Introduction

Options trading, a versatile financial strategy, has gained immense popularity among investors seeking enhanced returns and risk management capabilities. However, navigating the intricacies of options trading requires a systematic approach and a deep understanding of the various strategies available. In this comprehensive article, we present a detailed options trading strategies chart to equip traders with the knowledge they need to make informed decisions and maximize their trading potential.

Image: oxicivaru.web.fc2.com

Understanding Options Trading Strategies

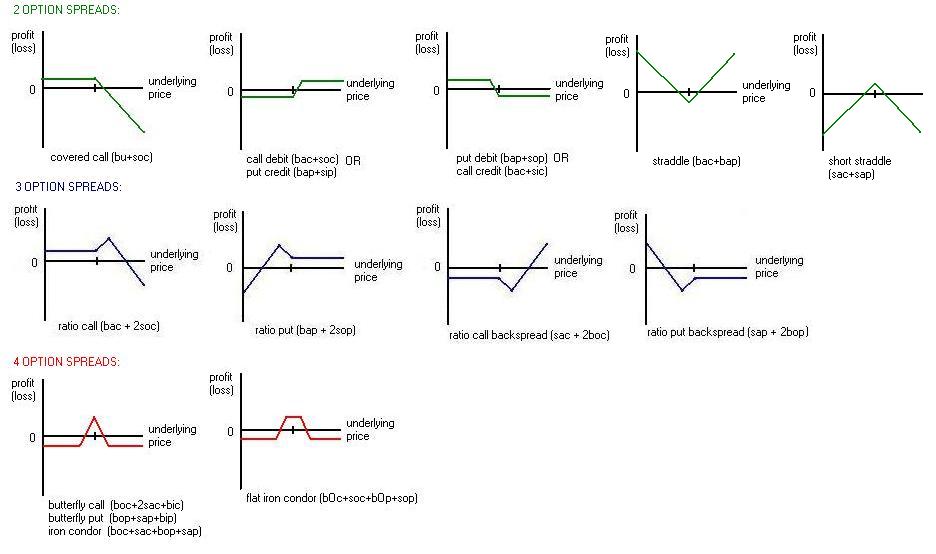

Options contracts provide traders with the rights, but not the obligation, to buy or sell an underlying asset at a specific price on or before a predetermined date. These strategies allow traders to capitalize on market fluctuations and mitigate risks associated with outright ownership of assets. The options trading strategies chart serves as a valuable tool for traders to explore the diverse range of strategies available and select the ones that align with their risk tolerance and investment objectives.

Types of Options Trading Strategies

Options trading strategies can be broadly classified into two categories: bullish and bearish. Bullish strategies are employed when traders anticipate an increase in the underlying asset’s price, while bearish strategies are used when a decline is expected.

- Bullish strategies include: calls, covered calls, and bull put spreads.

- Bearish strategies include: puts, cash-secured puts, and bear put spreads.

Each strategy involves unique combinations of options contracts, with varying levels of risk and reward potential. Understanding the specific characteristics of each strategy is crucial for successful options trading.

The options trading strategies chart provides a comprehensive overview of these strategies, including their respective payoff diagrams and risk-return profiles. Traders can use this chart as a quick reference guide to evaluate different strategies and make informed trading decisions.

Key Considerations for Selecting Options Trading Strategies

When selecting options trading strategies, traders should consider several key factors:

- Market outlook: Traders need to assess the direction of the underlying asset’s price movement to determine whether bullish or bearish strategies are appropriate.

- Risk tolerance: Options trading carries varying levels of risk. Traders should choose strategies that align with their risk appetite and financial capabilities.

- Time horizon: Options contracts have expiration dates. Traders should select strategies that match their investment horizon and avoid holding options until expiration.

- Volatility: Implied volatility is a key determinant of option prices. Traders should consider the expected volatility of the underlying asset when selecting strategies.

By carefully considering these factors, traders can optimize their options trading strategies and increase their chances of achieving desired outcomes.

Image: in.pinterest.com

Tips and Expert Advice for Options Traders

- Start with paper trading: Practice options trading in a simulated environment to gain experience and confidence before risking real capital.

- Set realistic expectations: Options trading can be profitable but also involves risks. Set realistic profit goals and avoid chasing unrealistic returns.

- Manage risk effectively: Use stop-loss orders to limit potential losses and avoid overtrading.

- Stay informed: Keep abreast of market news, earnings reports, and economic data that may affect the underlying asset you’re trading.

- Seek professional advice: Consult with a qualified financial advisor to tailor options trading strategies to your specific needs.

Following these tips and advice can enhance your options trading journey and potentially improve your profitability.

Frequently Asked Questions about Options Trading Strategies

Q: What is the difference between a call and a put option?

A: A call option gives the holder the right to buy an underlying asset at a specified price, while a put option gives the holder the right to sell an underlying asset at a specified price.

Q: What is the risk-reward ratio of options trading?

A: The risk-reward ratio varies depending on the strategy employed and market conditions. Riskier strategies offer higher potential rewards but also carry greater potential losses.

Q: How should I manage risk when trading options?

A: Effective risk management involves using stop-loss orders, controlling position size, and avoiding overtrading. Traders should also consider hedging strategies to mitigate potential losses.

Options Trading Strategies Chart

Image: allabouttreasury.com

Conclusion

Options trading strategies offer traders a powerful tool to enhance their financial strategies. By utilizing the options trading strategies chart, thoroughly researching different strategies, and following the guidance provided above, you can make informed decisions and navigate the options market with confidence.

Are you interested in learning more about options trading strategies and exploring the potential benefits they offer? Share your questions and insights in the comments section below.