Sharpen Your Skills and Master Options Trading Concepts

In the realm of financial markets, options trading stands as a powerful strategy for managing risk and potentially generating substantial returns. Embark on this options trading strategies module mock test to evaluate your understanding of key concepts, risk management techniques, and trading strategies. By navigating through this simulation, you will not only solidify your knowledge but also gain valuable insights to enhance your trading proficiency.

Image: www.quantifiedstrategies.com

Unveiling the Strategies: A Comprehensive Guide

Immerse yourself in the intricacies of various options trading strategies, each meticulously designed to navigate diverse market conditions. Comprehend the mechanics of bullish and bearish strategies, unraveling the secrets of covered calls, protective puts, and straddles. Explore the dynamic world of multi-leg strategies, where combinations of options work in harmony to create sophisticated trading approaches.

Bullish Strategies: Harnessing Market Upswings

When optimism pervades the market, bullish strategies come to the forefront. Covered calls emerge as a conservative strategy that leverages underlying assets while generating premium revenue. Protective puts serve as a safety net, guarding portfolios from potential downturns at a defined cost. Straddles, on the other hand, straddle the fence, betting on significant market movement in either direction.

Bearish Strategies: Navigating Market Declines

As the market tide ebbs, bearish strategies offer a strategic response to protect and potentially profit from falling prices. Cash-secured puts generate income by selling the right to buy an underlying asset, while naked puts amplify potential returns but demand a higher level of risk tolerance. Protective calls provide a cushion against sharp market declines, ensuring downside protection.

Image: www.pinterest.com

Multi-Leg Strategies: Orchestrating Options Combinations

Multi-leg strategies seamlessly blend multiple options types, creating a symphony of trading possibilities. Bull call spreads combine bullish calls to create a precisely defined risk and reward profile. Bear put spreads mirror this structure for bearish scenarios. Iron condors, a hybrid strategy, simultaneously profit from both limited market movement and substantial volatility fluctuations, offering a balanced approach in uncertain markets.

Risk Management: The Key to Trading Success

In the realm of options trading, risk management reigns supreme. Grasp the importance of position sizing, understanding the appropriate amount of capital to allocate to each trade. Calculate theoretical and potential returns to gauge both the upside potential and downside risks. Pinpoint the critical concept of implied volatility, appreciating its influence on options pricing and strategy effectiveness.

Discipline and Strategy Adherence: The Pillars of Profitability

Embark on this options trading strategies module mock test with unwavering determination to adhere to your trading plan. Discipline stands as the cornerstone of consistent execution, guiding every trade decision. Review your strategies objectively, continuously refining your approach based on performance analysis. Embrace the power of journaling, meticulously documenting trades to unearth biases, identify areas for improvement, and optimize future outcomes.

Options Trading Strategies Module Mock Test

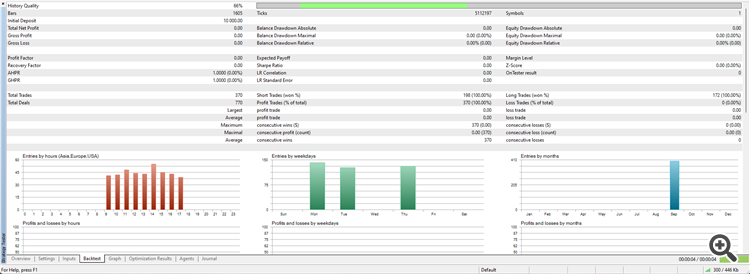

Image: www.mql5.com

Conclusion: Unveiling Your Trading Potential

This options trading strategies module mock test provides a valuable platform to assess your comprehension of key concepts and trading strategies. As you progress through the questions, immerse yourself in the intricacies of this dynamic market, unlocking the potential for informed decision-making and strategic trading execution. Let this mock test serve as a catalyst for your trading journey, empowering you to navigate financial markets with confidence and expertise.