In the ever-evolving financial landscape, options trading has emerged as a lucrative avenue for savvy investors. Deftly navigating the intricacies of options, particularly the Nifty options, can unlock doors to exceptional gains. As an ardent practitioner in the realm of options trading, I’ve witnessed firsthand the transformative power of this financial instrument, and I’m eager to unveil its nuances through this comprehensive guide.

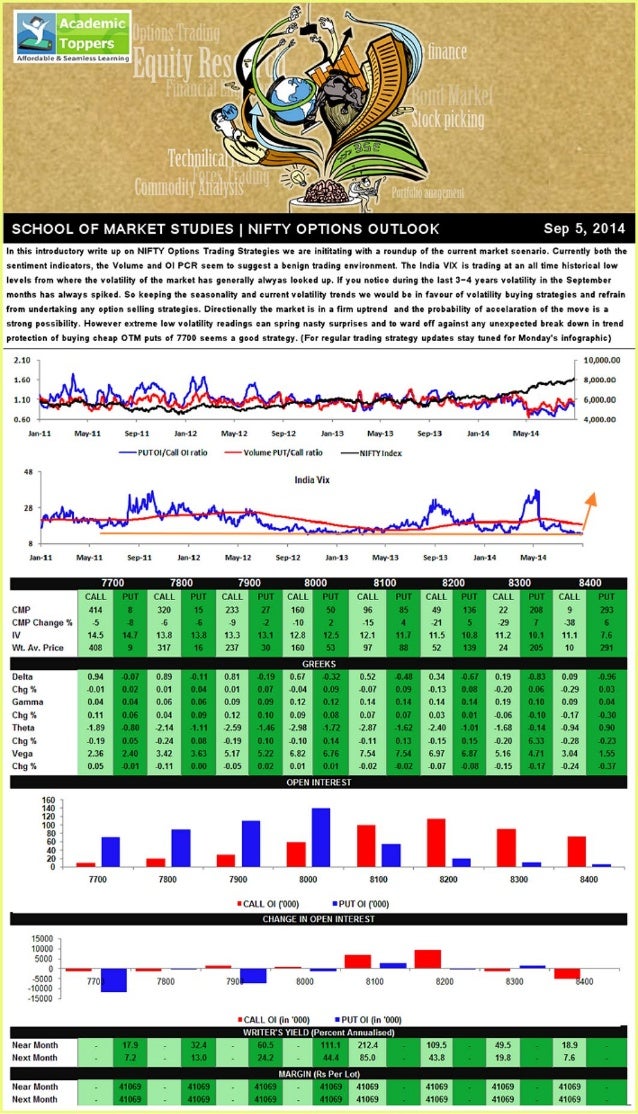

Image: www.youtube.com

Options, a potent financial derivative, grant the holder the right, not the obligation, to purchase (in the case of a call option) or sell (in the case of a put option) an underlying asset (in our context, the Nifty index) at a specified price (the strike price) on or before a specific date (the expiry date).

Understanding Nifty Options

The Nifty index, a benchmark of the Indian equity market, encompasses 50 of the largest and most liquid stocks traded on the National Stock Exchange (NSE). Nifty options, as their name suggests, are options contracts derived from this illustrious index. These versatile instruments empower traders to speculate on the future movement of the Nifty index, offering both upside potential and downside protection (in the case of put options).

Traders can choose between call and put options based on their market outlook. If they anticipate an upswing in the Nifty index, they can opt for call options. Conversely, if they foresee a decline, put options provide a hedge against potential losses. The strike price, a crucial element of an options contract, determines the exercise price of the option. Expiry dates, on the other hand, dictate the duration of the contract.

Strategies in Nifty Options Trading

The realm of Nifty options trading is teeming with diverse strategies, each tailored to specific market conditions and risk appetites. One popular approach is **Covered Call** writing, where an investor holds a long position in the underlying asset (Nifty index) and simultaneously sells call options against that position. This strategy generates income through option premiums while limiting potential upside gains.

Another commonly employed strategy is **Bull Put Spread**, which involves buying a call option at a lower strike price and simultaneously selling a call option at a higher strike price. This strategy is well-suited for a bullish market outlook and offers limited profit potential but reduced risk compared to buying a single call option outright.

Expert Advice for Success

To navigate the intricacies of Nifty options trading successfully, it’s imperative to heed the sage advice of seasoned experts. One key piece of counsel is to **thoroughly research the underlying asset**. A deep understanding of the factors influencing the Nifty index’s movement will provide a solid foundation for informed trading decisions.

Another crucial tip is to **manage risk judiciously**. Options trading involves inherent risks, and traders must meticulously weigh potential rewards against potential losses. Diversification across multiple contracts and strategies can mitigate risk and enhance overall portfolio performance.

Image: niyudideh.web.fc2.com

Frequently Asked Questions

- Q: What is the minimum capital required to start Nifty options trading?

A: The capital required varies depending on the number of contracts and the strike price chosen. However, it’s generally advisable to start with a manageable amount to limit potential losses.

- Q: How do I determine the right strike price and expiry date for an options contract?

A: Careful consideration of market conditions, technical analysis, and individual risk tolerance is crucial for selecting the appropriate strike price and expiry date. Research and practice are key.

- Q: Are there any free resources available for learning Nifty options trading?

A: Yes, there are numerous online resources, webinars, and courses that provide valuable insights and educational material on Nifty options trading. Utilize these resources to enhance your knowledge and decision-making.

Nifty Options Trading

Image: www.angelone.in

Conclusion

Nifty options trading, with its captivating blend of risk and reward, presents an enticing opportunity for both novice and experienced investors. By grasping the intricacies of this financial instrument, traders can harness its potential to amplify returns and navigate market complexities. Embrace the knowledge imparted in this comprehensive guide, seek expert counsel, and embark on your Nifty options trading journey with confidence.

Are you ready to delve deeper into the fascinating world of Nifty options trading? Join the discussion in the comments section below and share your insights, experiences, and questions. Together, we can unravel the secrets of this exhilarating arena.