Introduction

Image: www.chegg.com

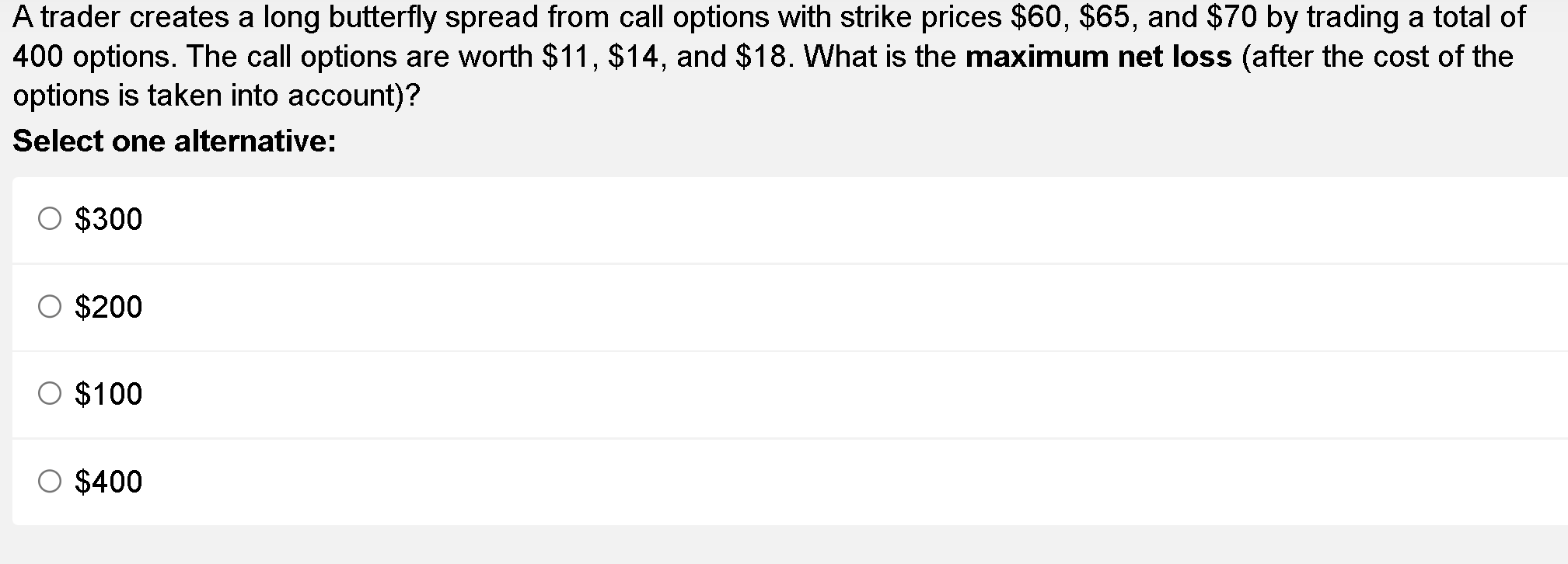

The world of options trading can be a daunting maze, but with the right strategies, you can navigate it with confidence and precision. One such technique that has gained prominence is the Charles Cottle Butterfly Adjustment. This innovative approach offers a calculated way to manage risk and potentially boost returns, making it an invaluable tool for savvy traders.

Understanding the Charles Cottle Butterfly Adjustment

The Charles Cottle Butterfly Adjustment, named after its creator, is a sophisticated options strategy that involves buying far-out-of-the-money calls and puts while selling closer-to-the-money calls and puts. This creates a butterfly-shaped pattern when plotted on a stock or options chart.

The rationale behind this strategy is to generate income by collecting the premium on the sold options. As long as the stock price remains within a specific range, the pattern maintains its shape, granting the trader steady returns. However, if the stock price moves beyond these boundaries, the losses from the long options can offset the gains from the short options.

Benefits of Using the Butterfly Adjustment

-

Income Generation: The adjustment allows traders to collect substantial premiums from the sold options, providing a steady source of income.

-

Risk Mitigation: The simultaneous buying and selling of options helps spread the risk, potentially mitigating potential losses compared to holding a single option position.

-

Directional Flexibility: The strategy can be employed in various market conditions, whether expecting a sideways trend or a breakout in either direction.

How to Implement a Butterfly Adjustment

Implementing a Charles Cottle Butterfly Adjustment requires careful planning and meticulous execution.

-

Identify a Stock with Expected Sideways Movement: Analyze the stock’s recent price action and market sentiment to predict whether it will likely trade within a range.

-

Determine Strike Prices and Time Frames: Choose far-out-of-the-money strike prices for the long options and closer-to-the-money strike prices for the short options. The expiry date should align with the expected range-bound period.

-

Calculate Premium and Risk: Carefully calculate the net premium to be collected and the potential risk involved. Ensure that the potential rewards outweigh the risks.

-

Execute the Strategy: Simultaneously execute an order to buy a small number of deep ITM and deep OTM calls and puts while selling a larger number of ATM or slightly OTM calls and puts.

Expert Insights

“The Butterfly Adjustment is an excellent strategy for income generation in a sideways market,” advises renowned options trader and author Chad Coleman. “However, it’s crucial to understand the risks involved and ensure that the stock has a high probability of remaining within the anticipated range.”

Additional Resources

- Charles Cottle’s Book: “Options Trading: The Complete Guide to Trading Stock Options”

- Interactive Brokers: “Butterfly Adjustment Strategy: How to Use It and When”

- Udemy: “Options Trading: Charles Cottle Butterfly Strategy”

Conclusion

The Charles Cottle Butterfly Adjustment is a powerful options strategy that empowers traders to capitalize on range-bound market conditions while potentially mitigating risks. By carefully following the guidelines outlined, beginner and experienced traders alike can harness the potential of this strategy and enhance their trading journey.

Embrace the opportunities presented by options trading. Remember to approach every strategy with a well-informed mind and a calculated risk appetite. As the legendary Warren Buffett said, “The only way to master the market is to master yourself.” Happy trading!

Image: bestoftrader.com

Options Trading Charles Cottle Butterfly Adjustment

Image: sacredtraders.com