Captivating Anecdote or Question:

Have you ever wondered how some investors seem to make remarkable returns in the stock market? While the answer may not always be clear-cut, options trading has emerged as a potential path to potentially substantial gains. As a relatively complex financial instrument, options trading can be both alluring and intimidating. But fear not, dear reader! This comprehensive guide is designed to empower you with the knowledge and confidence to explore the world of options trading with greater precision and understanding.

Image: www.youtube.com

Deep Dive into Navigating Options Trading:

What Are Options?

Options are financial contracts that give an individual the right, but not the obligation, to buy (call option) or sell (put option) an underlying asset at a specific price (strike price) on or before a certain date (expiration date). By trading options, investors can speculate on the future price movements of an underlying asset, such as stocks, commodities, indices, or currencies, without having to own the underlying asset itself.

Types of Options Strategies:

There is a wide array of options strategies to suit different investment goals and risk tolerances. Some common strategies include:

- Covered Call: Selling a call option against an underlying asset you own.

- Cash-Secured Put: Selling a put option while holding cash as collateral.

- Iron Condor: A combination of four options with different strike prices and expiration dates.

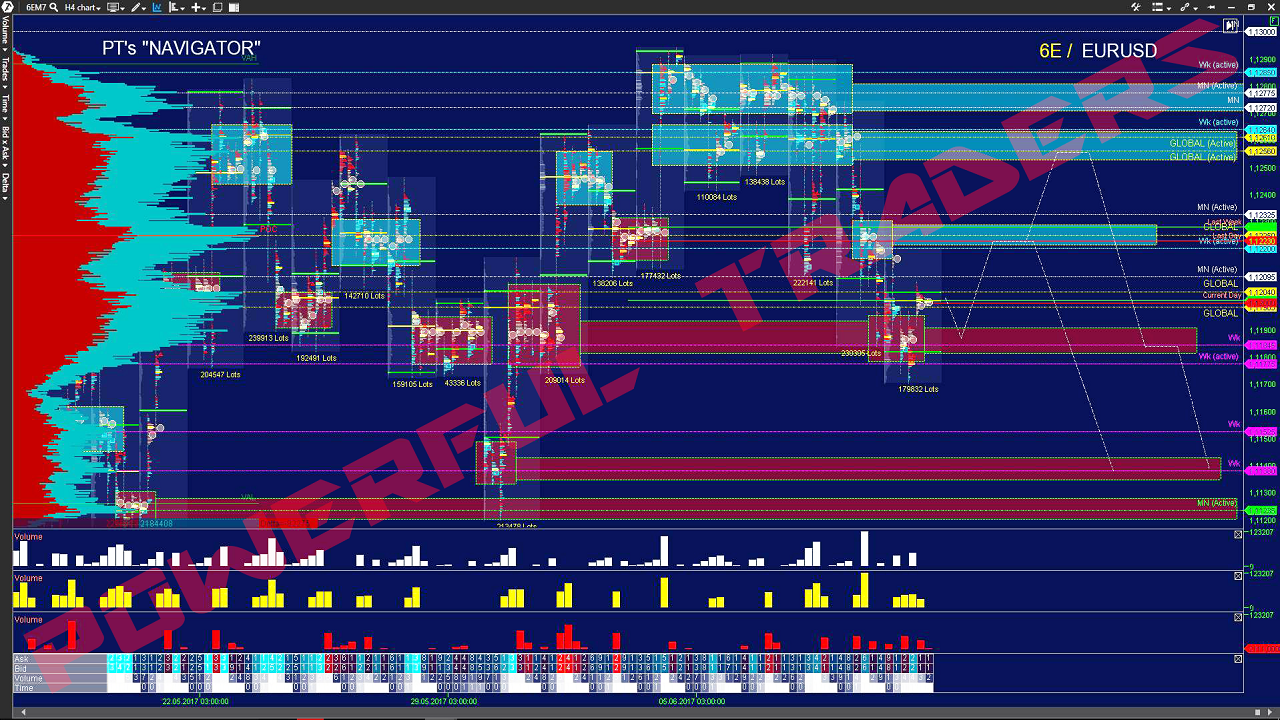

Image: powerfultraders.biz

Advantages of Options Trading:

- Leverage: Options enable investors to potentially magnify their returns by using borrowed capital.

- Directional Flexibility: Options provide the option (pun intended) to profit from both rising and falling prices.

- Hedging: Options can be used as a defensive tool to protect existing investments.

Challenges of Options Trading:

- Complexity: Understanding and executing options strategies requires a thorough understanding of the underlying markets.

- Risk: Options are inherently risky, and losses can exceed the initial investment.

- Expiration: Options have a finite lifespan, and their value decays as expiration approaches.

Expert Insights and Actionable Tips:

From Renowned Options Trader, Michael Carr:

“Options trading can be a rewarding endeavor, but it’s crucial to approach it with knowledge, discipline, and a well-defined risk management plan.”

Actionable Tips:

- Start Small: Begin with small trades to minimize potential losses.

- Learn Continuously: Dedicate consistent effort to understanding the intricacies of options trading.

- Seek Guidance: Consult with experienced advisors or join reputable trading communities for mentorship and support.

Navigating Options Trading

Image: www.pinterest.com

Compelling Conclusion:

Navigating options trading can be an enriching journey of potential gains and invaluable lessons. By following the insights presented here, you can embark on this path with greater confidence. Remember, options trading is not a panacea for easy wealth; it requires a strategic mindset, a deep understanding of financial markets, and the resilience to navigate both victories and setbacks. As you embrace this new realm, may your trades be informed, your risks managed, and your financial growth remarkable.