Introduction

In the high-stakes world of options trading, integrity and adherence to fair practices are paramount. One critical aspect that traders must grasp is the concept of good faith violation. A breach of good faith, whether intentional or unintentional, can have severe consequences for traders, potentially resulting in penalties, trading restrictions, or even legal action. This article delves into the nuances of good faith violations in options trading, empowering readers with the knowledge to safeguard their reputations and investments.

Understanding Good Faith in Options Trading

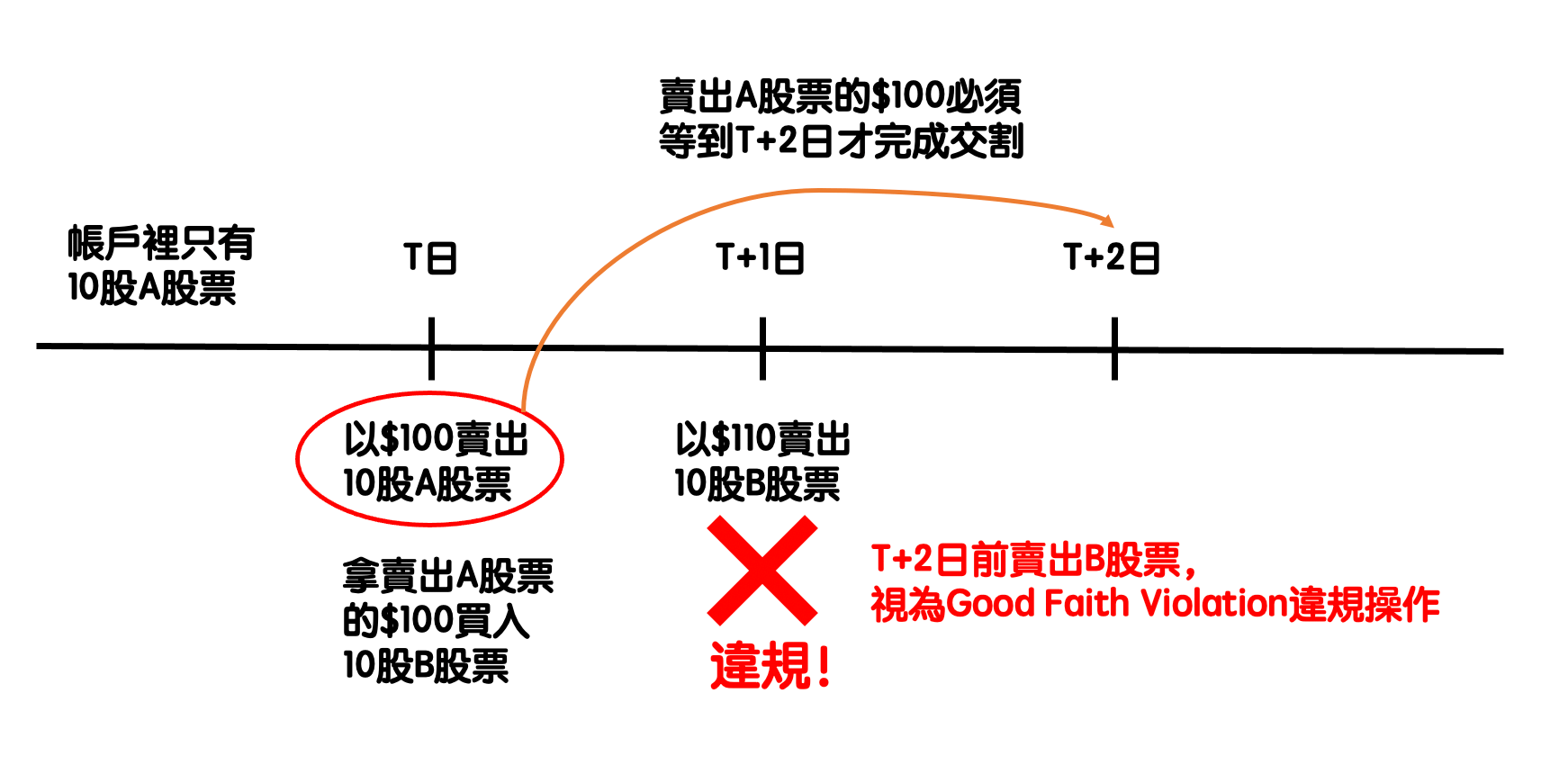

Good faith in options trading refers to the obligation of market participants to act with honesty, integrity, and fairness. It encompasses a range of principles, including fulfilling contractual commitments, disclosing material information, and adhering to ethical standards. As options are legally binding contracts, traders must uphold their obligations to prevent market manipulation and protect the integrity of the financial system.

Common Types of Good Faith Violations

Good faith violations can manifest in various forms:

-

Failure to Deliver: Traders are required to deliver or take delivery of the underlying security when an options contract expires. Failure to fulfill this obligation without a valid reason constitutes a good faith violation.

Image: slideplayer.com -

Wash Trading: This practice involves buying and selling the same options contract or identical options contracts to create artificial market activity or manipulate prices. It is strictly prohibited as it undermines market integrity.

-

Spoofing: Spoofing occurs when a trader places orders with the intention of canceling them before execution, creating a false impression of market demand or supply. This manipulative tactic is illegal and violates good faith principles.

-

Front Running: Front running involves trading ahead of clients’ orders based on non-public information. It is a serious breach of trust, as traders exploit their privileged access to trade at an unfair advantage.

Consequences of Good Faith Violations

The repercussions of good faith violations can be far-reaching:

-

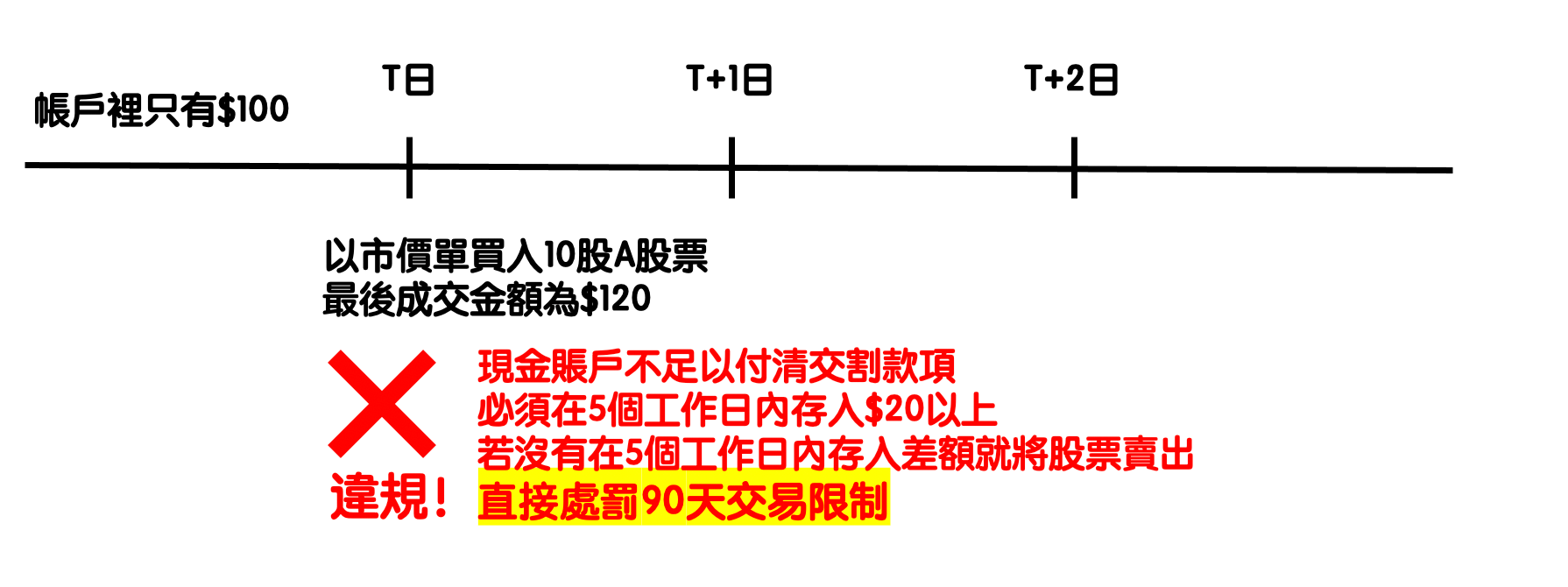

Financial Penalties: Regulatory bodies may impose significant fines on individuals or firms found guilty of such violations. These penalties can severely impact financial stability.

-

Trading Restrictions: Exchanges and regulators can restrict or suspend trading privileges for traders who violate good faith principles. This can significantly hinder their ability to participate in the markets.

-

Legal Action: In extreme cases, good faith violations can lead to criminal charges, resulting in potential imprisonment and hefty fines.

Protecting Against Good Faith Violations

To avoid falling prey to good faith violations, traders should adhere to the following best practices:

-

Understand Your Obligations: Familiarize yourself with the rules and regulations governing options trading, including the duty of good faith. Stay informed about market practices and ethical guidelines.

-

Maintain Transparency: Disclose all relevant information promptly to relevant parties. Transparency fosters trust in the market and mitigates the risk of misunderstandings.

-

Act Ethically: Uphold high ethical standards in all your trading activities. Refrain from any conduct that could be perceived as manipulative or unfair.

-

Seek Professional Advice: If you encounter complex situations or have concerns regarding good faith principles, consult with experienced professionals. They can provide valuable guidance and help you navigate the intricacies of options trading.

Image: planctofire.com

Options Trading Good Faith Violation

Image: planctofire.com

Conclusion

Navigating the complexities of options trading requires a deep understanding of good faith principles. By adhering to these principles, traders uphold the integrity of the financial system, safeguard their reputations, and minimize the risk of severe consequences. Remember, good faith violations can have profound implications, so approach the markets with honesty, transparency, and unwavering ethical standards. By embracing these practices, you can empower yourself as a responsible market participant and unlock the full potential of options trading.