Gold has captivated civilizations for millennia, with its allure captivating investors and traders alike. Its reputation as a safe haven asset and hedge against economic turmoil has made it an indispensable investment choice. One way to amplify your potential returns while leveraging the dynamics of the gold market is through option trading. This article delves into the fascinating world of option trading on gold, providing a comprehensive overview of its mechanics, strategies, and expert insights to empower you in navigating the complexities of this market.

Image: news.tradingcup.com

Understanding the Fundamentals of Option Trading

Option trading involves the buying or selling of options contracts, which grant the holder the right, but not the obligation, to buy or sell an underlying asset at a predetermined price (the strike price) on or before a specific date (the expiration date). In the case of gold, you can trade options on gold futures contracts, which represent an agreement to buy or sell a specified amount of gold at a certain price on a future date.

Benefits of Option Trading in the Gold Market

- Exposure to Gold Price Movements: Options provide a way to gain exposure to the gold market without having to purchase physical gold or hold underlying futures contracts.

- Leverage and Flexibility: Options offer leverage, allowing traders to control a larger exposure with a relatively small capital commitment. They also provide flexibility, enabling traders to tailor their positions to specific market expectations and risk tolerance.

- Hedging against Risk: Options can be used for hedging purposes, allowing traders to protect their existing gold investments or offset potential losses from adverse market conditions.

Essential Strategies for Option Trading on Gold

There are numerous option strategies that can be employed in the gold market, each with its own unique risk-reward profile. Here are some of the most commonly used strategies:

- Buying Call Options: A positive outlook on gold prices may prompt you to purchase a call option, which gives you the right to buy gold at a predetermined price. This strategy is suitable if you expect gold prices to rise above the strike price.

- Selling Put Options: If you anticipate a decline in gold prices, you could sell a put option, which grants the buyer the right to sell gold to you at a specific price. This strategy benefits from premiums collected at the sale, and profits are maximized when gold prices fall below the strike price.

- Bull and Bear Spreads: These involve buying and selling options of different strike prices and expiration dates, creating spreads that can enhance profitability within defined market ranges.

Image: www.vrogue.co

Tips and Expert Advice for Option Trading Success

To increase your chances of success in gold option trading, consider these valuable tips from experienced traders:

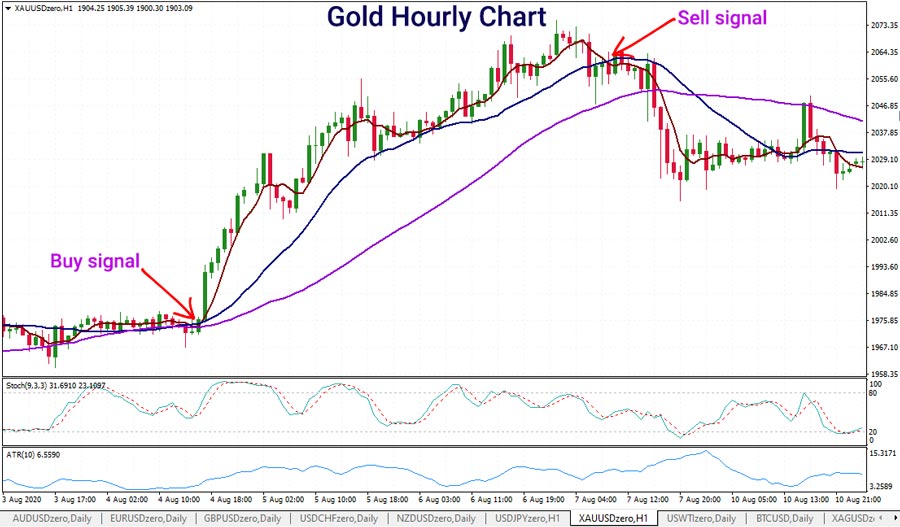

- Thorough Market Knowledge: Familiarity with the gold market, its price dynamics, and influential factors is crucial. Follow market news, technical analysis, and economic indicators to stay informed.

- Understanding Option Mechanics: Master the basics of option pricing, greeks, and trading strategies. This empowers you to make informed decisions and adjust positions accordingly.

- Risk Management: Always prioritize risk management. Determine your risk tolerance and allocate capital wisely, avoiding overleveraging or excessive speculation.

Frequently Asked Questions on Option Trading in the Gold Market

Q: What are the risks involved in option trading on gold?

Q: What are the advantages of using options over futures contracts?

Q: What resources can help me learn more about option trading in the gold market?

Option Trading On Gold Market

Image: thewaverlyfl.com

Conclusion

Option trading on gold provides a dynamic and potentially lucrative avenue for investors and traders. By harnessing the power of options, you gain the potential to enhance your gold-related investments, hedge against risks, and capitalize on price fluctuations. Remember to approach option trading with a solid understanding of the market and its complexities, employing sound risk management strategies. As you navigate the world of gold option trading, embrace this opportunity to explore new perspectives and expand your financial acumen. Embrace the challenge and delve into this rewarding realm of investment.