Are you ready to embark on the thrilling journey of options trading? The first step is paramount: choosing the right stock. This comprehensive guide will equip you with the knowledge and strategies to make informed decisions and strike gold in the options market.

Image: purepowerpicks.com

Factors to Consider When Picking a Stock

Selecting a stock for options trading requires careful consideration of several factors:

- Volatility: High-volatility stocks present greater opportunities for profit but come with elevated risks.

- Liquidity: Stocks with high trading volumes ensure easy entry and exit from options positions.

- Price Trend: Identify stocks with significant price movement in your desired direction.

- Technical Indicators: Use technical analysis tools like moving averages and support/resistance levels to assess market sentiment and potential price movements.

li>Company Fundamentals: Research the company’s financial performance, competitive landscape, and management team.

Steps for Smart Stock Selection

Follow these proven steps to select the perfect stock for options trading:

- Analyze Your Risk Tolerance: Determine your comfort level with potential losses before selecting a stock.

- Identify Market Opportunities: Study market trends, news events, and analyst reports to identify potential trading opportunities.

- Screen for Potential Stocks: Use stock screeners to identify stocks that meet your criteria for volatility, liquidity, and price trend.

- Conduct Due Diligence: Thoroughly research the company’s fundamentals to assess its financial health and growth potential.

- Make an Informed Decision: Based on your analysis and research, make an informed decision about the stock you wish to trade options on.

Expert Tips and Advice

Seasoned options traders share their insights:

“Focus on high-probability trades with a clear edge.” – John Carter, Analyst

“Manage your risk by setting stop-loss orders and understanding position sizing.” – Mark Douglas, Trading Psychologist

“Be patient and disciplined, waiting for the right trading opportunities to present themselves.” – Jack Schwager, Author

Image: www.fortunebuilders.com

FAQs on Stock Selection for Options Trading

- Q: What is the ideal stock price range for options trading?

A: Generally, stocks with prices between $10 and $100 are considered optimal for options trading.

- Q: Should I choose stocks with strong or weak fundamentals?

A: Both can be suitable. Strong fundamentals indicate a stable underlying company, while weak fundamentals can sometimes lead to greater volatility, creating trading opportunities.

- Q: Is it wise to trade options on highly speculative stocks?

A: Exercise caution when trading options on such stocks, as they carry a high risk of significant losses.

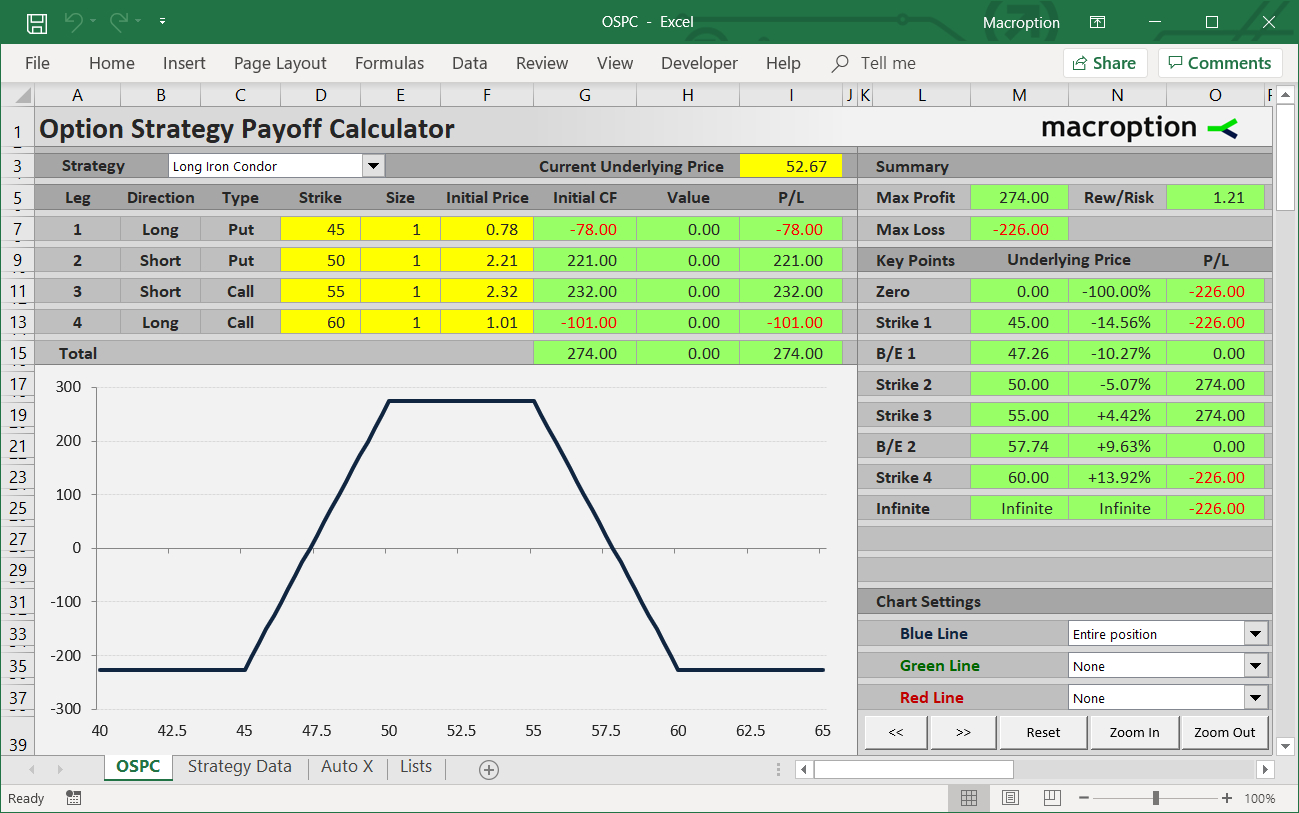

How To Pick A Stock For Options Trading

Image: db-excel.com

Conclusion

Selecting the right stock for options trading is a crucial skill that can significantly enhance your chances of success. By considering the factors outlined above, following the steps provided, and heeding the expert advice, you can make informed choices that align with your risk tolerance and trading goals. Remember to stay engaged and continuously educate yourself to stay ahead in this dynamic market. Are you ready to pick your winning stock and conquer the options trading frontier?