Introduction

In the realm of investing, option trading stands as a potent tool for savvy investors seeking to augment their portfolios. These financial instruments empower individuals to leverage market volatility and potentially generate substantial returns. Understanding the intricacies of option trading is paramount for those seeking to navigate this complex yet rewarding domain.

Image: kurskpu.ru

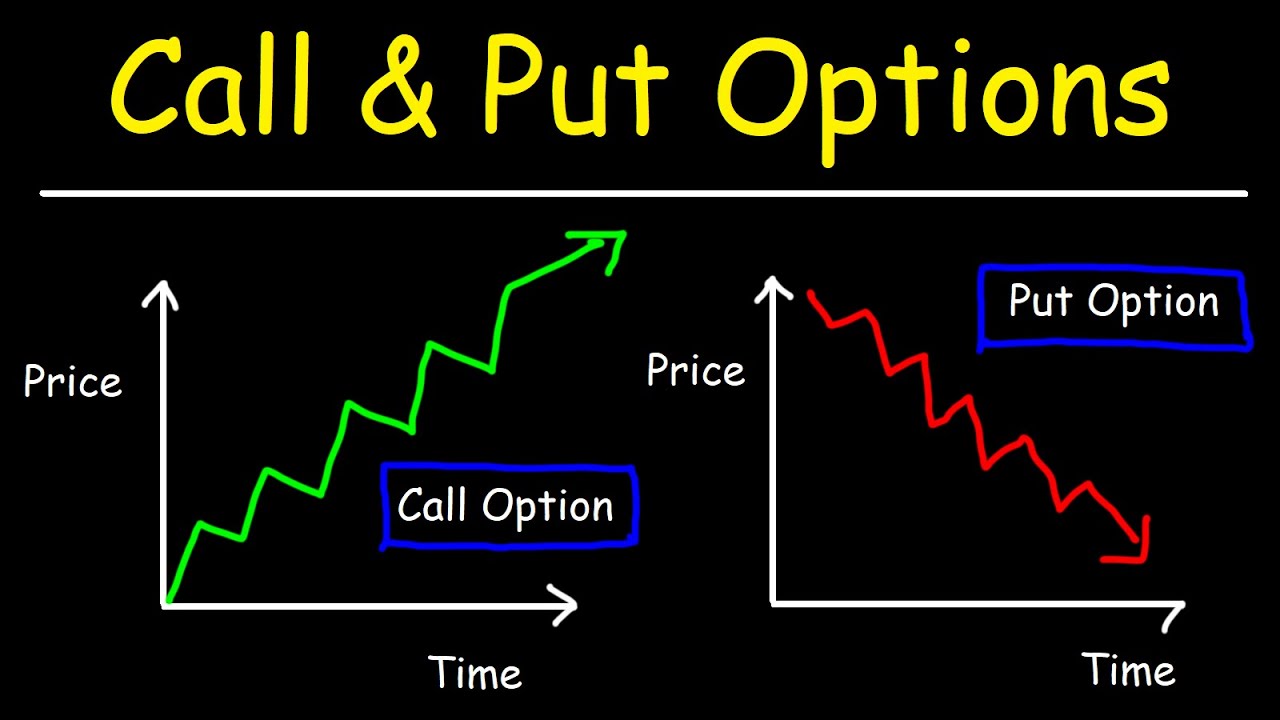

Options are contracts that confer upon their holders the right, but not the obligation, to conclude a certain transaction involving an underlying asset. They come in two primary flavors: calls and puts. Call options grant the holder the right to acquire an asset at a predetermined price, while put options offer the right to sell. Option contracts are traded on designated exchanges, conferring liquidity upon these instruments.

Unveiling the Options Lexicon

To fully comprehend option trading, familiarity with key terminology is essential. The underlying asset serves as the bedrock of the transaction, whether it be stocks, commodities, indices, or currencies. The strike price represents the predetermined price at which the underlying asset can be acquired (call) or sold (put) upon the exercise of the option.

Two fundamental concepts define the lifespan of an option: expiration date and time value. The expiration date signifies the ultimate day on which the holder can exercise their right. Time value, on the other hand, represents the intrinsic value of the option predicated upon the passage of time and the likelihood of the option being exercised.

Types of Options Strategies

The versatility of option trading manifests through a diverse array of strategies, each tailored to specific market conditions and risk appetites. Here are a few popular approaches:

- Covered Call: The investor owns the underlying asset and simultaneously sells a call option, generating premium income while capping the potential upside of the stock.

- Naked Call: An advanced strategy where the investor sells call options without owning the underlying asset, potentially yielding elevated returns but amplifying the risk of unlimited loss.

- Bull Call Spread: Purchasing a lower strike price call option while concurrently selling a higher strike price call option to capitalize on an upward price move.

- Cash-Secured Put: Selling a put option while maintaining sufficient cash reserves to purchase the underlying asset should the option be exercised, securing a premium and potentially acquiring an asset at a favorable price.

Advantages of Option Trading

Option trading presents numerous benefits, including:

- Enhanced Returns: Options provide a potent tool for amplifying returns, particularly in volatile markets.

- Risk Management: They offer investors a mechanism to mitigate downside risks and protect their portfolios during market downturns.

- Flexibility: Options enable investors to tailor strategies to their individual risk tolerance and investment objectives.

- Income Generation: Option premiums can serve as a consistent income stream, particularly through strategies like covered calls and cash-secured puts.

Image: www.pinterest.ph

Risks Associated with Options Trading

As with any investment, options trading involves certain inherent risks:

- Unlimited Loss: Some option strategies, notably naked calls, expose investors to unlimited potential losses.

- Time Decay: The value of options dwindles over time, especially as the expiration date nears, which emphasizes the importance of judicious timing.

- Margin Requirements: Option trading often entails the use of margin, which magnifies potential gains and losses and may necessitate additional capital.

Option Trading Investments

Image: www.financestrategists.com

Conclusion

Option trading presents a complex yet potent avenue for investors seeking to augment their portfolios and manage risk. By grasping the fundamental concepts, diligently monitoring market dynamics, and employing appropriate strategies, investors can harness the power of options to their advantage. Remember, due diligence, prudent risk management, and a thorough understanding of this intricate domain are the cornerstones of success in the captivating realm of option trading.