Introduction

Options trading, a sophisticated yet potentially lucrative investment strategy, has gained traction in recent years. The Chicago Board Options Exchange (CBOE), a leading global destination for options trading, offers a vast platform for investors to explore this dynamic market. This comprehensive guide will shed light on the intricacies of options trading on the CBOE, empowering you with the knowledge to navigate this complex financial landscape.

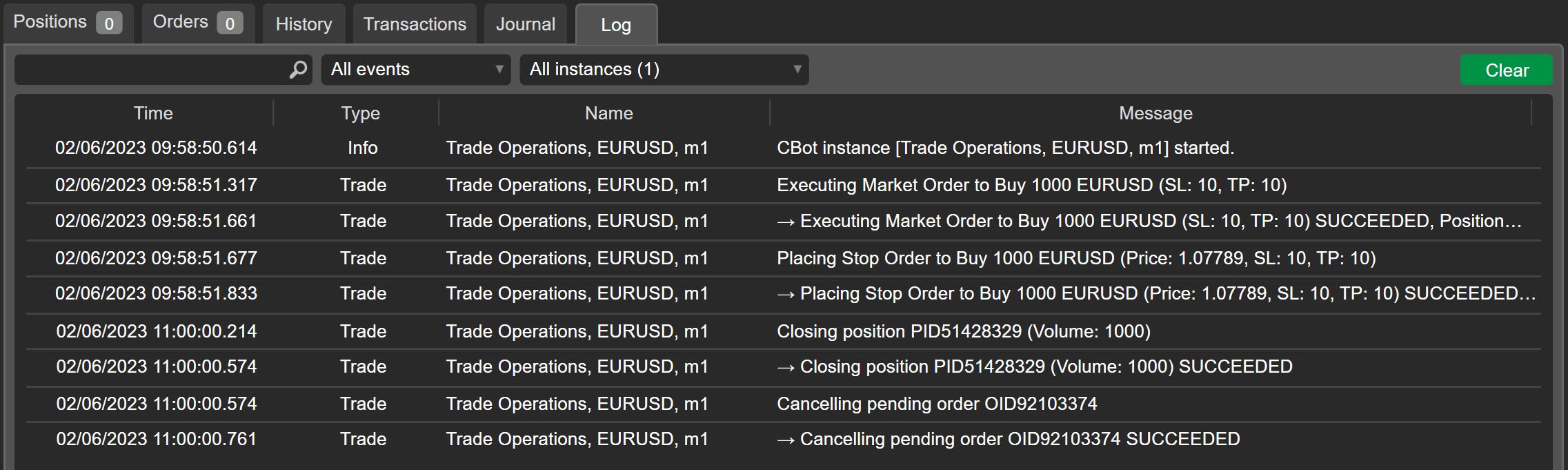

Image: help.ctrader.com

Understanding Options Trading

Options are financial contracts that grant you the right, but not the obligation, to buy (call option) or sell (put option) an underlying asset, such as a stock or commodity, at a predetermined price (strike price) on or before a specific date (expiration date). Unlike stocks, where you own the physical asset itself, options give you the flexibility to speculate on the price movements of an underlying without taking direct ownership.

Options on the CBOE

The CBOE, established in 1973, is the birthplace of listed options trading. It provides a regulated and transparent platform where investors can trade a wide range of options contracts on various underlying assets, including stocks, indices, currencies, and commodities. The CBOE’s centralized exchange model ensures market depth, liquidity, and fair and orderly execution of trades.

Key Concepts

Call Option: Gives you the right to buy an underlying asset at the strike price. You profit if the asset’s price rises above the strike price.

Put Option: Gives you the right to sell an underlying asset at the strike price. You profit if the asset’s price falls below the strike price.

Expiration Date: The date on which an option contract expires. After this date, you lose all rights associated with the contract.

Premium: The price you pay to purchase an option contract. It represents the cost of acquiring the option’s rights.

Image: www.gettyimages.com

Strategies and Applications

Options offer a versatile toolset for investors, enabling them to implement various strategies tailored to their risk tolerance and investment goals:

Hedging: Options can be used to protect existing investments from adverse market movements. For example, if you own a stock and fear a potential decline, you could buy a put option to lock in a selling price.

Speculation: Options can be traded for profit based on predictions about the direction of underlying asset prices. For instance, if you anticipate a stock’s value to rise, you could buy a call option.

Benefits and Risks

Pros:

- Flexibility and customization: Options allow investors to tailor their investment strategies based on their risk appetite and market outlook.

- Potential for high returns: Successful options trading can lead to substantial profits due to leverage.

- Hedging and risk management: Options provide efficient tools for managing portfolio risk.

Cons:

- High risk: Options are leveraged instruments, which can amplify both gains and losses.

- Limited time to profit: Options have a finite lifespan, and your investment can expire worthless if the underlying asset’s price does not move in your favor.

- Complexity: Options can be complex and require a deep understanding of market dynamics.

Expert Insights

“Options can be a powerful investment tool, but they should not be approached without proper education and understanding of the risks involved,” cautions financial analyst John Smith.

“To be successful in options trading, it’s crucial to conduct thorough due diligence, manage your risk effectively, and stay abreast of market trends,” advises investment advisor Mary Jones.

Actionable Tips

- Start with paper trading or simulation platforms to gain hands-on experience without risking real capital.

- Seek guidance from reputable brokers or financial advisors who specialize in options trading.

- Understand the Greeks (measures of option sensitivity to various factors) to gauge potential risk and returns.

- Trade within your financial limits and only risk what you can afford to lose.

Options Trading From Cbot

Image: app.gumroad.com

Conclusion

Options trading on the CBOE can be a rewarding endeavor for those who possess the knowledge, skill, and risk tolerance to navigate this dynamic market. By embracing the principles outlined in this guide, you are well-positioned to explore the intricacies of options trading and make informed decisions that align with your investment goals. Remember to trade cautiously, seek expert advice when necessary, and always prioritize risk management. The world of options trading awaits your exploration, where the potential for financial success awaits those who embrace its challenges and opportunities.