Options Trading: A Gateway to Limitless Returns

Options trading has emerged as a lucrative avenue for investors seeking exponential returns. Unlike traditional stock trading, options contracts offer the potential for both unlimited profit and limited risk, making them an alluring option for risk-tolerant individuals. In this comprehensive guide, we delve into the intricacies of options trading, exploring its history, mechanics, strategies, and the immense profit potential it holds.

Image: ironapo.weebly.com

Understanding Options Trading

Options contracts, also known as derivatives, are financial instruments that derive their value from the underlying asset, such as a stock, bond, or commodity. These contracts grant the buyer the right, but not the obligation, to buy (call option) or sell (put option) a specified quantity of the underlying asset at a predetermined price (strike price) on or before a specific date (expiration date).

As the price of the underlying asset fluctuates, so too does the value of the option contract. If the price moves in the direction predicted by the option holder, they can exercise their right to buy or sell the asset at a favorable price, potentially generating substantial profits. However, if the price moves against their prediction, they can simply let the option contract expire, losing only the premium paid for it.

Profit Potential of Options Trading

The profit potential of options trading is virtually limitless. Unlike traditional stock trading, where gains are capped at the appreciation of the stock price, options trading allows for exponential returns even with small price movements. This is because options contracts are leveraged products, meaning they control a larger position size with a relatively small investment (margin).

Furthermore, options trading provides the flexibility to customize strategies based on market conditions and risk tolerance. By combining different types of options contracts (e.g., calls, puts, spreads), traders can create tailored strategies that maximize profit potential while managing risk.

Strategies for Maximizing Profits

To maximize profits in options trading, a combination of technical analysis, fundamental research, and strategic execution is essential. Traders employ various strategies to profit from market movements, including:

-

Bull Call Spread: This involves buying a lower-priced call option and simultaneously selling a higher-priced call option with the same expiration date. The potential profit lies in the difference between the two strike prices, minus the premium paid. It is suitable for moderately bullish market conditions.

-

Bear Put Spread: The opposite of a bull call spread, this involves selling a put option with a higher strike price and buying a put option with a lower strike price. It profits from a decline in the underlying asset’s price and is ideal for moderately bearish market conditions.

:max_bytes(150000):strip_icc()/BuyingPuts-d28c8f1326974c16807f23cb32854501.png)

Image: www.investopedia.com

Tips for Success in Options Trading

To increase your chances of success in options trading, follow these expert tips:

-

Educate Yourself: Thoroughly understand the concepts and mechanics of options trading before risking any capital.

-

Set Realistic Expectations: Do not expect to become a millionaire overnight. Options trading requires patience, discipline, and a clear understanding of risk management.

-

Start Small: Begin with small investments until you gain confidence and master the nuances of options trading.

-

Manage Risk: Always use stop-loss orders to limit potential losses. Diversify your portfolio to spread risk across multiple contracts and underlying assets.

FAQs on Options Trading

Q: Is options trading risky?

A: Yes, options trading can be risky due to the leverage it offers. Proper risk management is essential to protect capital.

Q: What are some common mistakes to avoid in options trading?

A: Overtrading, trading without a plan, and failing to understand the risks involved are some common pitfalls to avoid.

Q: Can I make a lot of money from options trading?

A: Yes, it is possible to generate significant profits from options trading. However, it requires a combination of skill, knowledge, and experience.

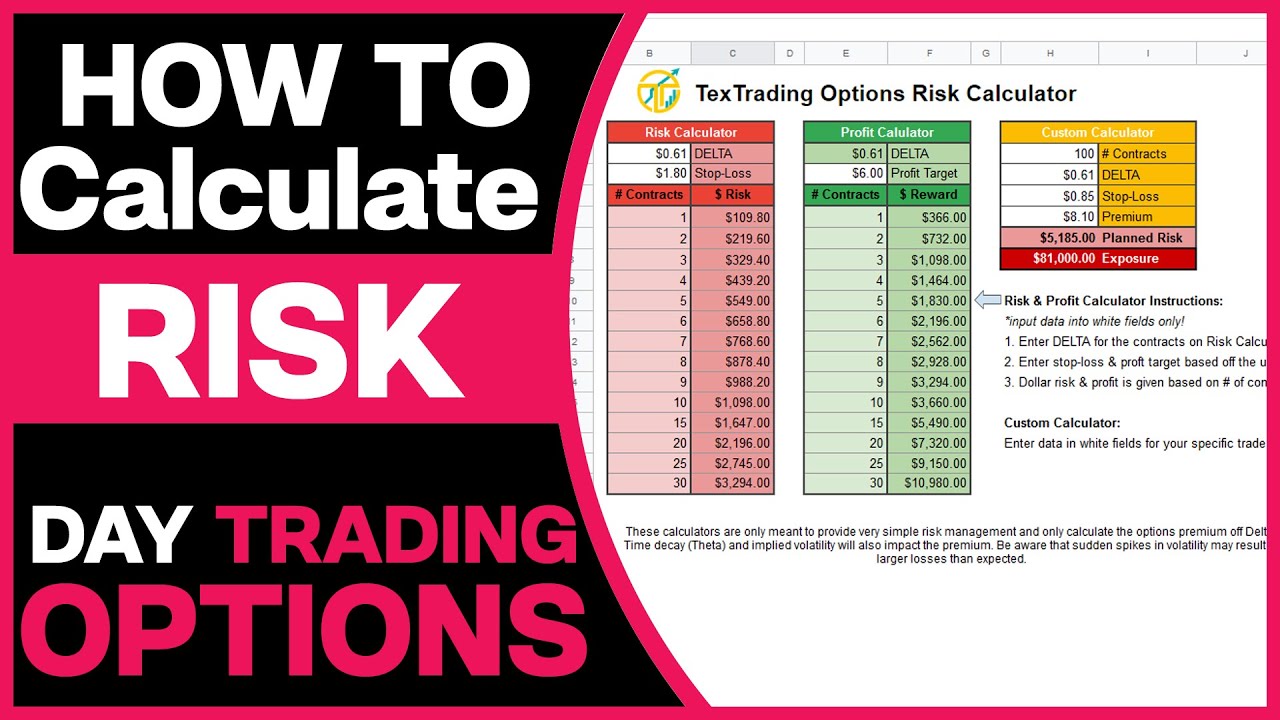

Options Trading Profit Potential

Image: www.youtube.com

Conclusion

Options trading presents an unparalleled opportunity to tap into the limitless profit potential of the financial markets. By comprehending the mechanics, strategies, and risks involved, traders can harness the power of options to enhance their returns. Remember, the path to success in options trading requires unwavering education, diligent execution, and a disciplined approach to risk management. Are you ready to explore the world of options trading and unlock its vast profit potential?