navigating the UK Tax Landscape for Options Trading

In the UK, options trading is subject to Capital Gains Tax (CGT). CGT is levied on the profit you make from the sale or disposal of an asset, including options. When it comes to options, the tax treatment depends on whether you are considered a trader or an investor.

Options Trading as a Trader

If you trade options frequently and as part of your business or profession, you will be classified as a trader. In this case, your options trading profits are treated as business income and taxed accordingly. This means you will pay income tax and National Insurance contributions on your profits.

Options Trading as an Investor

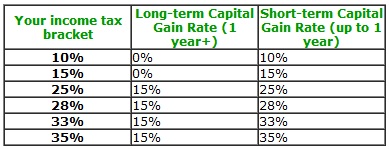

If you trade options less frequently and as a means of investment, you will be classified as an investor. In this case, your options trading profits are subject to CGT. The applicable CGT rate will depend on your overall income and gains for the tax year.

Image: laqenyberegi.web.fc2.com

Calculating Your Tax Liability

Calculating your tax liability for options trading involves determining your taxable profit. This is calculated by subtracting the cost of acquiring the option (including any brokerage fees) from the proceeds you receive when you sell or exercise the option. Your taxable profit is then added to your other income for the tax year to determine your overall tax liability.

Tax Treatment of Different Types of Options

Different types of options are taxed differently in the UK.

- Call options: The profit you make from selling or exercising a call option is subject to CGT.

- Put options: The profit you make from selling or exercising a put option is also subject to CGT.

- Spread betting: Spread betting on options is not subject to CGT. However, any winnings are not tax-free and may be subject to income tax if you are considered a professional trader.

Tax Planning Tips for Options Traders

To optimize your tax position as an options trader, consider the following tips:

- Keep accurate records: Maintain detailed records of all your options trades, including the date, strike price, expiration date, and proceeds. This will help you accurately calculate your taxable profits.

- Utilize tax-advantaged accounts: Consider trading options within a tax-advantaged account, such as an ISA, where your profits are exempt from CGT.

- Seek professional advice: Complex tax situations may require expert guidance. Consult with a qualified tax advisor to ensure you understand your obligations and optimize your tax position.

Common FAQs about Options Trading UK Tax

- Q: Do I need to pay tax if I lose money on options trading?

A: No, you only pay tax on profits from options trading in the UK. - Q: Can I offset options trading losses against other income?

A: Yes, if you are classified as a trader, you may be able to offset options trading losses against your other business income. - Q: What is the tax rate for options trading profits?

A: The tax rate for options trading profits depends on whether you are classified as a trader or an investor. For traders, the profit is taxed as business income, while for investors, it is subject to CGT.

Understanding the tax implications of options trading in the UK is essential for successful trading. By staying informed and adopting sound tax planning strategies, you can maximize your returns and minimize your tax liability. Remember, the information provided in this guide is general in nature. For personalized advice tailored to your specific circumstances, please consult with a qualified tax advisor.

Options Trading Uk Tax

Image: www.youtube.com

Are you ready to elevate your Options Trading Journey?

Embarking on the path of options trading can be both lucrative and challenging. However, by equipping yourself with the necessary knowledge and guidance, you can navigate the complexities and maximize your potential. If you’re eager to delve deeper into options trading, I encourage you to explore our comprehensive collection of articles and resources. Stay informed, make wise decisions, and let your trading journey be marked by success.