Introduction

Image: www.schaeffersresearch.com

In the ever-evolving world of investing, options trading has emerged as a potent tool for savvy investors seeking to navigate market dynamics. Among the many options contracts available, Lyft options hold a unique position in the ride-sharing industry, presenting both potential opportunities and risks. This comprehensive guide will delve deep into the realm of Lyft options trading, empowering you with the knowledge and insights necessary to make informed decisions and potentially unlock market advantage.

Understanding Lyft Options

Lyft options are financial contracts that grant you the right, but not the obligation, to buy (call option) or sell (put option) a specified number of Lyft shares at a pre-determined price (strike price) on or before a certain date (expiration date). This flexibility allows you to speculate on the future movement of Lyft’s stock price without the full commitment of purchasing or selling the actual shares.

Benefits of Lyft Options Trading

- Leverage: Options provide leverage, enabling you to potentially magnify your returns with a relatively small investment compared to purchasing shares directly.

- Risk Management: Options allow you to manage risk by hedging against potential market downturns or limiting potential losses.

- Income Generation: You can generate income by selling options contracts, earning a premium from other investors who are willing to take on the risk associated with the underlying shares.

How to Trade Lyft Options

Trading Lyft options involves several key steps:

- Choose a reputable options broker: Select a broker that offers a reliable platform, low commissions, and access to the Lyft options market.

- Determine your trading strategy: Clearly define your investment goals, risk tolerance, and time horizon. This will guide your decision-making process.

- Analyze the market: Stay informed about market conditions and company-specific news that may impact Lyft’s stock price. Technical analysis and fundamental analysis can provide valuable insights.

- Place an order: Once you have analyzed the market and identified a suitable trading strategy, you can place an order to buy or sell Lyft options through your broker’s platform.

Expert Insights and Strategies

- Volatility is key: Lyft options trading is heavily influenced by market volatility. Options prices tend to inflate when volatility is high, offering opportunities for both profits and losses.

- Consider the underlying trend: Pay attention to the overall trend of Lyft’s stock price. If the price is trending upward, call options may be a more viable strategy, while put options may be appropriate if a downtrend is expected.

- Use stop-loss orders: Prudent risk management involves setting stop-loss orders to limit potential losses if the market moves against your position.

- Educate yourself continuously: Stay ahead of market developments by attending webinars, reading books, and following financial experts on social media.

Conclusion

Lyft options trading can be a potent tool for discerning investors seeking to amplify their market returns or manage risks. By understanding the basics, analyzing market conditions, and continuously seeking knowledge, you can unlock the potential of Lyft options and potentially achieve your financial goals. Remember, options trading involves both opportunities and risks, so always proceed with caution, conduct thorough due diligence, and consult with a financial advisor if necessary.

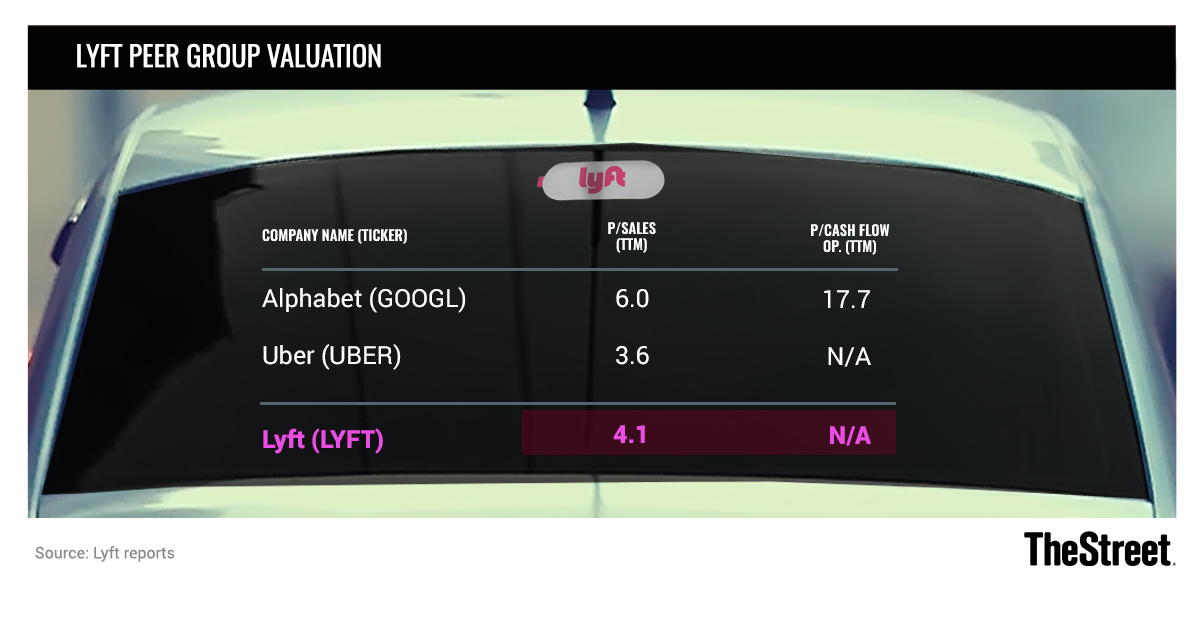

Image: www.thestreet.com

Lyft Options Trading

Image: www.code-brew.com