The Swiss financial market offers numerous opportunities for investors, including options trading. As an investor in the heart of Europe, you will encounter unique advantages and considerations when engaging in this dynamic market. Let’s dive into the essentials of options trading in Switzerland.

Image: www.youtube.com

Understanding Options Trading

Options are financial contracts that grant the holder the right, but not the obligation, to buy or sell an underlying asset at a predetermined price and date. They provide investors with the flexibility to speculate on price movements while managing risk.

There are two main types of options: calls and puts. Calls give the holder the option to buy the underlying asset at the specified price, while puts offer the opposite, the option to sell. Investors can use options to hedge against risk, speculate on price movements, or as part of complex investment strategies.

Market Overview

The SIX Swiss Exchange (SIX) operates the Swiss options market. It offers a diverse range of underlying assets, including stocks, bonds, and commodities. Investors have access to listed options from various issuers, providing ample liquidity and market depth.

Switzerland has a long history of financial stability and a robust regulatory framework. The Swiss Financial Market Supervisory Authority (FINMA) oversees the options market, ensuring transparency and fairness for investors. This regulatory oversight provides a sense of security and trust.

Trading Platform

The SIX Swiss Exchange has developed a modern and user-friendly trading platform for options trading. Investors can access real-time market data, place orders electronically, and manage their portfolios conveniently and securely.

Several banks and financial institutions in Switzerland offer access to options trading platforms. These institutions provide additional features such as research, trading tools, and expert advice to support their clients’ trading activities.

Image: www.tradingview.com

Benefits of Options Trading in Switzerland

- Access to a liquid and diverse market

- Excellent trading infrastructure and platform

- Robust regulatory framework ensuring transparency and fairness

- Strategic location in the heart of Europe, providing opportunities for cross-border trading

- Ability to engage in sophisticated trading strategies

Tips for Options Trading in Switzerland

- Educate Yourself: Thoroughly understand options trading concepts, strategies, and risks before entering the market. Attend seminars, read books, and consult experts.

- Choose a Reliable Broker: Select a reputable broker that offers a suitable trading platform, research tools, and customer support.

- Manage Risk: Options can involve substantial risk. Use appropriate risk management techniques, such as setting stop-loss orders, diversifying your portfolio, and understanding your position’s potential losses.

- Follow Market Trends: Stay updated with news and economic data that can influence market movements. Use technical analysis to identify trading opportunities.

FAQs on Options Trading in Switzerland

- Q: Is options trading legal in Switzerland?

- Yes, options trading is fully legal and regulated in Switzerland.

- Q: Do I need a special license to trade options?

- No, retail investors do not require a special license to trade options.

- Q: What are the tax implications of options trading in Switzerland?

- Capital gains from options trading are subject to income tax, while losses can be used to offset other capital gains.

- Q: Are there any restrictions on foreign investors trading options in Switzerland?

- No, foreign investors have equal access to the Swiss options market.

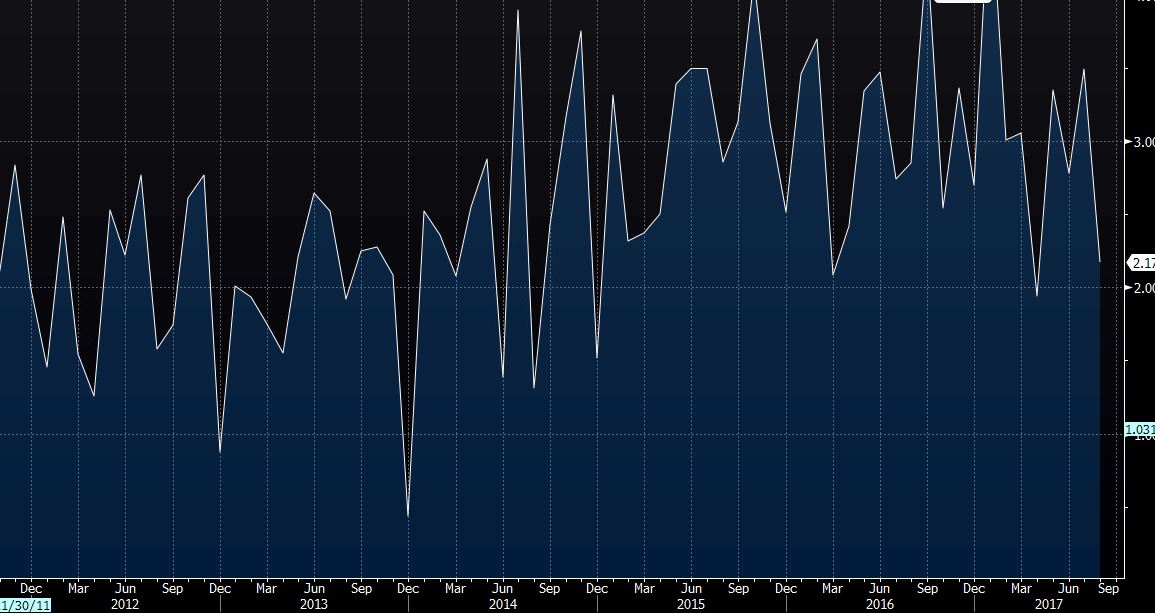

Options Trading Switzerland

Image: www.forexlive.com

Conclusion

Options trading in Switzerland offers a compelling value proposition for both domestic and international investors. The liquid market, robust regulatory framework, and access to a diverse range of underlying assets make it an attractive destination for trading options. By embracing a well-informed and risk-conscious approach, investors can harness the benefits of options trading while navigating the challenges.

Are you interested in exploring the world of options trading in Switzerland? Share your thoughts and experiences in the comments below.