The realm of options trading, like a tantalizing game of financial chess, awaits those who dare to explore its intricacies. In this meticulous guide, we embark on a journey to decipher the enigmatic options trading profit formula, empowering you with the knowledge to navigate this volatile market with strategic precision.

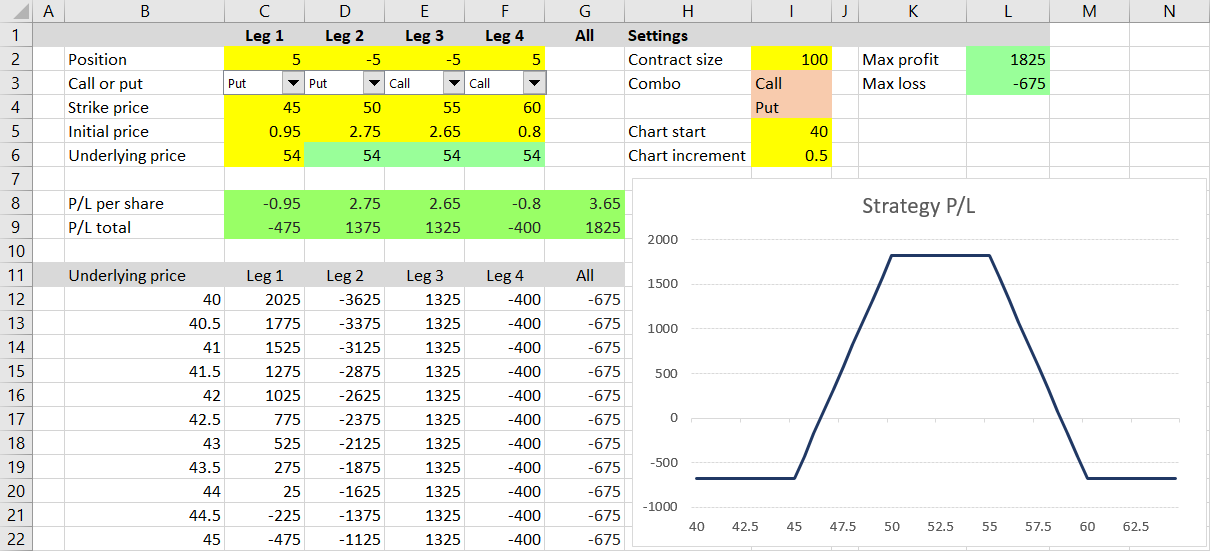

Image: marketxls.com

Options trading, in essence, is a contract that grants the buyer the right, but not the obligation, to buy (call option) or sell (put option) an underlying asset at a predetermined price (strike price) on or before a specified date (expiration date). This contract-based approach opens up a myriad of possibilities for investors to speculate on price movements, hedge against risks, or enhance their portfolios.

At the heart of options trading lies the profit formula, a mathematical equation that dictates the potential financial outcome of a given trade. However, unraveling this formula requires a deep understanding of the underlying factors that influence its variables. Let’s delve into each component one by one.

Intrinsic Value:

The intrinsic value of an option is the difference between the underlying asset’s current market price and the option’s strike price. For a call option, the intrinsic value becomes positive when the underlying price exceeds the strike price, and vice versa for put options. This intrinsic value represents the minimum profit that can be realized if the option is exercised immediately.

Time Value:

Unlike stocks or bonds, options have an expiration date, which assigns a time value to the contract. The time value reflects the potential for the underlying asset’s price to continue fluctuating until the option expires. As the expiration date approaches, the time value gradually diminishes, which means closer to expiration, the less time there is for the stock price to move in your favor, and thus the time value component of the option price will decrease.

Volatility:

Volatility measures the magnitude and frequency of price fluctuations in the underlying asset. Higher volatility tends to inflate option prices since the probability of significant price movements increases, making the option more valuable. Consequently, lower volatility leads to lower option prices.

Interest Rates:

Interest rates play a crucial role in options pricing, particularly for long-term options. Higher interest rates make it more attractive to hold cash rather than invest in long-term options, which can suppress option prices. Conversely, lower interest rates boost option prices.

Understanding these fundamental components is pivotal to comprehending the options trading profit formula, which takes the following shape:

Profit = (Intrinsic Value + Time Value) – Premium Paid

Unraveling this formula empowers you to calculate the potential profit of an options trade before you execute it. By factoring in the interplay of intrinsic value, time value, volatility, and interest rates, you can make informed decisions about your trading strategy and enhance your chances of success.

However, it’s essential to emphasize that options trading involves substantial risk and is not suitable for all investors. Education, sound research, and a disciplined approach are fundamental to navigating this volatile market. This guide provides a solid foundation for your options trading journey, but remember to seek additional knowledge from reputable sources and consult with financial professionals to refine your strategies as you progress.

Embark on this adventure with a thirst for wisdom and a resilient spirit, for the rewards of options trading can be substantial. But always remember, the market is an unpredictable force that requires a blend of strategic acumen and calculated risk-taking.

Image: www.macroption.com

Options Trading Profit Formula

Image: www.youtube.com