Introduction

Navigating the world of options trading demands a methodical approach to risk management. Options contracts, with their unique payoff profiles, introduce an inherent level of uncertainty that requires careful quantification. In this comprehensive guide, we delve into a step-by-step framework to systematically quantify risk when trading options, empowering you with a solid foundation for informed decision-making.

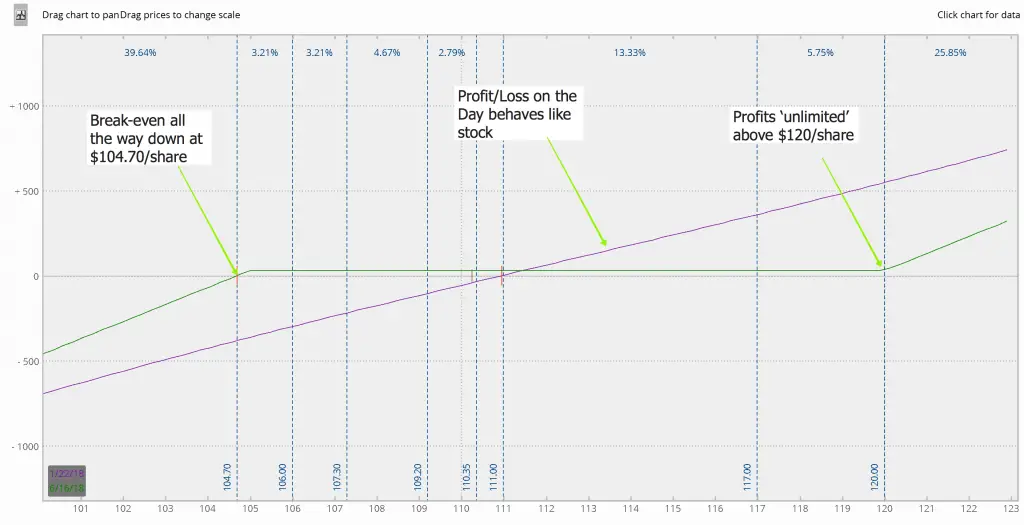

Image: www.newtraderu.com

Understanding Options Risk: Options contracts represent the right, but not the obligation, to buy or sell an underlying asset at a predetermined price within a specific time frame. This inherent flexibility, while offering potential rewards, also carries the risk of financial loss.

Components of Options Risk

Quantifying options risk involves assessing three critical components: market risk, volatility risk, and time decay. Together, these factors determine the potential range of outcomes and the likelihood of incurring losses in options trading.

- Market risk: Measures the sensitivity of an option’s value to changes in the price of the underlying asset. Higher market risk implies greater vulnerability to price fluctuations.

- Volatility risk: Captures the potential for fluctuations in the underlying asset’s price. Increased volatility enhances the uncertainty surrounding options pricing and profitability.

- Time decay: Refers to the gradual loss of an option’s value as time passes towards its expiration date. This erosion in value affects the risk-reward profile of options investments.

Image: medium.com

Quantifying Risk

To quantify risk in options trading, traders employ various metrics and techniques:

- Greeks: A set of Greek letters (Delta, Gamma, Vega, Theta, and Rho) provides insights into the option’s sensitivity to different market factors, aiding in risk assessment.

- VaR (Value at Risk): VaR measures the potential maximum loss under a given probability within a specific time horizon, quantifying market risk.

- Historical Simulation: This technique involves simulating a large number of future scenarios based on historical data to estimate potential risk exposure.

Mitigating Options Risk

Minimizing risk in options trading requires a proactive strategy:

Diversification: Spreading investments across various options contracts and underlying assets reduces exposure to a single source of risk.

Hedging: Employing offsetting positions in different options contracts or related assets neutralizes risk and enhances portfolio stability.

Conservative Strategies: Opting for options with lower risk profiles, such as deep ITM (in-the-money) contracts, provides a buffer against adverse market conditions.

Conclusion

Quantifying risk in options trading is a crucial step towards responsible and profitable investing. By understanding the components of risk, employing appropriate metrics, and adopting proactive mitigation strategies, traders can navigate the options market with greater confidence. Remember, risk quantification is an ongoing process, requiring constant vigilance and adaptation to changing market dynamics.

How To Quantify Risk When Trading Options

Image: www.youtube.com

FAQ

Q: What is the most important factor to consider when quantifying options risk?

A: Market risk, as it measures the direct impact of underlying asset price fluctuations on the value of the option.

Q: How can I reduce the VaR of an options portfolio?

A: Diversifying across different options contracts, underlying assets, and market sectors helps reduce portfolio-level VaR.

Q: Is it possible to completely eliminate risk in options trading?

A: No, options trading inherently involves risk. However, by quantifying and mitigating risk effectively, traders can minimize potential losses and increase the likelihood of profitable outcomes.