If you’re seeking to expand your trading horizons and uncover the lucrative potential of options, building a personalized watchlist is a crucial step. An option trading watchlist acts as your curated radar, helping you pinpoint stocks with attractive option premiums and underlying movement that aligns with your trading strategies. In this comprehensive guide, we’ll delve into the essence of option trading watchlists, exploring their components, strategies, and the practical steps to create your own.

Image: www.youtube.com

Understanding Option Trading Watchlists

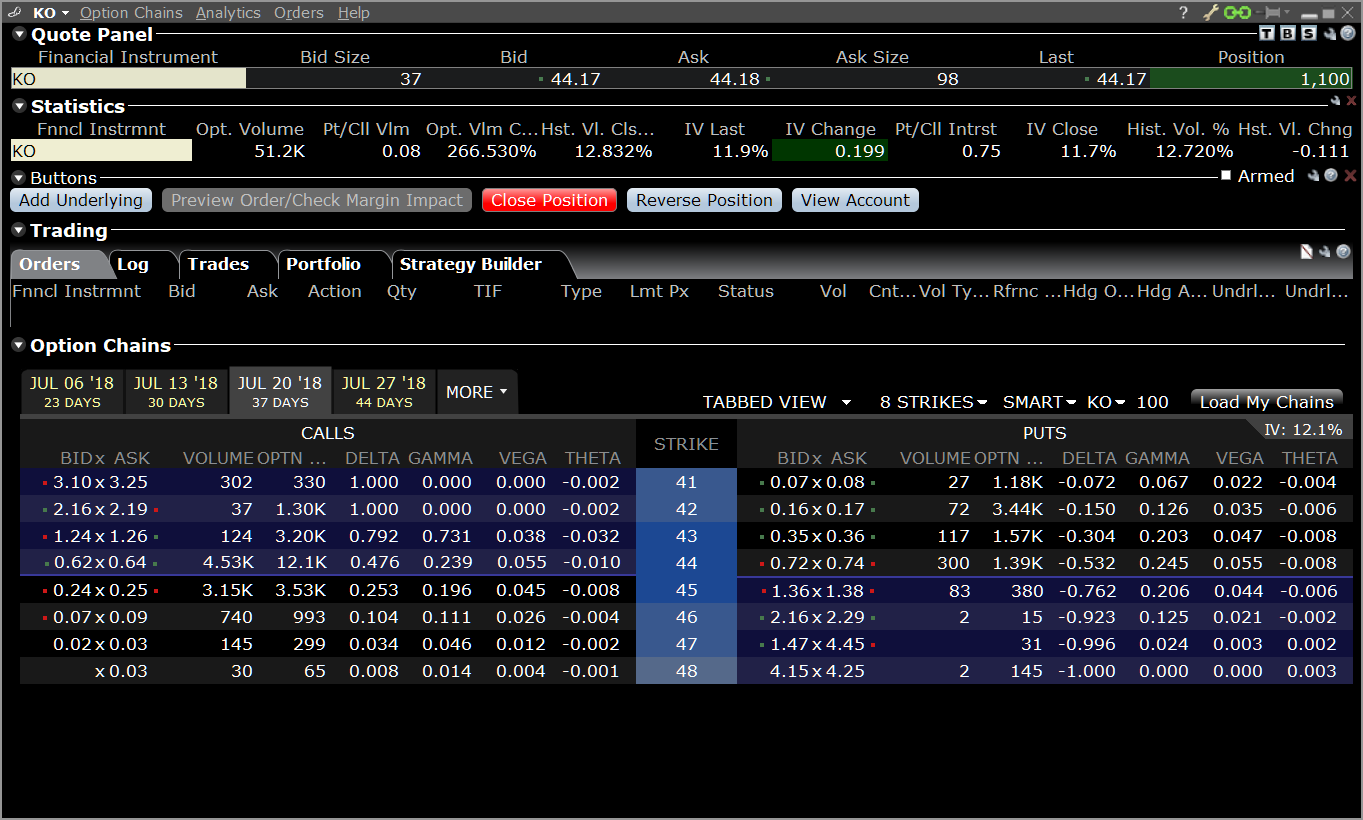

Simply put, an option trading watchlist is a customized collection of stocks, exchange-traded funds (ETFs), or other underlying assets that have caught your eye for potential options trading opportunities. These assets exhibit characteristics that fit your trading preferences, such as high volatility, specific price patterns, or favorable technical indicators. By keeping a close watch on these assets, you can swiftly identify trading opportunities and capitalize on market movements.

Components of a Watchlist

Effective watchlists are not merely a random assembly of assets but are strategically constructed based on well-defined criteria. Some of the key components to consider are:

1. Volatility: Volatility refers to the extent of price movement in an asset. Options with higher volatility offer greater potential for profit but also carry higher risk. It’s essential to align the volatility of the underlying asset with your risk tolerance and trading strategy.

2. Liquidity: Liquidity measures the ease with which an asset can be bought or sold. Illiquid assets can result in slippage or delayed execution, potentially affecting your profits. Choose assets with sufficient liquidity to ensure smooth trading.

3. Technical Indicators: Technical indicators are mathematical formulas applied to historical price data to identify trading opportunities. Incorporating technical indicators into your watchlist can help you spot potential trend reversals or breakouts.

4. Fundamental Data: Fundamental data provide insights into the financial health and prospects of a company. Consider factors such as earnings reports, dividend yield, and industry trends to make informed decisions about the underlying asset’s potential.

Image: tradamaker.com

Option Trading Watchlist

Image: scuba-dawgs.com

Creating a Watchlist

Building a robust watchlist is not a one-size-fits-all endeavor. The optimal watchlist varies depending on your trading style, risk appetite, and investment objectives. Follow these steps to craft a watchlist tailored to your needs:

1. Determine Trading Strategy: Define your trading strategy, whether it’s day trading, swing trading, or long-term investing. This will guide your selection of underlying assets and the criteria used to filter your watchlist. Consider the time frame, risk-reward ratio, and profit targets that align with your strategy.

2. Identify Underlying Assets: Research and identify stocks, ETFs, or commodities that exhibit characteristics consistent with your trading strategy. Utilize fundamental data, technical analysis, and volatility assessments to make informed choices.

3. Set Filters: Establish clear-cut filters for your watchlist based on criteria such as price range, volatility, liquidity, and technical indicators. These filters will automatically populate your watchlist with assets that meet your predefined conditions.

4. Continuous Monitoring: Regularly monitor your watchlist to track the performance of the underlying assets and identify potential trading opportunities. Adjust your watchlist over time to reflect changes in market conditions and your trading preferences.

By diligently following these steps, you can construct a robust option trading watchlist that empowers you to identify and act upon lucrative opportunities in the financial markets. Embrace the potential of option trading watchlists and transform your trading journey into a more informed, strategic, and ultimately profitable endeavor.