Harnessing the Power of Technical Analysis

For investors seeking to maximize their returns in the dynamic world of options trading, chart reading is an indispensable skill. By analyzing historical price movements, traders can identify patterns and trends that offer valuable insights into future market behavior. This article delves into the intricacies of chart reading, providing a comprehensive guide to understanding and leveraging technical analysis for successful option trades.

Image: finance.yahoo.com

Understanding Chart Patterns

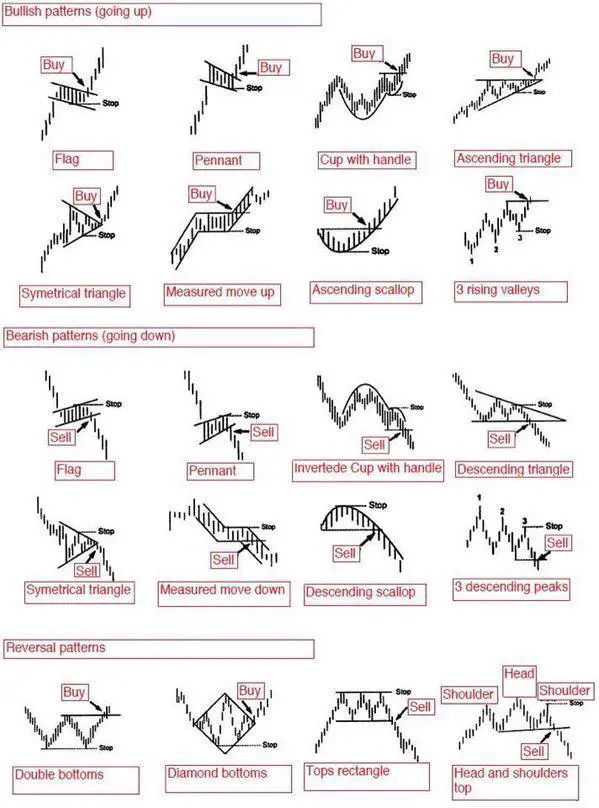

Chart patterns are formations that occur on price charts and can indicate potential price movements. Some common chart patterns include:

- Bullish Patterns: Head and shoulders, double bottom, ascending triangle

- Bearish Patterns: Inverse head and shoulders, double top, descending triangle

- Continuation Patterns: Pennants, flags, triangles

- Reversal Patterns: Double tops and bottoms, head and shoulders

Identifying and interpreting these patterns can help traders determine the direction and momentum of price movements, providing valuable entry and exit points for option trades.

Analyzing Technical Indicators

Technical indicators are mathematical formulas applied to price data to provide additional insights into market behavior. Some commonly used indicators include:

- Moving Averages: Plot the average price over specified periods, indicating trends and support/resistance levels.

- Bollinger Bands: Envelopes above and below moving averages, indicating volatility and potential breakouts.

- Relative Strength Index (RSI): Measures the momentum of price changes, identifying overbought or oversold conditions.

- Stochastic Oscillator: Compares prices to the high-low range, indicating momentum and potential turning points.

Combining Chart Patterns and Indicators

By combining chart patterns and technical indicators, traders can develop a robust technical analysis strategy. For instance, a bullish chart pattern, such as a double bottom, may be further supported by a break above a key moving average, indicating increased momentum and a potential buying opportunity.

Image: printable.esad.edu.br

Tips and Expert Advice for Successful Chart Reading

- Use Multiple Time Frames: Analyze different time frames to gain insights into both short-term and long-term trends.

- Avoid Overtrading: Stick to your trading strategy and avoid making impulsive trades based on emotions.

- Manage Your Risk: Use stop-loss orders to limit potential losses.

- Stay Up-to-Date: Follow financial news and analysis to stay informed about market events.

- Seek Professional Guidance: Consider consulting with a financial advisor to enhance your trading knowledge and skills.

FAQs on Chart Reading for Option Trading

- Q: What are the most important chart patterns to know?

A: Head and shoulders, double bottom, ascending triangle, inverse head and shoulders, double top, descending triangle. - Q: What is the difference between a bullish and a bearish trend?

A: A bullish trend is when prices are rising, while a bearish trend is when prices are falling. - Q: What do Bollinger Bands indicate?

A: Bollinger Bands show volatility and potential breakouts. - Q: How do I avoid overtrading?

A: Stick to your trading strategy and avoid making impulsive trades based on emotions.

Chart Reading For Option Trading

Conclusion

Mastering chart reading is a crucial skill for option traders seeking to maximize their profits. By understanding chart patterns, analyzing technical indicators, and combining these techniques, traders can gain a deep understanding of market behavior. Remember, successful trading requires patience, discipline, and continuous learning. If you’re interested in leveraging chart reading for option trading, take the first step by exploring additional resources and seeking guidance from experienced traders.

Is chart reading for option trading something you’re interested in learning more about? Share your thoughts and questions in the comments below.