Introduction

Ready to dive into the thrilling world of options trading? E*TRADE’s paper trading platform offers a remarkable opportunity to hone your skills and gain valuable insights without risking any capital. Options paper trading lets you experience the complexities of this financial market in a risk-free environment, allowing you to make strategic decisions and test ideas before venturing into real-time trading.

Image: thebrownreport.com

What Is Options Paper Trading?

Options paper trading simulates real-world options trading, albeit without the actual financial commitment. You’re given a virtual account with a set amount of play money, enabling you to buy and sell options contracts and track your performance as if you were trading with real funds. This virtual environment provides a secure sandbox to learn, experiment, and refine your trading techniques.

Benefits of Options Paper Trading

- Risk-free Learning: Engage in options trading without the fear of losing real money.

- Real-Time Market Experience: Gain a firsthand understanding of market fluctuations and option pricing behavior.

- Strategy Refinement: Test and adjust your trading strategies in a safe setting before employing them in real life.

- Education and Skills Building: Learn the intricacies of options trading and improve your analytical and decision-making abilities.

- Decision Confidence: Develop confidence in your trading decisions by testing your assumptions and ideas in a paper trading environment.

Getting Started with E*TRADE Options Paper Trading

To start paper trading options with ETRADE, simply create a paper trading account. ETRADE’s user-friendly platform provides comprehensive trading tools, educational resources, and a vast library of learning materials to guide you through your trading journey.

Image: ujejocykixova.web.fc2.com

Understanding Options Trading Basics

Before delving into paper trading, it’s essential to grasp the basics of options trading. Options are contracts that give the buyer the right, but not the obligation, to buy or sell an underlying asset at a predetermined price on or before a specific date. There are two main types of options:

- Calls: The right to buy an underlying asset.

- Puts: The right to sell an underlying asset.

Options have specific characteristics, including strike price (the price at which the underlying asset can be bought or sold), expiration date (the deadline for exercising the option), and premium (the price paid to purchase the option).

Trading Options on the E*TRADE Paper Trading Platform

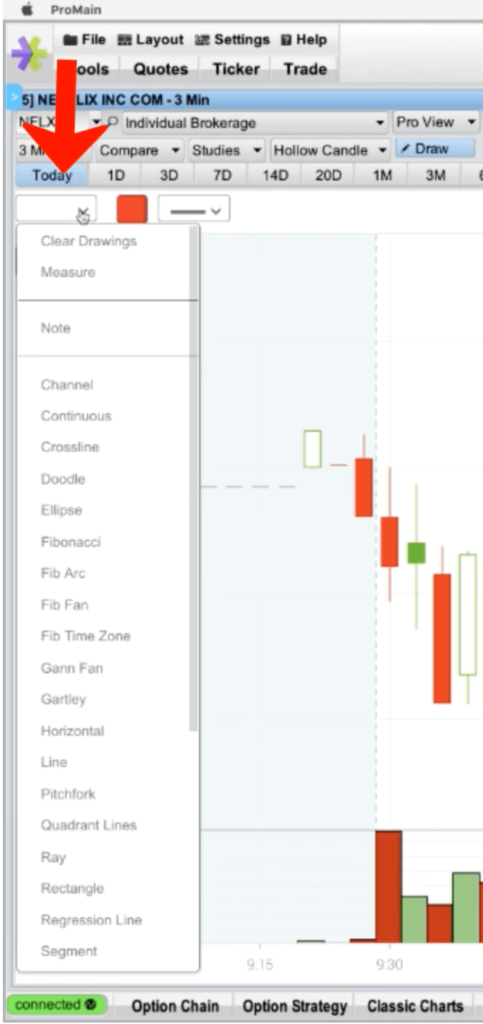

E*TRADE’s paper trading platform provides a realistic trading experience. Once you’re familiar with options basics, you can utilize the platform’s advanced trading tools, including:

- Option Chain Analysis: Assess different options contracts based on strike price, expiration date, and premium.

- Interactive Charting: Analyze price patterns and trends of the underlying asset and its impact on option pricing.

- Technical Indicators: Employ technical analysis tools to identify potential trading opportunities.

Developing a Trading Strategy

A successful options trading strategy relies on a combination of fundamental and technical analysis.

- Fundamental Analysis: Evaluate the underlying asset’s financial health, industry trends, and overall market conditions.

- Technical Analysis: Study historical price patterns and market indicators to identify potential trading opportunities.

By combining these approaches, you can develop a trading strategy that aligns with your risk tolerance and investment goals.

Etrade Options Paper Trading

Conclusion

E*TRADE’s options paper trading platform is an invaluable tool for both experienced and aspiring traders. It offers a risk-free environment to learn, experiment, and refine trading strategies, all while gaining an in-depth understanding of the complexities of options trading. By embracing this educational approach, you can confidently navigate the financial markets with enhanced knowledge and decision-making abilities.