In the realm of finance, options trading stands as a beacon of potential wealth, beckoning savvy traders with the promise of substantial returns. But navigating this intricate terrain demands discerning eyes, a keen understanding of market forces, and the unwavering guidance of reliable indicators.

Image: cuentabilletes.com

Like celestial navigators, best indicators serve as indispensable guideposts, illuminating the path to informed and profitable trading decisions. They harness the collective wisdom of historical data, market sentiment, and technical analysis, providing traders with a roadmap to traverse the otherwise opaque waters of options trading.

Volume: The Lifeblood of Markets

Volume, the relentless heartbeat of any market, holds immense sway over option trading. It signifies the intensity of trading activity, revealing the pulse of supply and demand. Surging volume heralds increased volatility, amplifying potential price swings. Conversely, waning volume suggests a lull in trading, often preceding market consolidation or reversals.

Open Interest: A Census of Commits

Traders leave an indelible footprint in the form of open interest, a metric capturing the number of outstanding options contracts yet to be closed or exercised. This financial census provides invaluable insights into market sentiment. Rising open interest in a particular option signals growing bullish or bearish sentiment, suggesting an influx of buyers or sellers anticipating future price movements.

Implied Volatility: Forecasting the Unpredictable

The enigmatic nature of market volatility finds expression in implied volatility (IV), an indicator that projects the anticipated level of price fluctuations. Options with higher IV suggest the market expects substantial price swings, while lower IV indicates a period of relative tranquility. Understanding IV is crucial for traders seeking to gauge market risk and adjust their strategies accordingly.

Image: www.daytradetheworld.com

Delta: Quantifying Price Sensitivity

Delta measures the sensitivity of an option’s price to changes in the underlying asset’s price. It serves as a gauge of an option’s inherent leverage. Options with high positive deltas tend to rise in value as the underlying asset increases in price, while negative deltas indicate a bearish bias. Comprehending delta empowers traders to fine-tune their risk-reward ratio.

Greeks: Deciphering Option Dynamics

Delving deeper into the world of options, traders encounter the enigmatic Greeks, a constellation of indicators that unravel the complex interplay of options prices and market conditions. These Greek letters—delta, gamma, theta, and others—quantify the impact of various factors on an option’s value, such as time decay, price changes, and volatility shifts.

Chart Patterns: Stories Etched in Price

Technical analysts swear by chart patterns, graphical representations of historical price movements that often reveal recurrent formations. These patterns serve as signposts, aiding traders in identifying potential market reversals, continuations, and breakouts. Some popular chart patterns include head and shoulders, triangles, and double tops, each with its unique significance.

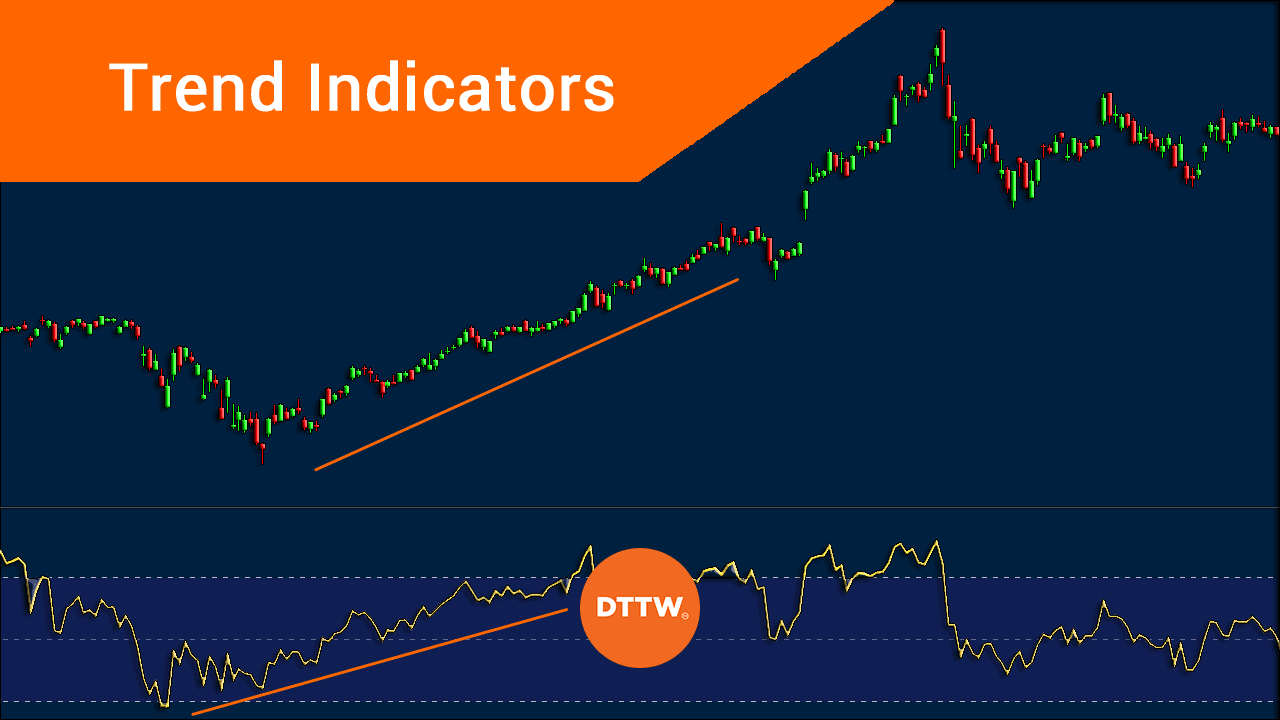

Trend Lines: Guiding the Market’s Course

Time-honored trend lines connect a series of price points, revealing the prevailing market bias. These diagonal lines delineate the general direction of price movements, serving as support zones when prices find a floor or resistance levels when prices encounter resistance. Traders utilize trend lines to identify potential trading opportunities and mitigate risk.

Moving Averages: Smoothing out the Noise

Moving averages, a cornerstone of technical analysis, strive to mitigate market volatility’s distorting effects. These mathematical calculations smooth out price data, revealing underlying trends and support and resistance areas. Traders can employ various moving averages, such as the simple moving average (SMA) and exponential moving average (EMA), each with its own unique characteristics and suitability for specific market environments.

Relative Strength Index (RSI): Gauging Market Momentum

The relative strength index (RSI) shines a light on market momentum, measuring the relative strength of price changes over a specified period. This oscillator fluctuates between 0 and 100, reflecting overbought or oversold conditions. Traders use RSI to identify potential trend reversals and gauge the market’s overall sentiment.

Option Trading Best Indicators

Image: www.amtradingtips.com

Stochastic Oscillator: Uncovering Hidden Trends

The stochastic oscillator, akin to the RSI, investigates market momentum but does so by comparing a security’s closing price to its price range over a predetermined period. It generates two lines that oscillate within a range, providing insights into overbought or oversold conditions. The stochastic oscillator complements RSI in uncovering potential trading opportunities.

In the hands of discerning traders, these best indicators coalesce into a formidable arsenal, empowering them to navigate the complexities of options trading with precision and confidence. By harnessing the power of these market beacons, traders illuminate their path toward informed decisions, maximizing their potential for financial success.