In the realm of options trading, understanding the concept of time frames is paramount to achieving success. Options, as financial instruments, possess a predetermined lifespan, and their value fluctuates based on the time remaining until their expiration. Grasping the significance of time frames enables traders to make informed decisions, maximize profits, and mitigate risks in this dynamic market.

Image: howtotradeblog.com

The Role of Time in Options Trading

Options, unlike stocks, do not represent ownership in a company. Instead, they grant the holder the right, but not the obligation, to buy or sell an underlying asset at a specified price within a predetermined time period. This time period, known as the option’s “life,” is crucial in determining its value. As the expiration date approaches, the option’s value decays, reaching zero at the moment of expiry.

Types of Time Frames in Options Trading

Options are classified into two primary categories based on their expiration dates: short-term and long-term options. Short-term options, also known as short-dated options, typically have a lifespan of one month or less. In contrast, long-term options, referred to as long-dated options, have expirations that can extend several years into the future.

Short-Term Options

- Advantages: Lower premiums, higher decay rate, suitable for short-term trading strategies.

- Disadvantages: Susceptible to rapid price movements, can result in significant losses if not managed properly.

Image: tradingtact.com

Long-Term Options

- Advantages: More time to profit from favorable market conditions, lower volatility, allows for long-term investment strategies.

- Disadvantages: Higher premiums, slower decay rate, may not be suitable for active trading.

Choosing the Right Time Frame

Selecting the appropriate time frame for an options trade depends on the trader’s risk tolerance, investment objectives, and trading style. Short-term options suit traders seeking quick returns and are comfortable with higher risk. Conversely, long-term options align better with investors seeking stable growth, tolerating lower risk, and pursuing long-term goals.

Managing Time Frames

Traders need to monitor the time frames of their options positions actively to optimize their investments. This involves understanding the time decay associated with each option and adjusting the position accordingly. For short-term options, traders may consider closing the position or rolling it over to a longer-term option. For long-term options, holding the position until expiry or adjusting it based on market conditions may be more suitable.

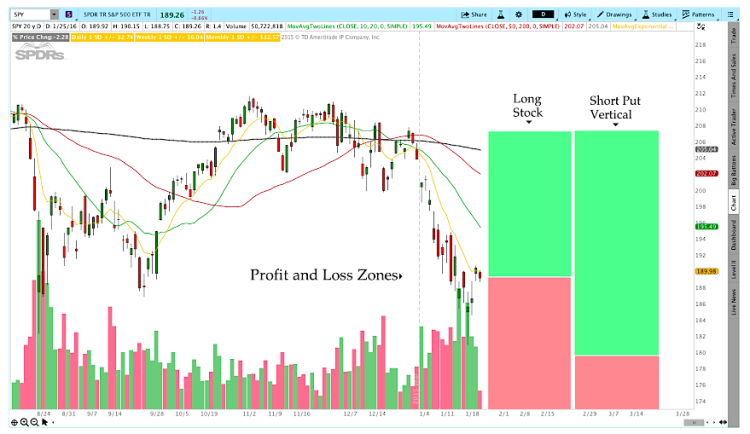

Options Trading Period Of Time

Image: www.seeitmarket.com

Conclusion

Time frames play a pivotal role in options trading, influencing the value, risk, and potential rewards of an investment. Understanding the different types of time frames, their advantages and disadvantages, and how to manage them effectively empowers traders to make informed decisions, capitalize on market opportunities, and navigate the dynamic options market.