Introduction

In the realm of financial markets, where precision and profitability intertwine, the choice of brokerage services can make a world of difference. For options traders seeking the most cost-effective conduits to success, identifying the lowest brokerage for options trading becomes paramount. This comprehensive guide will delve into the labyrinth of brokers, uncovering their fee structures, account offerings, and hidden costs to help you make an informed decision.

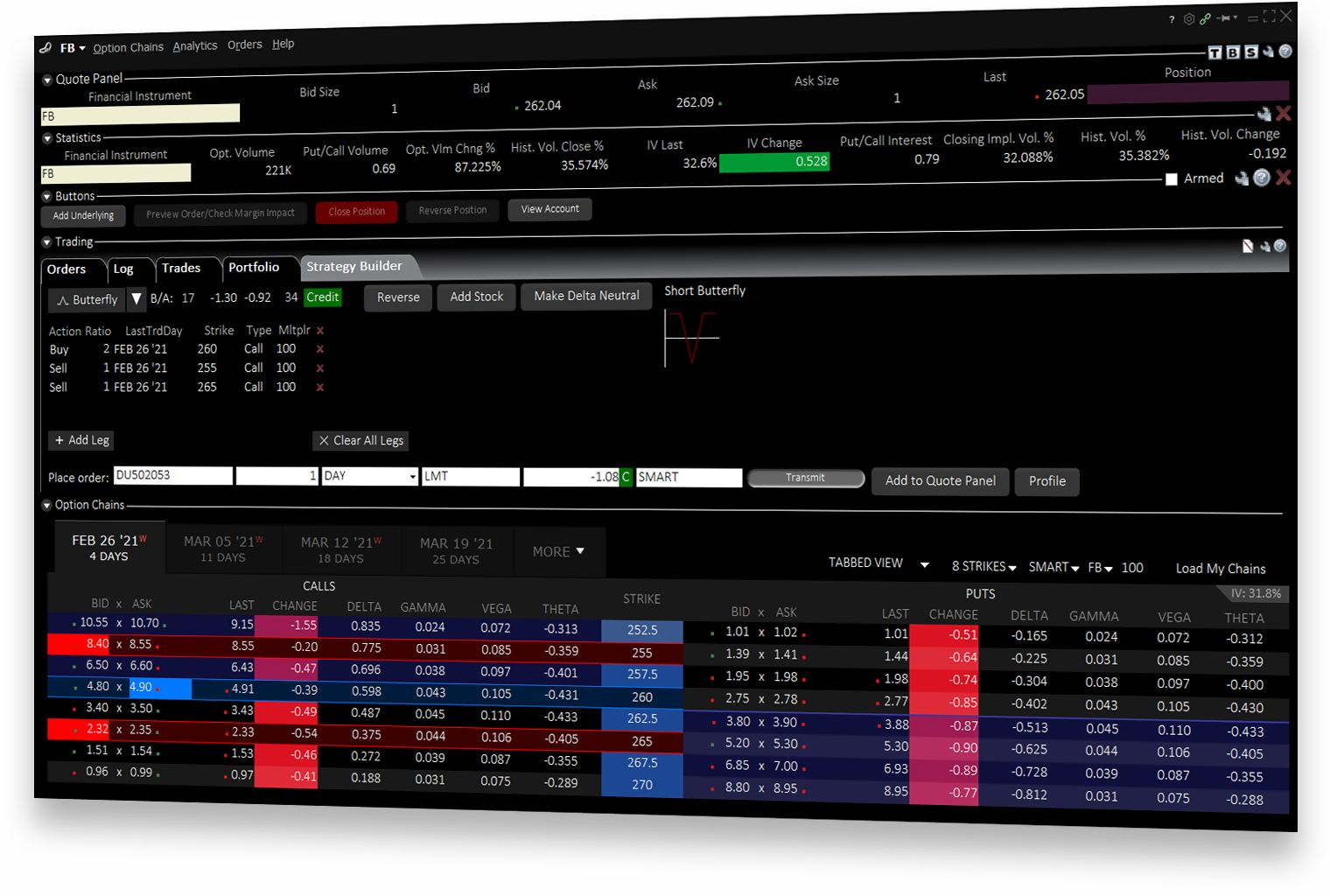

Image: www.interactivebrokers.com

Options trading offers a unique avenue for income generation and risk management, utilizing contracts that confer the right to buy (call options) or sell (put options) an underlying asset at a predetermined price on a future date. However, the lucrative potential of options trading can be eroded by excessive brokerage commissions and fees, making it essential to pinpoint brokers that provide the lowest brokerage for options trading.

Types of Options Brokers

The landscape of options brokers is a diverse tapestry of established institutions and agile fintech startups, each offering a distinct blend of features and pricing. To navigate this myriad of choices, it is imperative to understand the different types of brokers available:

- Full-Service Brokers: These traditional brokers offer a comprehensive suite of services, including personalized guidance, research reports, and portfolio management. While they may command higher fees, their expertise can be invaluable for novice traders.

- Discount Brokers: As their name suggests, discount brokers prioritize low commissions over personalized services. They cater to self-directed traders seeking a cost-effective platform to execute their trades.

- Online Brokers: These online-only brokers leverage technology to deliver streamlined trading interfaces and competitive pricing. They are ideal for traders who value convenience and cost savings.

Assessing Broker Fees and Commissions

When comparing the lowest brokerage for options trading, it is crucial to dissect the intricate web of fees and commissions imposed by different brokers. These charges typically include:

- Per-Contract Fees: This is the most straightforward fee, charged per contract traded. It can vary depending on the underlying asset, contract type, and expiration date.

- Commission-Based Fees: Some brokers charge a percentage-based commission on the value of each trade. This fee structure can be more suitable for traders who execute high-volume trades.

- Platform Fees: Certain brokers may charge a subscription fee or usage fee for access to their trading platform or advanced features.

- Account Fees: Some brokers charge maintenance fees or inactivity fees for holding an account. It is essential to compare these fees and determine if they align with your trading frequency.

Uncovering Hidden Costs

Beyond the explicit fees and commissions, it is equally important to be mindful of hidden costs that can erode your profits:

- Spreads: The spread is the difference between the bid price (the price at which you can sell) and the ask price (the price at which you can buy). Wide spreads can significantly reduce your profit potential.

- Margin Interest: If you trade options on margin (borrowed funds), you will be charged interest on the borrowed capital. High margin interest rates can eat into your returns.

- Exchange Fees: Some brokers pass on exchange fees to their clients. These fees are typically minimal, but they can add up over time.

Image: hangcoach.vn

Comparing the Lowest Brokers for Options Trading

Armed with the knowledge of different broker types and fee structures, let us now delve into a comparative analysis of the lowest brokerage for options trading in the market today:

1. Webull

Webull has gained prominence as a low-cost options broker, offering commission-free options trading and a user-friendly platform. They charge no account fees or platform fees, making them a compelling choice for beginners and active traders alike.

2. Robinhood

Robinhood has revolutionized the brokerage industry with its zero-commission trading model. This includes options trading, making it one of the lowest-cost brokers for options traders. However, Robinhood’s platform lacks some advanced features and research tools.

3. TD Ameritrade

TD Ameritrade strikes a balance between low costs and comprehensive services. They offer a tiered pricing structure based on trading volume, with the lowest fees available to high-volume traders. TD Ameritrade’s platform is well-equipped with research tools and educational resources.

4. Fidelity

Fidelity is another established broker that provides competitive options trading commissions. They offer a range of account options tailored to different trader needs, including low-cost accounts for beginners and premium accounts with advanced features for experienced traders.

5. E*Trade

E*Trade has been a mainstay in the brokerage industry for decades. They offer commission-free options trades for their Power E*Trade platform, which is designed for active traders. E*Trade also provides extensive research and educational resources, making it a good choice for traders seeking a holistic trading experience.

Lowest Brokerage For Options Trading

Image: voyager8.blogspot.com

Conclusion

Selecting the lowest brokerage for options trading is a multifaceted endeavor that requires careful consideration of fees, account offerings, and hidden costs. By understanding the different types of brokers, deciphering fee structures, and evaluating the market’s offerings, you can equip yourself with the knowledge needed to make an informed choice. Remember, the best broker for you will depend on your individual trading style, volume, and requirements. By conducting thorough research, you can uncover the lowest brokerage for options trading and unlock the potential for greater profitability and market success.