Introduction

Are you ready to embark on a trading odyssey and conquer the enigmatic world of options? Understanding the intricacies of option trading cost basis is pivotal in navigating this market successfully. In this comprehensive guide, we’ll unravel the ins and outs of cost basis, providing you with the knowledge and insights to maximize your trading potential.

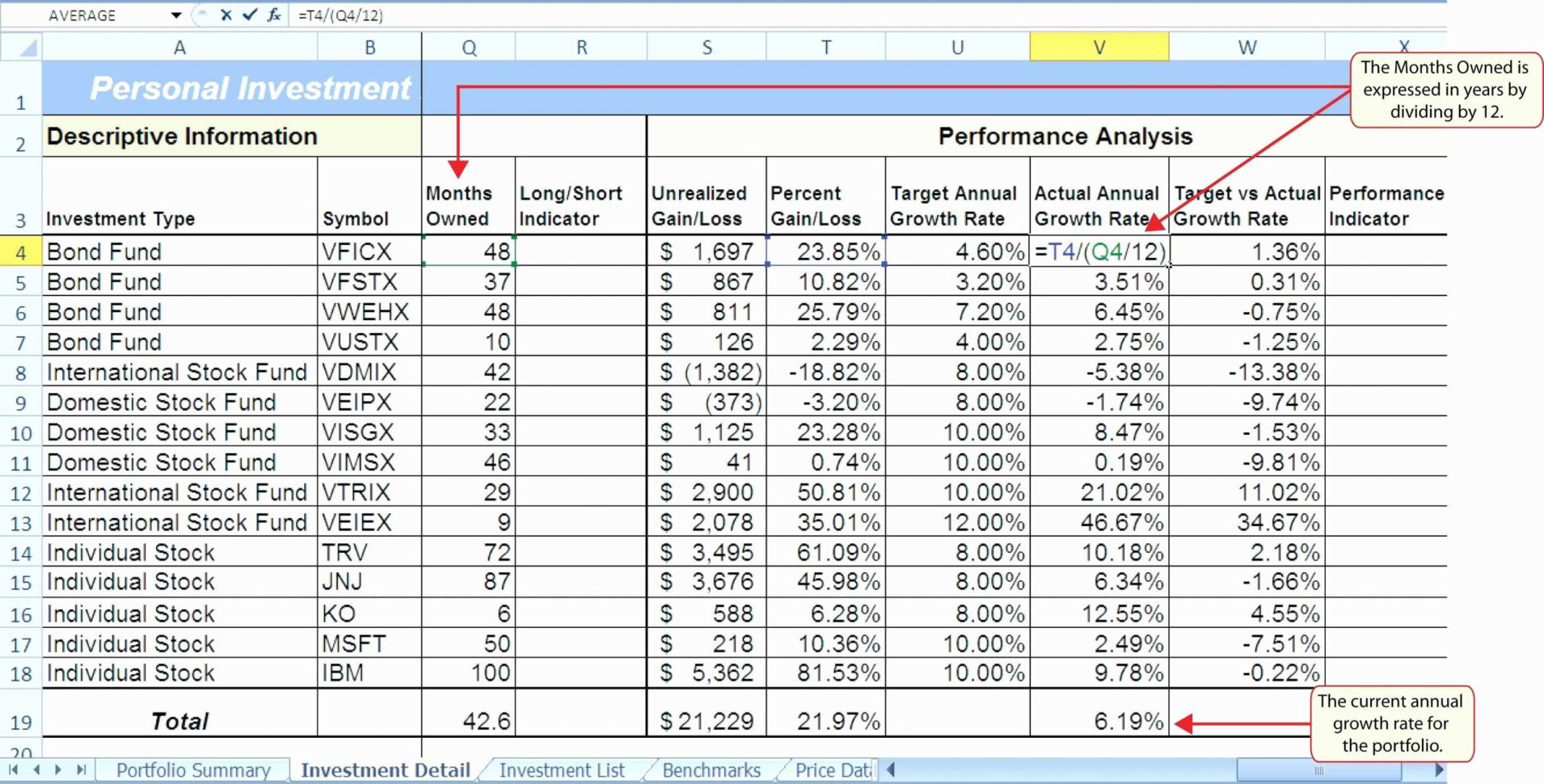

Image: db-excel.com

Delving into Option Trading Cost Basis: The Essential Concepts

An option’s cost basis represents the total capital you’ve invested in it. This includes the purchase price, commissions, and any other fees associated with the trade. Understanding your cost basis is essential for several reasons:

1. Accurate Profit/Loss Calculation

Determining the profitability of your options trades requires precise knowledge of your cost basis. Only by subtracting this cost from the selling price can you truly assess your gains or losses.

2. Tax Implications

Depending on your jurisdiction, option trading profits may be subject to taxation. Your cost basis forms the foundation for calculating your taxable income, ensuring accurate tax reporting.

Image: kbfinancialadvisors.com

Unlocking the History of Option Trading Cost Basis: A Legacy of Value

Cost basis has its roots in the heart of option trading practices. Early on, traders recognized the need to track their investment expenses to determine the true value of their trades. This concept has since evolved into a cornerstone of option trading, shaping the industry’s standards and regulations.

Breaking Down the Components of Option Trading Cost Basis: A Deeper Understanding

The option trading cost basis comprises various elements that shape its overall value:

1. Purchase Price

This is the price you paid to acquire the option contract. It forms the primary component of your cost basis.

2. Commissions

Brokerage fees charged for executing the trade contribute to your cost basis.

3. Option Premiums

The premium you paid to purchase the option is included in the cost basis.

4. Exercise Fees

If you exercise your option, the exercise fee becomes part of the cost basis.

Expert Insights and Actionable Tips: Unlocking the Secrets of Successful Trading

Seasoned option traders share their wisdom on mastering cost basis:

-

Prioritize Accurate Record-Keeping: Maintain meticulous records of your option trades, including purchase prices, commissions, and other expenses.

-

Utilize Trading Platforms: Many trading platforms offer tools for calculating and tracking cost basis, streamlining your record-keeping process.

-

Consider Tax Implications: Be aware of the tax laws governing option trading in your jurisdiction and consult with a tax professional if needed.

Conclusion: Empowering Traders with the Knowledge of Cost Basis

Understanding option trading cost basis not only enhances your trading acumen but also empowers you to make informed financial decisions. By grasping the concepts outlined in this guide, you’ll gain a competitive edge in the ever-evolving options market.

Option Trading Cost Basis

Image: www.adigitalblogger.com

Call to Action: Embark on Your Trading Journey

Unlock the potential of option trading today by embracing the knowledge of cost basis. Invest wisely, and may your trades be filled with success and profitability.