The realm of investments offers a vast spectrum of possibilities, with options and after hours trading emerging as gateways to enhanced returns and unparalleled flexibility. Understanding these financial instruments can empower traders to navigate market complexities, capitalize on market inefficiencies, and maximize their trading prowess. In this article, we delve into the nuances of options and after hours trading, unraveling the advantages, strategies, and potential pitfalls associated with these sophisticated trading avenues.

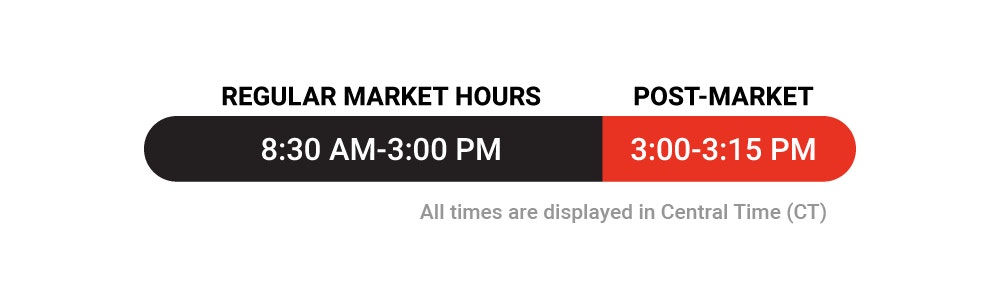

Image: tastytrade.com

Unveiling Options: A Gateway to Amplified Returns

Options trading provides investors with an array of financial instruments that offer unique advantages over traditional stock trading. An option grants the holder the right, but not the obligation, to buy (call option) or sell (put option) an underlying asset at a specified strike price and expiration date. This empowers traders with an array of strategies, from speculating on price movements to hedging against potential losses.

The key concept in options trading is the “premium,” the price paid for the right to exercise the option. This premium encapsulates various factors, including the underlying asset’s price, volatility, time to expiration, and interest rates. Understanding these factors enables traders to strategically select options and optimize their returns.

After Hours Trading: Exploring Hidden Market Opportunities

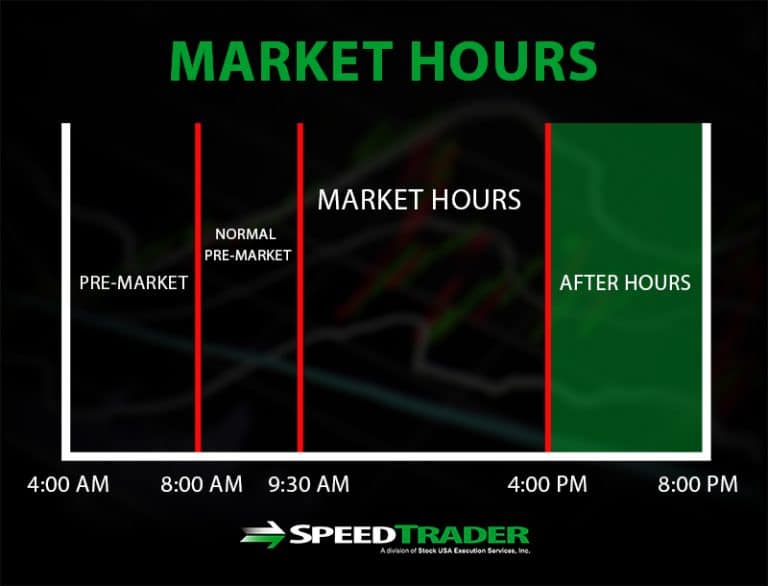

After hours trading transpires beyond the confines of regular market hours, typically extending from 4 pm to 8 pm EST. This unique trading window offers traders with extended access to the markets, facilitating the execution of trades after the market’s closing bell.

The after hours trading arena presents distinct advantages, allowing traders to react swiftly to significant news releases, execute large orders discreetly, and take advantage of price disparities that may arise during extended hours. Moreover, it provides an opportune platform for traders to monitor market movements and adjust their strategies accordingly.

Exploring Options Strategies for Enhanced Returns

Options trading encompasses a diverse range of strategies, catering to varying risk appetites and investment goals. Some of the most prevalent strategies include:

- Covered Calls: Options strategy where an investor holds the underlying asset and sells call options against it. This strategy seeks to generate income from premium while limiting potential losses.

- Protective Puts: Buying a put option with a higher strike price than the current stock price. It offers downside protection, mitigating losses in case of a market downturn.

- Iron Condors: A neutral strategy that involves selling one call, one put, and buying one call and one put at various strike prices. It aims to capitalize on low volatility by selling options at prices where exercise is unlikely.

Image: www.schwab.com

Unraveling the Risks of Options and After Hours Trading

Like any investment avenue, options and after hours trading come with inherent risks that require prudent consideration.

- Time Decay: The value of options steadily declines over time, even if the underlying asset’s price remains unchanged. Understanding this crucial concept is vital for successful options trading.

- Volatility Risk: Option premiums are closely tied to the volatility of the underlying asset. High volatility can lead to rapid price swings, resulting in substantial losses or gains.

- Low Liquidity: After hours trading often involves lower liquidity than regular market hours. This lack of liquidity can make it challenging to trade large orders at desired prices.

Options And After Hours Trading

Image: speedtrader.com

Conclusion: Embracing Sophisticated Investment Avenues

Options and after hours trading provide investors with sophisticated avenues to boost their trading potential, whether they seek substantial returns, mitigate risks, or capitalize on off-hour market inefficiencies. However, navigating these markets demands a comprehensive understanding of trading strategies, risk management, and market dynamics. By embracing a prudent approach and seeking guidance from reputable sources, traders can harness the power of options and after hours trading to amplify their investment returns and achieve their financial goals.