Introduction

Have you ever wanted to delve into the world of options trading, only to find that your beloved Robinhood platform doesn’t offer it? Don’t fret! This article will delve deep into the realm of options trading, shedding light on its intricacies and exploring alternative platforms that cater to your options trading aspirations.

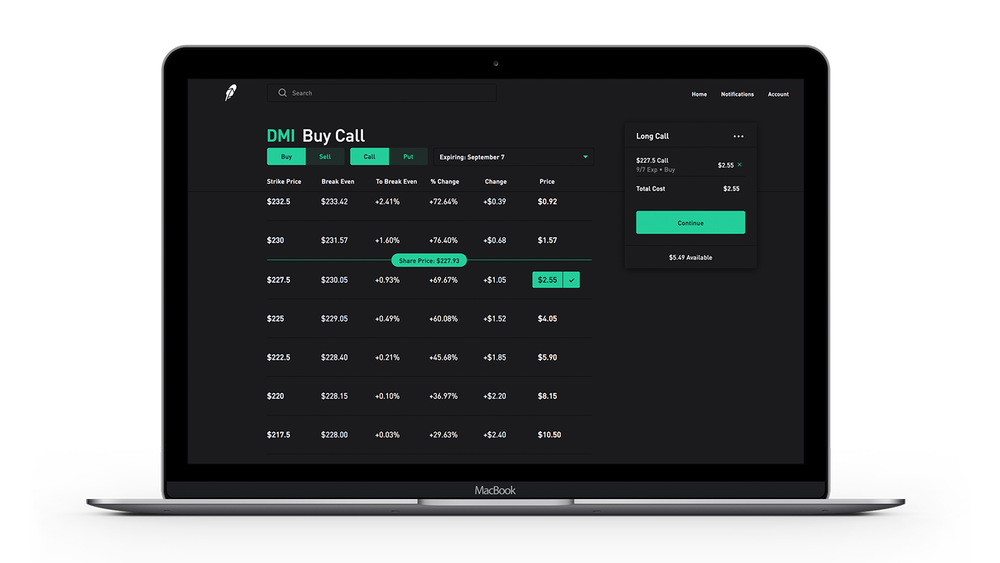

Image: joshgallagher.com

Options trading presents a captivating avenue for investors seeking to expand their trading horizons, harnessing the potential to amplify both profits and risks. However, it’s crucial to approach this arena with a clear understanding of its complexities.

Why Options Trading Is Not Available on Robinhood

Robinhood, while renowned for its user-friendly interface and commission-free stock trading, currently doesn’t extend its services to options trading. This is primarily due to the inherent complexities associated with options contracts, which necessitate a higher level of market knowledge and risk tolerance.

Options trading involves sophisticated strategies and carries substantial risk, posing potential consequences for novice investors. Hence, Robinhood has prudently opted to safeguard its users by limiting access to options trading until they attain a deeper understanding of the financial markets.

Alternative Platforms for Options Trading

While Robinhood may not cater to options trading, there exists a plethora of alternative platforms that do. These platforms offer varying levels of features, educational resources, and risk management tools to accommodate traders of diverse experience levels.

Some of the most reputable platforms for options trading include:

- Fidelity: A comprehensive platform offering a wide array of options trading tools, educational resources, and research capabilities.

- Interactive Brokers: Known for its robust trading platform, low commissions, and advanced order types suitable for experienced traders.

- Tastyworks: Specifically tailored for options traders, providing intuitive platforms, educational content, and a supportive community.

- TradeStation: A powerful platform with a robust charting package, paper trading capabilities, and a vast selection of technical indicators for advanced analysis.

Tips and Expert Advice for Options Trading

Navigating the realm of options trading requires a blend of knowledge, strategy, and risk management. Here are some invaluable tips to empower your trading journey:

- Educate yourself: Delve into the intricacies of options trading by studying books, articles, and online courses. This foundational knowledge will equip you to make informed decisions.

- Start with paper trading: Utilize paper trading accounts provided by many platforms to simulate real-world trading without risking capital. This allows you to hone your skills in a risk-free environment.

- Understand the risks: Options trading involves significant risk. It’s imperative to grasp the potential losses and manage your risk exposure prudently.

- Choose the right platform: Select an options trading platform that aligns with your experience level, trading style, and risk tolerance. Consider factors like fees, educational resources, and trading tools.

- Don’t chase returns: Avoid the temptation to make impulsive trades in pursuit of quick profits. Successful options trading requires patience, discipline, and a long-term perspective.

Image: www.youtube.com

Frequently Asked Questions (FAQs) on Options Trading

- Q: What is an options contract?

A: An options contract grants the buyer the right, but not the obligation, to buy (in the case of a call option) or sell (in the case of a put option) a specific asset at a predetermined price on or before a specified expiration date. - Q: What are the different types of options strategies?

A: There are numerous options strategies, ranging from simple to complex, that cater to various investment objectives and risk appetites. Some common strategies include covered calls, cash-secured puts, bull call spreads, and bear put spreads. - Q: How do I calculate the risk and reward of an options trade?

A: Utilizing option pricing models, such as the Black-Scholes model, traders can assess the potential profit and loss associated with an options trade. These models take into account factors like the underlying asset price, volatility, time to expiration, and strike price. - Q: What are the tax implications of options trading?

A: Options trading is subject to taxation, and the specific tax treatment depends on the type of option, the holding period, and individual tax circumstances. Consulting with a tax advisor is recommended for guidance on tax implications. - Q: Can I trade options on margin?

A: Margin trading allows investors to borrow funds to increase their trading power. However, options trading on margin involves higher risk and is only suitable for experienced traders with a thorough understanding of the risks involved.

Options Trading Not Available Robinhood

Image: freisisfrias.blogspot.com

Conclusion

Venturing into options trading offers a compelling opportunity for investors seeking to expand their portfolios. However, it’s paramount to approach this realm with a deep understanding of the complexities involved. While Robinhood currently doesn’t offer options trading, there are a plethora of alternative platforms that cater to options traders of all experience levels. By following the tips and advice outlined in this article, you can equip yourself with the knowledge and skills necessary to navigate the options trading landscape and potentially reap its rewards.

Are you interested in delving deeper into the world of options trading and exploring its potential for expanding your investment portfolio?