Harnessing the Power of Derivative Strategies

As an experienced investor, I’ve witnessed firsthand the transformative power of option spread trading in maximizing income potential. It’s an intricate strategy that combines the principles of both fundamental and technical analysis, offering seasoned traders an avenue to mitigate risk and potentially generate substantial returns. Whether you’re a seasoned veteran or just starting out, this comprehensive guide will provide you with an in-depth understanding of option spread trading, its application, and the secrets to optimizing your success in this dynamic market.

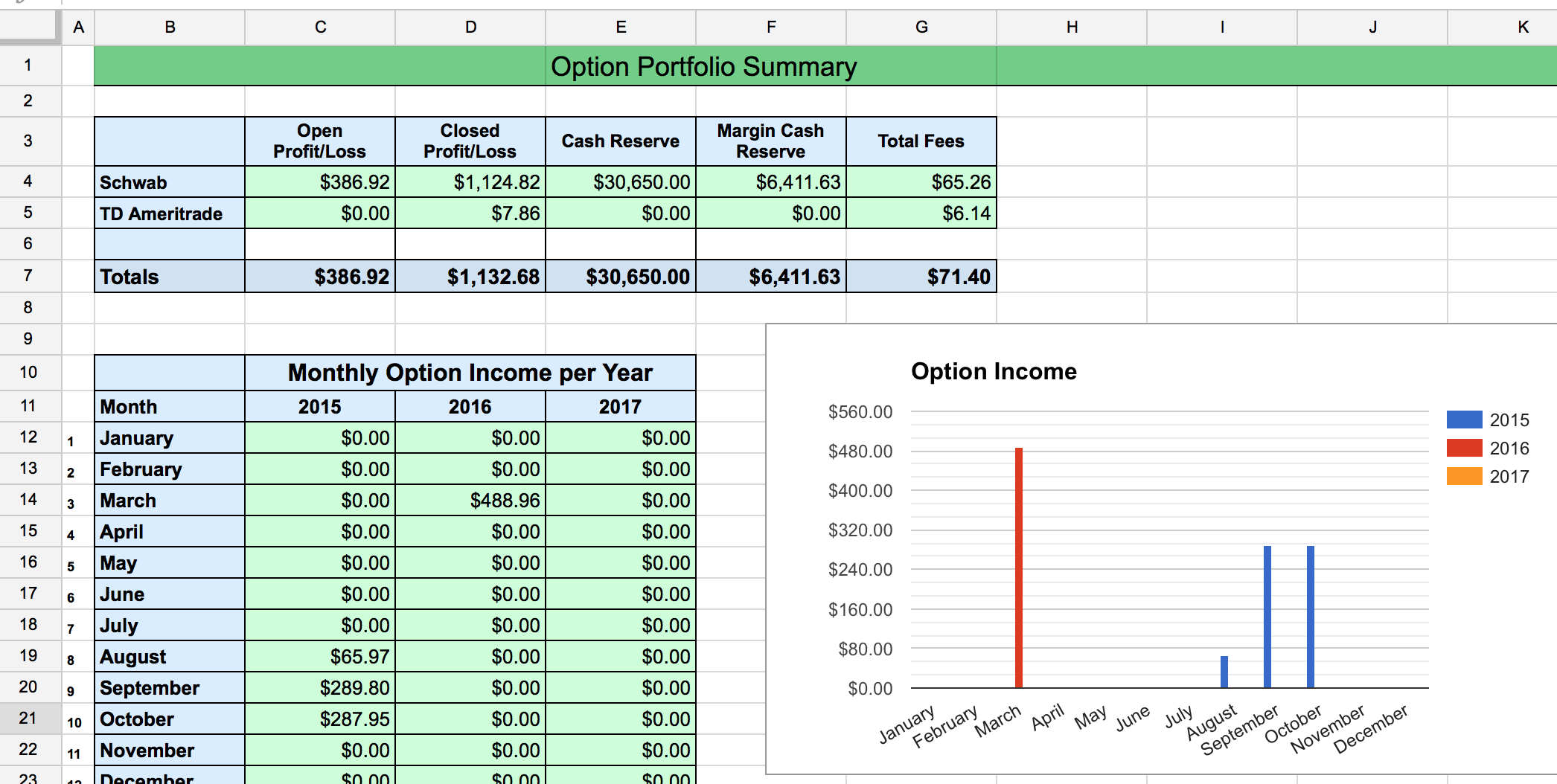

Image: tradeoptionswithme.com

What is Option Spread Trading?

Option spread trading involves the simultaneous purchase and sale of two or more options contracts with different strike prices and expiration dates. By strategically combining these contracts, traders aim to achieve a specific profit target while managing potential risk. Options themselves are derivative instruments that give the holder the right, but not the obligation, to buy (call option) or sell (put option) an underlying asset at a predetermined price on or before a specific date. By combining multiple options contracts, traders can craft sophisticated strategies that align with their risk tolerance and profit objectives.

Historical Evolution and Significance

The concept of option spread trading has its roots in the early 20th century, with the Chicago Board Options Exchange (CBOE) playing a pivotal role in its development and standardization. Initially confined to seasoned traders, the advent of online trading platforms and educational resources has made option spread trading more accessible to a wider audience. Today, it is widely employed by individuals and institutions seeking to enhance their investment strategies, manage risk, and potentially generate additional income streams.

Detailed Exploration of Option Spread Trading Strategies

Understanding the intricacies of option spread trading requires a close examination of the different strategies employed by traders. Each strategy is tailored to specific market conditions and risk profiles, allowing traders to adapt their approach based on their individual circumstances. Some of the most commonly utilized strategies include:

-

Bull Call Spread: A bullish strategy involving the purchase of a lower strike price call option and the simultaneous sale of a higher strike price call option with the same expiration date. Traders employ this strategy when they anticipate a moderate increase in the underlying asset’s price.

-

Bear Put Spread: A bearish strategy involving the purchase of a higher strike price put option and the simultaneous sale of a lower strike price put option with the same expiration date. Traders employ this strategy when they anticipate a moderate decrease in the underlying asset’s price.

-

Iron Condor Spread: A neutral strategy involving the purchase of a lower strike price call option and a higher strike price put option, along with the simultaneous sale of a higher strike price call option and a lower strike price put option, all with the same expiration date. Traders employ this strategy when they anticipate a range-bound market with limited price fluctuations.

-

Butterfly Spread: A bullish or bearish strategy involving the simultaneous purchase of one option at a middle strike price and the sale of two options at higher or lower strike prices, respectively, all with the same expiration date. Traders employ this strategy when they anticipate a substantial but defined move in the underlying asset’s price.

Image: rmoneyindia.com

Expert Insights and Tips for Success

Mastering the art of option spread trading requires not only a thorough understanding of the underlying concepts but also the ability to navigate the market’s ever-changing dynamics. Seasoned traders have developed a wealth of insights and strategies that can significantly enhance your chances of success:

-

Proper Risk Management: Always prioritize risk management by carefully calculating potential losses and implementing appropriate stop-loss orders.

-

Technical and Fundamental Analysis: Combine technical analysis tools, such as chart patterns and indicators, with fundamental analysis factors, including economic data and company financials, to make informed trading decisions.

-

Market Volatility Assessment: Analyze market volatility using metrics like the VIX to determine the optimal strategies and strike prices for your trades.

-

Liquidity Considerations: Choose options with high liquidity to ensure ease of execution and minimize slippage, which can erode your potential profits.

Frequently Asked Questions (FAQs)

1. What is the minimum capital required for option spread trading?

The capital requirement can vary based on the chosen strategy and the underlying asset. It is generally recommended to start with a small account and gradually increase your positions as your experience and risk tolerance grow.

2. Can beginners engage in option spread trading?

While it’s possible for beginners to learn the basics of option spread trading, it is highly advisable to gain a solid understanding of options and market dynamics before risking capital. Consider paper trading or seeking guidance from an experienced trader.

3. What are the potential returns of option spread trading?

Returns can vary significantly depending on market conditions, strategy execution, and risk tolerance. Some traders aim for consistent but moderate returns, while others pursue more aggressive strategies with the potential for higher profits but also greater risks.

Option Spread Trading Strategy

Image: www.twoinvesting.com

Conclusion

Option spread trading presents a multifaceted approach to potentially enhancing your investment returns while managing risk. By understanding the various strategies, incorporating expert advice, and adhering to sound risk management principles, you can harness the power of this versatile trading technique. Whether you’re a seasoned veteran or just starting out, the information provided in this comprehensive guide will serve as a valuable resource in your journey towards mastering option spread trading and achieving your financial goals.

Are you ready to explore the world of option spread trading and unlock its potential for income generation?