Introduction

Image: www.pinterest.com

In the realm of investing, options trading stands out as a versatile financial instrument capable of unlocking significant profit potential. Yet, mastering the nuances of options requires a concerted effort, and practice plays a pivotal role in sharpening your skills. Through this comprehensive guide, we will delve into a series of practice questions that will test your understanding of key options concepts and prepare you for real-world trading scenarios.

Foundational Concepts

-

Define an option.

- An option grants the buyer a right, but not an obligation, to buy (for a call option) or sell (for a put option) an underlying asset at a predetermined price (the strike price) on or before a specified date (the expiration date).

-

Explain the difference between a call and a put option.

- A call option gives the buyer the right to buy the underlying asset, while a put option gives the buyer the right to sell the underlying asset.

-

What is option premium?

- The premium is the price paid to the option seller in exchange for the option contract.

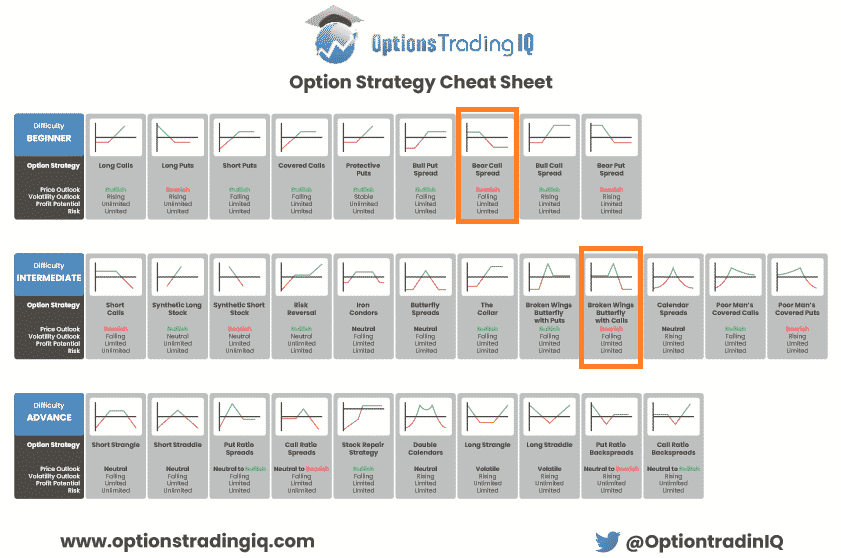

Trading Strategies

-

Describe a long call strategy.

- A long call strategy involves buying a call option, anticipating an increase in the underlying asset’s price.

-

Explain a short put strategy.

- A short put strategy involves selling a put option, expecting the underlying asset’s price to rise or remain stable.

-

What is the role of volatility in options trading?

- Volatility measures the fluctuations in the underlying asset’s price, and it significantly influences option pricing and trading strategies.

Advanced Concepts

-

Explain the concept of option Greeks.

- Option Greeks are metrics that measure the sensitivity of an option’s price to changes in various underlying variables, such as the underlying asset’s price, time, volatility, and interest rates.

-

Describe the use of implied volatility in options pricing.

- Implied volatility is a measure of the market’s expectation of the underlying asset’s price volatility over the option’s life, and it is factored into option pricing models.

-

What is option hedging?

- Option hedging involves using options to reduce or offset the risks associated with holding or trading other financial instruments.

Practice Questions

-

You own 100 shares of Apple stock at $150 per share. The current implied volatility is 35%. What is the approximate value of an at-the-money call option with a strike price of $152.50 and an expiration date in 30 days?

-

You are considering selling a put option on Tesla stock with a strike price of $800 and an expiration date in 60 days. The current stock price is $820. What is the maximum amount of profit you can make from this trade?

-

Explain the impact of an increase in interest rates on the price of an out-of-the-money call option.

Conclusion

Mastering the intricacies of options trading requires a combination of theoretical knowledge and practical experience. By diligently working through these practice questions, you will develop a solid foundation in options concepts and strategies. As you continue to hone your skills, remember to seek guidance from reputable sources, stay up-to-date with market trends, and approach trading with a disciplined and informed mindset. May this guide serve as an invaluable resource in your journey toward financial empowerment through options trading.

Image: www.studocu.com

Options Trading Practice Questions

Image: optionstradingiq.com