Introduction

Have you ever wondered about the enigmatic world of options trading and its potential to amplify your investments? If so, you’re in the right place. In this comprehensive guide, we’ll delve into the intricacies of options trading, demystifying it for rookies and laying out a clear path to becoming an options trader.

Image: www.angelone.in

Options, simply put, are financial instruments that grant you the right, but not the obligation, to buy or sell an underlying asset at a specific price before a certain date. They provide traders with the flexibility to leverage market movements and manage risk in the ever-fluctuating financial landscape.

Understanding Options Terminology

To navigate the realm of options trading, it’s imperative to familiarize yourself with key terminology.

- Call option: Grants you the right to buy an underlying asset.

- Put option: Grants you the right to sell an underlying asset.

- Strike price: The predetermined price at which you can exercise your right to buy or sell.

- Expiration date: The date on which your option contract ceases to be valid.

- Premium: The upfront payment you make to purchase an option contract.

- Intrinsic value: The difference between the current market price of the underlying asset and the strike price.

- Time value: The additional value assigned to an option due to the time remaining until expiration.

Types of Options Trading Strategies

Options trading offers a wide array of strategies, each catering to different risk appetites and investment goals.

- Covered call: Selling a call option against an underlying asset you own.

- Protective put: Buying a put option to hedge against potential losses in an existing investment.

- Iron condor: Selling both a call and a put option at different strike prices.

- Butterfly spread: Buying a call or put option at one strike price and selling two options at different strike prices.

- Strangle: Buying both a call and a put option at different strike prices.

How to Become an Options Trader

Becoming an options trader requires a comprehensive understanding of the market and risk management strategies. Here are some steps to get started:

- Educate yourself: Read books, attend webinars, and take courses to enhance your knowledge of options trading concepts and strategies.

- Open an options trading account: Select a brokerage firm that offers options trading and open an account after due research.

- Practice with paper trading: Simulate real-world trading experiences using virtual funds to familiarize yourself with the trading platform and test your strategies.

- Start with small positions: As a beginner, it’s recommended to start with small options contracts to manage risk and gain practical experience.

- Manage your risk: Use stop-loss orders to cap potential losses and limit your exposure to market fluctuations.

Image: www.markettradersdaily.com

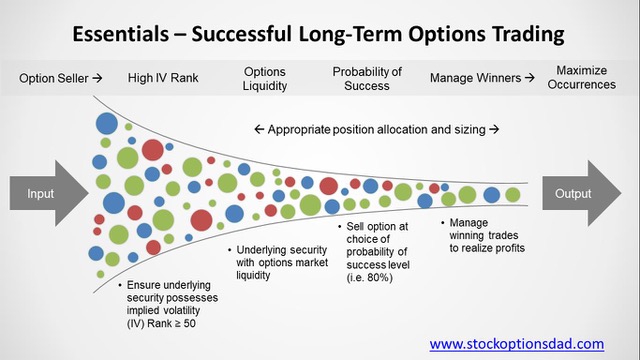

Advanced Options Trading Techniques

As your experience grows, you may explore advanced options trading techniques to enhance your risk management and return potential:

- Volatility trading: Profiting from fluctuations in the volatility of the underlying asset.

- Delta hedging: Adjusting your portfolio to maintain a desired delta, which measures the sensitivity of an option price to changes in the underlying asset’s price.

- Theta trading: Exploiting the decay of time value as options approach expiration.

- Options spreads: Combining multiple options contracts with different strike prices and expiration dates to create customized strategies.

Options Trading For Rookies How To Become An Options Trader

Image: www.ino.com

Conclusion

Venturing into the realm of options trading can be an exhilarating endeavor, but it’s crucial to approach it with a solid understanding of market dynamics, risk management, and advanced trading techniques. By following the steps outlined in this guide, rookies can embark on their options trading journey with confidence and leverage this powerful financial tool to maximize their investment potential.