Unveiling the Gateway to Informed Decision-Making

Image: www.asktraders.com

The financial landscape is constantly evolving, and options trading has emerged as a potent force in navigating its ever-fluctuating currents. These versatile financial instruments empower traders with the flexibility to tailor their strategies and mitigate risk in today’s dynamic market. As the world of options trading continues to expand, it presents an invaluable opportunity for both novice and seasoned investors seeking to enhance their financial acumen.

Navigating the Nuances of Options Trading

Options, rooted in the realm of derivative contracts, provide the right, not the obligation, to buy or sell an underlying asset at a predetermined price on a specified date. This characteristic bestows upon traders the potential to reap gains both when markets trend upward and when they undergo correction.

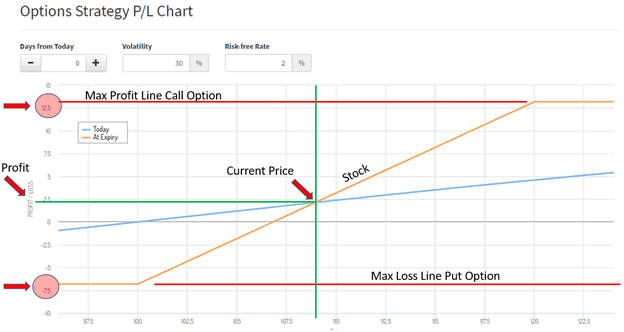

A fundamental understanding of two primary types of options forms the cornerstone of options trading. Call options grant traders the right to purchase an underlying asset, while put options convey the right to sell. The intrinsic value of an option, determined by the difference between the strike price and the current market price of the underlying asset, indicates the option’s inherent profitability.

Decoding Volatility and Trading Strategies

Volatility, a quintessential aspect of options trading, measures the magnitude of price fluctuations in the underlying asset. High volatility portends greater potential profitability but also amplifies the risks. Comprehending the concept of volatility enables traders to calibrate their strategies, embracing higher-risk, higher-reward approaches during periods of heightened volatility and adopting more conservative tactics when markets exhibit stability.

Options trading encompasses a diverse array of strategies, tailored to varying market conditions and investor objectives. Traders can, for instance, employ covered calls to generate income through option premiums while limiting downside risk. Alternatively, protective puts offer a safety net against potential declines in the underlying asset’s value. For bolder investors, straddles or strangles provide exposure to both rising and falling markets.

The Art of Risk Management

While options trading offers a tantalizing allure of profit, it is prudent to acknowledge the inherent risks involved. Prudent risk management should serve as the bedrock of every options trading strategy.

Traders must conscientiously evaluate their tolerance for risk, calibrating their positions accordingly. Meticulous due diligence, including thorough research on underlying assets and market trends, is essential for informed decision-making. Furthermore, limiting leverage can mitigate potential losses, especially during periods of market volatility.

Image: www.pinterest.com

Education and Continuous Improvement

Success in options trading hinges upon continuous learning and refinement of skills. Dedicating time to education, immersing oneself in books, attending webinars, and engaging with experienced mentors can empower traders with the knowledge and insights required to thrive in this dynamic market.

Market analysis, encompassing technical and fundamental techniques, provides a valuable lens through which market trends and patterns can be deciphered. Staying abreast of economic data, corporate earnings reports, and geopolitical events can further enhance decision-making capabilities.

Options Trading In Today’S Marlet

Image: www.marketoracle.co.uk

Conclusion: A Path to Financial Empowerment

Options trading presents an alluring pathway to harnessing the potential of today’s dynamic financial landscape. By comprehending the fundamental concepts, employing prudent risk management strategies, and engaging in continuous learning, individuals can unlock the potential of options trading to complement their financial strategies.

The ever-evolving nature of the market may present challenges, but the rewards await those willing to embrace the power of options trading. With knowledge as their guide and a commitment to informed decision-making, traders can navigate the complexities of this fascinating financial arena, reaping the potential benefits of this versatile tool.