An adrenaline rush awaits every trader as they navigate the ever-evolving realm of stock trading. Fidelity, a renowned financial powerhouse, extends its expertise through an options trading agreement that empowers investors to amplify their earning potential. Join us as we embark on an enthralling journey to decipher the intricacies of this agreement, unlocking a gateway to lucrative stock market adventures.

Image: www.trading101.com

The Anatomy of a Fidelity Options Trading Agreement

An options trading agreement with Fidelity grants you the privilege to trade options contracts, instruments that bestow the right (but not the obligation) to buy or sell an underlying asset at a predetermined price. This flexibility opens up a world of possibilities, empowering you to adapt your trading strategy to dynamic market conditions.

Central to this agreement is the concept of a premium. When you purchase an option, you pay a price known as the premium. This premium represents the cost of acquiring the right to exercise your option contract. Your potential profit or loss is directly tied to the difference between the premium you paid and the value of the underlying asset at the time of expiration or exercise.

Exploring the Types of Fidelity Options Trading Agreements

Fidelity accommodates varying investment objectives by offering a spectrum of options trading agreements. Each agreement is meticulously designed to align with your risk tolerance and financial goals.

Cash-Covered Put Trading Agreement:

This agreement requires you to possess sufficient cash in your account to cover the potential purchase of the underlying asset. It grants you the right to sell a specific number of shares at a set price before the contract expires. The potential profit lies in receiving the premium paid by the party seeking to acquire your right to sell.

Margin-Enabled Option Trading Agreement:

This agreement allows you to utilize borrowed funds to amplify your trading power. Exercise caution, as this strategy involves higher risks and may result in significant losses.

Naked Option Trading Agreement:

An advanced option trading strategy reserved for seasoned traders, this agreement permits you to sell options without owning or holding the underlying asset. While offering the potential for substantial rewards, it also exposes you to greater risks.

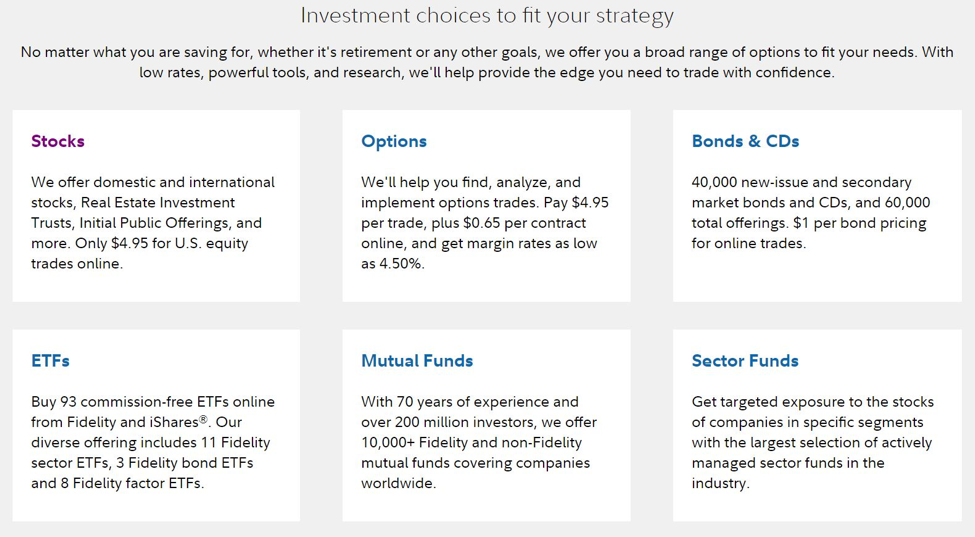

Empowering You with Exclusive Fidelity Features

Fidelity’s commitment to empowering traders extends beyond mere agreements. Leverage their state-of-the-art trading platform, tailored to enhance your trading experience.

Advanced Trading Tools:

Harness the power of sophisticated charting tools, real-time market data, and customizable alerts to gain a competitive edge in your trading endeavors.

In-Depth Market Research:

Stay abreast of market trends and delve into insightful research reports meticulously crafted by Fidelity’s team of experts.

Dedicated Customer Support:

A dedicated support team stands ready to assist you at every turn, ensuring your trading journey is smooth and well-informed.

Image: zulassung-pieske.de

Expert Insights: Unlocking Maximum Potential

Renowned trading expert, Marcus Banfield, shares his invaluable insights on maximizing your Fidelity options trading agreement.

“Embrace the power of smaller, tactical trades. Start with manageable positions, gradually increasing your involvement as you gain experience and confidence.”

“Manage your risks prudently. Never trade with funds you cannot afford to lose, and employ stop-loss orders to mitigate potential losses.”

“Diligence is the key to success. Dedicate time to researching and understanding the underlying assets and market dynamics that impact your trading decisions.”

Fidelity Options Trading Agreement

Conclusion: A Gateway to Financial Empowerment

A Fidelity options trading agreement is not merely a contract; it is a conduit to unlocking the boundless possibilities of stock market trading. Whether you seek to enhance your income, hedge against market risks, or simply explore the thrill of strategic investing, this agreement provides the necessary framework for success.

Embrace this opportunity to join Fidelity, a trusted financial partner dedicated to empowering traders like you. Embrace the excitement of stock trading and unlock the potential for financial freedom. Remember, knowledge is power, and with the right education and unwavering determination, you can conquer the stock market and achieve your financial dreams.