Introduction

Have you ever wondered how to leverage the Indian stock market for potential gains? NSE option trading, a versatile financial instrument, empowers traders with the opportunity to seize market movements. This comprehensive guide will introduce you to the basics, potential benefits, and a practical example of NSE option trading.

Understanding NSE Option Trading

NSE (NSE) is India’s largest stock exchange, offering a diverse range of financial instruments including equity shares and derivatives. Option contracts, a type of derivative, grant traders the right but not the obligation to buy or sell an underlying asset at a predetermined price on a specified date.

Image: www.stockradar.in

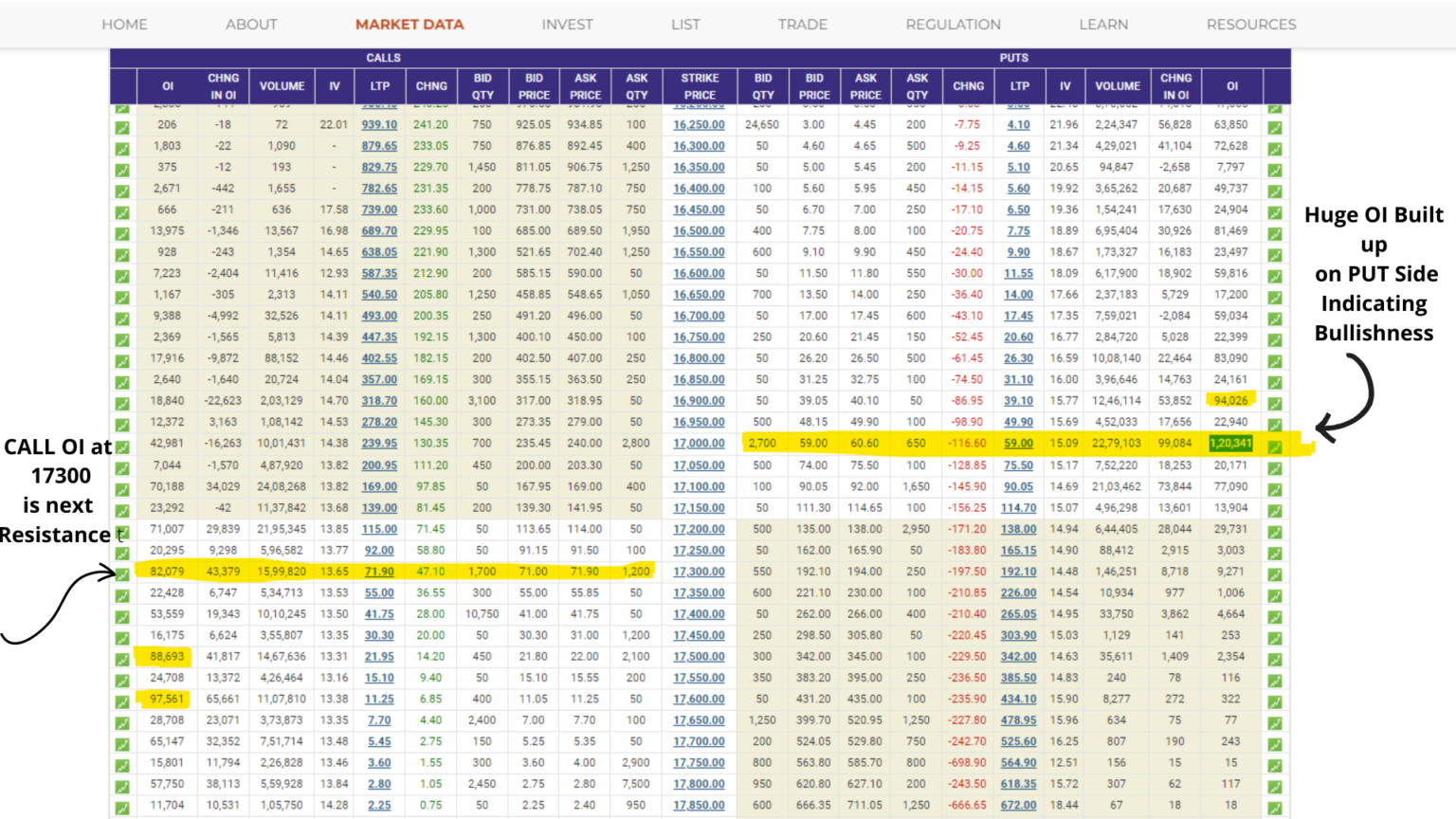

NSE option trading involves trading standardized option contracts. These contracts are characterized by specific underlying assets (stocks or indices), strike prices (the price at which the underlying asset can be bought or sold), expiry dates, and premium prices (the cost of acquiring the contract).

Benefits of NSE Option Trading

One of the primary advantages of NSE option trading is the flexibility it offers. Traders can choose from a wide range of options contracts tailored to their individual risk appetite and investment strategy. Option trading also enables traders to:

-

Generate income through option premiums

-

Hedge against potential losses in their stock portfolio

-

Leverage market movements to amplify potential gains

Example of NSE Option Trading

To illustrate the concept of NSE option trading, let’s consider a practical example. Say you believe the stock price of Reliance Industries (RIL) will increase in the coming days. You could purchase a RIL call option contract with a strike price of Rs. 2,700 expiring in one month. This contract would give you the right to buy RIL shares at Rs. 2,700 any time before the expiry date.

Now, assume that the RIL stock price increases to Rs. 2,800 during the option’s life. You could exercise your option contract, buying RIL shares at Rs. 2,700 and immediately selling them in the market at Rs. 2,800. This transaction would result in a profit of Rs. 100 per share, excluding brokerage and exchange fees.

Expert Insights

Dr. Reema Patel, a renowned financial advisor, emphasizes the importance of thorough research before engaging in NSE option trading. “Understanding the underlying asset, market dynamics, and option pricing models is crucial for successful trading,” she says.

Mr. Ramesh Rao, a seasoned options trader, advises beginners to start with small trades and gradually increase their involvement as they gain experience. “It’s essential to manage risk effectively by setting clear stop-loss levels and limiting your exposure to any single trade,” he adds.

Image: pankajchaudhary.in

Nse Option Trading Example

Image: www.youtube.com

Conclusion

NSE option trading provides a valuable opportunity to navigate the complexities of financial markets. By understanding the basics, leveraging expert insights, and practicing prudent risk management, you can harness the potential benefits of this powerful financial instrument. Embrace the world of NSE option trading and unlock a path to market success.

Disclaimer: The information contained in this article is provided for educational purposes only and should not be construed as investment advice. Trading in options and other derivative instruments involves significant risk and may not be suitable for all investors.