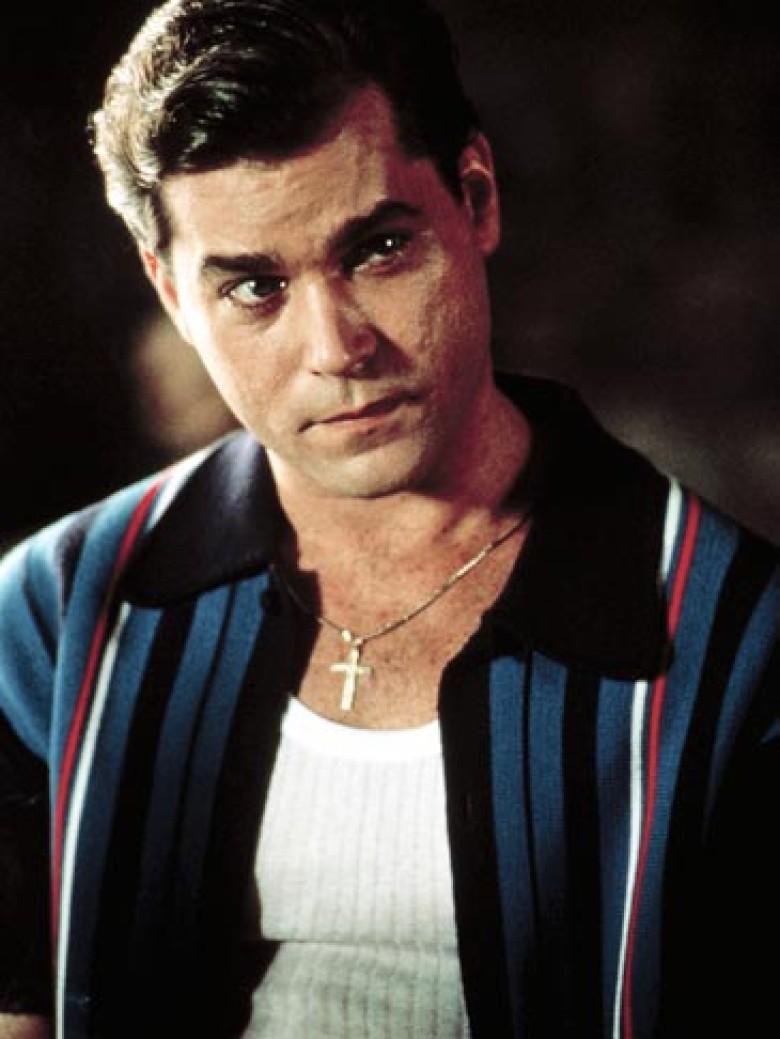

In the electrifying world of financial markets, options trading stands as a captivating realm, offering the potential for both immense rewards and significant risks. At its core lies the concept of buying or selling contracts that grant the right, not the obligation, to buy or sell a specific underlying asset at a predetermined price within a set time frame. Enter Henry Hill, the legendary ex-mafia insider whose captivating memoir, “Goodfellas,” has become a cultural phenomenon. Hill’s firsthand experiences in the high-stakes world of stock trading provide valuable insights into the intricacies and perils of this financial arena.

Image: www.pinterest.com

Delving into the Basics:

Options contracts, often referred to as derivatives, are instruments that derive their value from the underlying assets they represent, such as stocks, bonds, or commodities. When purchasing an option, traders have the optionality to exercise their right to buy or sell the underlying asset at a specific price on or before the expiration date. Failure to exercise the option results in its expiration, eliminating any financial obligation for the holder.

Understanding Call and Put Options:

There are two primary types of options: call options and put options. Call options grant the holder the right to buy the underlying asset, while put options provide the right to sell the underlying asset. These options come with varying premiums, representing the cost of acquiring the contract and granting the optionality.

Navigating Market Dynamics:

Options trading involves a complex interplay of market forces, including underlying asset price fluctuations, time decay, volatility, and interest rates. Savvy traders must possess a keen understanding of these factors to effectively navigate the options market, managing risks and maximizing potential returns.

Image: hero.fandom.com

Henry Hill’s Lessons from the Trenches:

Henry Hill’s experiences provide invaluable lessons for options traders. He emphasizes the importance of thorough research, understanding market dynamics, and adhering to a disciplined risk management strategy. As he vividly recounts in his memoir, the allure of quick profits can often lead to reckless decisions and financial ruin.

Mastering Risk Management:

Risk management lies at the core of successful options trading. Establishing clear entry and exit points, as well as setting realistic profit targets and stop-loss orders, helps traders mitigate potential losses and protect their capital. Hill himself underscores the significance of calculated risk-taking and avoiding emotional decision-making.

Leveraging Expert Insights:

Beyond Henry Hill’s firsthand wisdom, options traders can benefit from seeking insights from recognized experts in the field. Seasoned traders, financial analysts, and industry leaders offer invaluable guidance through blogs, articles, webinars, and seminars. By tapping into these resources, traders can stay abreast of the latest trends, market movements, and successful trading strategies.

Options Trading Henry Hill

Image: hungryinkal.com

Conclusion:

Options trading presents a challenging but rewarding avenue for investors seeking to enhance their financial returns. Educating oneself on the intricacies of options contracts, understanding market forces, and embracing risk management practices is essential for navigating this complex arena. Henry Hill’s insights and the wisdom shared by experts provide invaluable guidance for aspiring traders seeking to succeed in the options markets. Remember, success in options trading requires patience, discipline, and a deep understanding of the underlying dynamics that govern this captivating financial realm.