Introduction:

Image: investpost.org

In the realm of financial markets, where volatility reigns supreme, options traders seek strategies to navigate risk and reap rewards. One such strategy is gamma trading, a sophisticated technique that leverages the option’s sensitivity to price changes known as gamma. Enter the option volcube PDF, a valuable tool that decodes the mysteries of gamma trading and empowers traders with actionable insights.

What is Option Gamma Trading?

Gamma measures the rate of change in an option’s delta with respect to the underlying asset’s price. In simpler terms, gamma quantifies how the option’s hedging requirement changes as the underlying asset’s price fluctuates. Traders exploit this relationship to create strategies that capitalize on rapid price movements and generate income.

The Option Volcube PDF: A Blueprint for Success

The option volcube PDF is a graphical representation of an option’s price as it relates to the underlying asset’s price and time to expiration. By visualizing this complex relationship, traders can gain a deeper understanding of gamma and identify optimal trading opportunities.

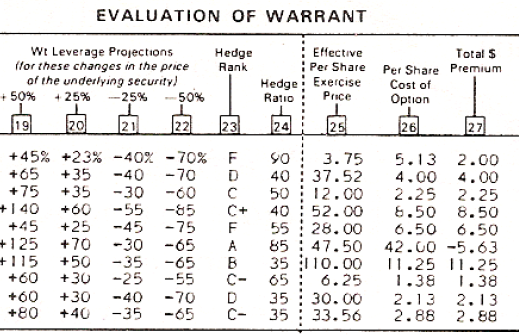

The volcube PDF provides insights into:

- Option pricing at different underlying asset prices and time horizons

- Delta and gamma values for each option price level

- The shape and curvature of the volcube surface

Leveraging Option Gamma for Profit

Traders can employ gamma trading strategies to capitalize on both rising and falling markets. By selling options with high gamma values, they can generate premium income and benefit from widening bid-ask spreads. Conversely, buying options with low gamma values allows traders to reduce risk and position themselves for potential upside.

Expert Insights and Actionable Tips

Seasoned option traders emphasize the importance of:

- Understanding the Greeks, including gamma, delta, and theta

- Managing risk through proper position sizing and hedging strategies

- Staying informed about market trends and upcoming events that may impact option pricing

Conclusion:

Option gamma trading is a powerful tool for sophisticated traders seeking to unlock the potential of options markets. By utilizing the option volcube PDF, traders can visualize gamma dynamics and develop strategies that harness the power of this crucial Greek. By embracing the principles of gamma trading and leveraging the insights provided by the volcube PDF, traders can empower themselves to navigate market volatility and enhance their trading success.

Image: www.youtube.com

Option Gamma Trading Volcube Pdf

Image: unygeduc.web.fc2.com