Navigating the Dynamic World of Option Trading

Immerse yourself in the captivating realm of options trading, where seasoned investors harness the power of volatility to amplify their returns. Embark on a comprehensive journey with Interactive Brokers, a trusted broker renowned for its advanced trading platform and unwavering commitment to customer success. This in-depth tutorial will navigate you through the intricacies of options trading, empowering you with the knowledge and strategies to unlock new frontiers of financial growth.

Image: ibkrcampus.com

Understanding the Fundamentals of Options

Options are financial instruments that derive their value from the underlying asset’s future performance. They empower traders with the flexibility to either buy (call option) or sell (put option) the underlying asset at a specified price on or before a predeterminated expiration date. This unique structure offers investors the potential for both unlimited profits and limited but manageable losses.

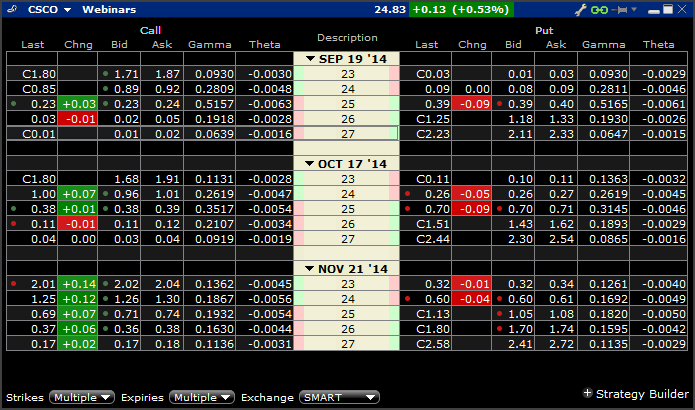

Options are categorized into two primary types: American options and European options. American options can be exercised at any time up until their expiration date, while European options can only be exercised on their designated expiration date. Understanding these distinctions is crucial for developing and implementing effective trading strategies.

Delving into the Mechanics of Option Trading

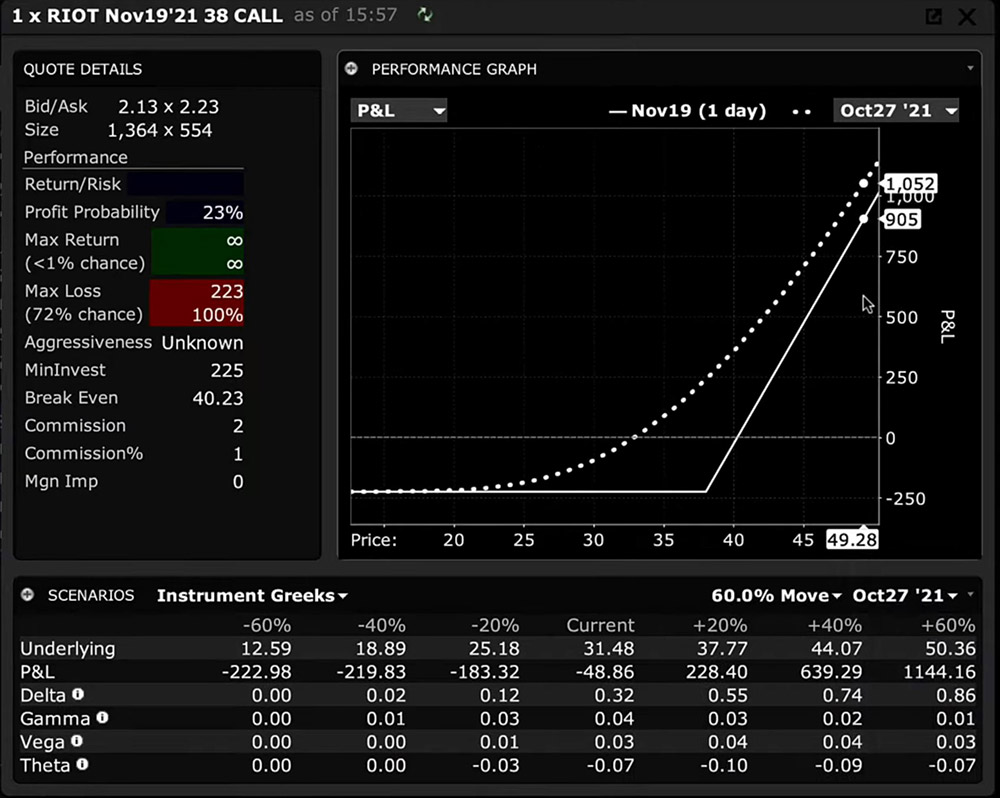

To initiate an options trade, you must first familiarize yourself with the critical elements involved. The option’s strike price represents the price at which you can buy or sell the underlying asset, while the premium is the price you pay to acquire the option contract. Both the strike price and premium significantly impact the potential profitability and risk associated with the trade.

Time decay is another crucial concept to grasp. As an option approaches its expiration date, its value gradually diminishes due to the diminishing likelihood of the underlying asset reaching the strike price. This time-sensitive nature requires traders to monitor their options positions meticulously and make timely decisions regarding adjustment or exit strategies.

Mastering Option Trading Strategies

Navigating the world of options trading involves implementing a diverse range of strategies tailored to your individual risk tolerance and financial objectives. Covered calls and secured puts are two widely employed strategies that seek to generate income through premium collection while managing risk. These strategies involve selling options against underlying assets you own (covered calls) or selling options while simultaneously purchasing the underlying asset (secured puts).

For more aggressive traders, strategies like naked calls and naked puts offer the potential for amplified returns but demand a higher level of sophistication and risk management. These strategies involve selling options without owning (naked calls) or purchasing the underlying asset (naked puts), exposing the trader to potentially unlimited losses. Careful consideration and a thorough understanding of these strategies are essential before implementation.

Image: udilisavu.web.fc2.com

Embracing the Trends and Innovations in Option Trading

The realm of options trading is constantly evolving, with new trends and innovations emerging to enhance trading efficiency and expand market opportunities. The proliferation of exchange-traded options (ETFs) has democratized access to a diversified portfolio of options, enabling investors to spread risk and align their trading strategies with specific market sectors or indices.

Artificial intelligence (AI) and machine learning (ML) are also reshaping the options trading landscape, providing traders with advanced analytical tools and predictive insights. These technologies can assist in identifying optimal entry and exit points, optimizing position sizing, and managing risk through sophisticated algorithmic trading strategies.

Tips and Expert Advice for Successful Option Trading

To elevate your options trading journey, embrace the following invaluable tips and expert advice:

- Thorough Research and Understanding: Acquire a thorough understanding of options fundamentals, trading strategies, and risk management principles before entering the market.

- Risk Management First: Implement robust risk management measures, including setting clear stop-loss levels, to protect your capital and mitigate potential losses.

- Stay Informed and Monitor Trends: Continuously monitor market news, earnings announcements, and economic indicators to stay abreast of factors that can impact the performance of options.

- Patience and Discipline: Practice patience and discipline in your trading approach, avoiding emotional decision-making and adhering to your predefined strategies.

- Continuous Learning and Improvement: Engage in continuous learning and development, exploring new strategies, studying market trends, and refining your trading techniques.

FAQs on Option Trading

Q: What is the difference between a call option and a put option?

A: A call option grants the buyer the right to buy an underlying asset at a set price on or before the expiration date, while a put option provides the right to sell an underlying asset at a set price on or before the expiration date.

Q: How do I determine the profitability of an options trade?

A: The profitability of an options trade depends on the difference between the strike price and the market price of the underlying asset, as well as the premium paid for the option.

Q: What are the risks involved in option trading?

A: Option trading involves the risk of losing the premium paid for the option, as well as the potential for unlimited losses in certain strategies. It’s essential to manage risk effectively through proper position sizing and stop-loss orders.

Interactive Brokers Option Trading Tutorial

Image: lazuxyderonav.web.fc2.com

Conclusion

Embracing the intricacies of options trading can empower you to unlock new horizons of financial growth. With Interactive Brokers as your trusted trading partner and this comprehensive tutorial as your guide, you can navigate the dynamic world of options with confidence and skill. Remember, knowledge, strategic implementation, and continuous learning are the keys to unlocking the transformative power of option trading. Are you ready to embark on this captivating journey?