In the realm of finance, options trading has emerged as a powerful instrument for investors seeking to hedge risks, enhance returns, and navigate market volatility. Among the leading platforms for options trading, Thinkorswim stands out as a comprehensive and user-friendly solution for traders of all levels. In this comprehensive guide, we delve into the intricacies of options trading on Thinkorswim, empowering you with the knowledge and strategies to harness its full potential.

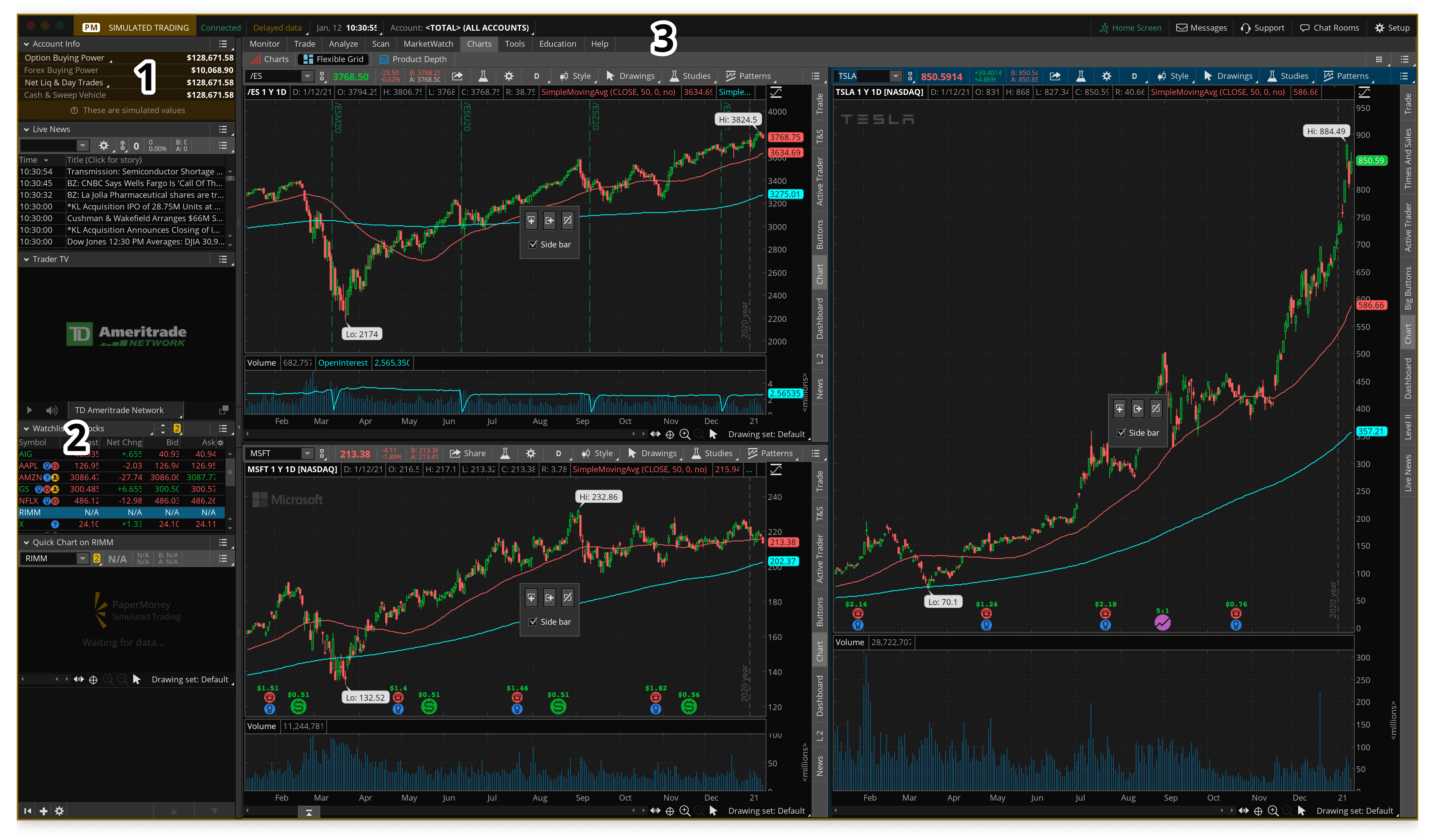

Image: thecollegeinvestor.com

A Gateway to Empowered Options Trading

Thinkorswim is not merely a trading platform; it’s an ecosystem tailored to the needs of options traders. Its intuitive interface, advanced charting capabilities, and unparalleled research tools provide traders with a comprehensive view of the markets, enabling them to make informed decisions and execute trades seamlessly. Whether you’re a seasoned professional or a novice trader seeking to explore the world of options, Thinkorswim empowers you with the resources and support to succeed.

Unveiling the Fundamental Concepts

Options, by nature, are derivative financial instruments that derive their value from an underlying asset, such as a stock or index. They grant the holder the right, but not the obligation, to buy (call option) or sell (put option) the underlying asset at a predetermined price (strike price) on or before a specific date (expiration date). Understanding these foundational concepts is paramount for successful options trading.

Harnessing the Power of Option Strategies

The realm of options trading extends beyond merely buying or selling individual contracts. Thinkorswim empowers traders to construct sophisticated strategies by combining multiple options contracts, each with varying strike prices and expiration dates. These strategies, such as spreads, butterflies, and iron condors, enable traders to tailor their risk and reward profiles according to their specific goals and market conditions.

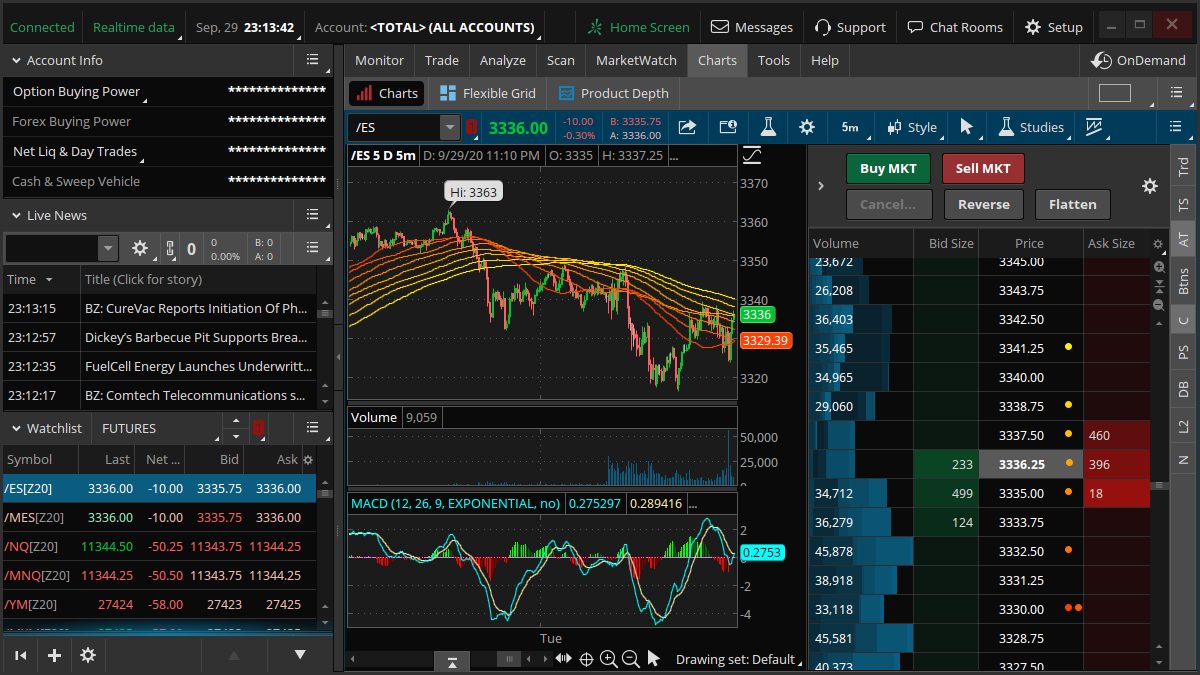

Image: software.manjaro.org

Mastering the Art of Technical Analysis

Technical analysis plays a pivotal role in options trading, providing traders with insights into market trends and price movements. Thinkorswim’s robust charting tools empower traders to apply a wide range of technical indicators and charting techniques, allowing them to identify trading opportunities, assess market momentum, and anticipate future price movements.

Navigating Market Volatility with Precision

Options provide traders with powerful tools to manage market volatility, which is an inherent characteristic of financial markets. By strategically combining options strategies, traders can hedge against adverse price fluctuations, limit potential losses, and enhance their overall portfolio resilience. Thinkorswim’s risk management features, such as profit/loss charts and margin calculators, enable traders to monitor their positions closely and adjust them dynamically as market conditions evolve.

Embracing the Role of Technology

Thinkorswim leverages cutting-edge technology to provide traders with a seamless and efficient trading experience. Its paperMoney feature allows traders to simulate real-world trading scenarios without risking actual capital, enabling them to hone their strategies and test new ideas in a risk-free environment. Additionally, Thinkorswim’s customizable alerts and mobile trading capabilities empower traders to stay connected to the markets and respond promptly to changing conditions.

Options Trading On Thinkosim

Image: www.reddit.com

Conclusion: Empowering Traders with Options Mastery

Options trading on Thinkorswim opens up a world of possibilities for those seeking to navigate the complexities of financial markets. By harnessing its comprehensive features and advanced capabilities, traders can unlock the full potential of options to enhance portfolio returns, mitigate risks, and pursue financial success. Whether you’re an experienced trader seeking to refine your skills or a novice eager to venture into the world of options, Thinkorswim provides the platform and resources to empower your trading journey.