Options trading is a popular investment strategy that offers the potential for significant gains. However, it also carries significant risks. Before you start trading options, it is important to understand how they work and how to apply for options trading.

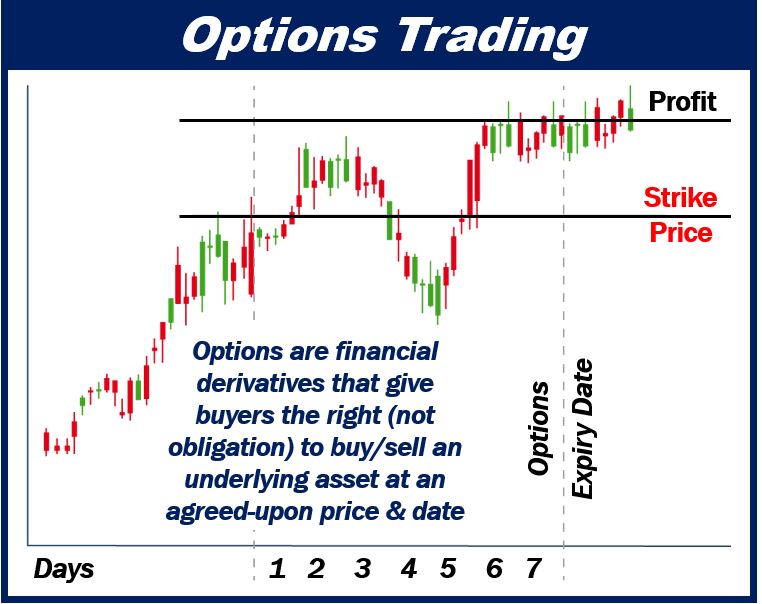

Image: marketbusinessnews.com

What are options?

Options are contracts that give the buyer the right, but not the obligation, to buy or sell a specific asset at a specified price on or before a specified date. There are two main types of options: calls and puts. Call options give the buyer the right to buy an asset at a specified price, while put options give the buyer the right to sell an asset at a specified price.

How do options work?

When you buy an option, you are paying for the right to buy or sell an asset at a specified price. The price that you pay for the option is called the premium. If the price of the asset moves in your favor, then you can exercise your option and buy or sell the asset at the specified price. However, if the price of the asset moves against you, then you will lose the premium that you paid for the option.

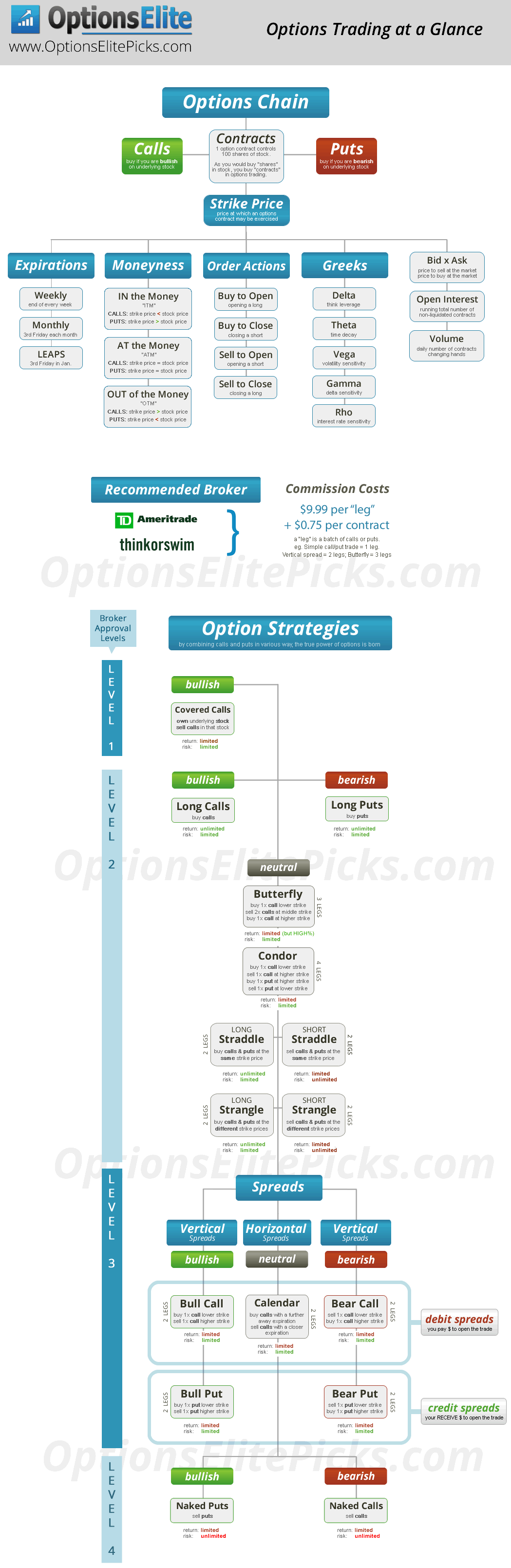

How to apply for options trading

To apply for options trading, you need to open an account with a broker that offers options trading services. Once you have opened an account, you will need to complete an application form and provide the broker with information about your financial situation and investment objectives. If you are approved for options trading, you will be able to trade options through your broker’s platform.

Image: www.simplertrading.com

Risks of options trading

Options trading can be a risky investment strategy. It is important to understand the risks involved before you start trading options. The following are some of the risks of options trading:

• Loss of principal: You can lose all of the money that you invest in options trading.

• Unlimited risk: The potential loss on an option is unlimited.

• Time decay: Options have a limited life span. The value of an option decreases as it approaches its expiration date.

• Volatility: The value of an option is sensitive to changes in the price of the underlying asset.

Tips for options trading

• Do your research: Before you start trading options, it is important to do your research and understand how they work.

• Start small: When you start trading options, it is important to start small. Don’t invest more money than you can afford to lose.

• Use a stop-loss order: A stop-loss order can help you limit your losses if the price of the asset moves against you.

• Be patient: Options trading can be a slow-moving process. It is important to be patient and wait for the right opportunity to trade.

How To Apply For Options Trading

Image: thestockmarketwatch.com

Conclusion

Options trading can be a lucrative investment strategy, but it is also important to understand the risks involved. Before you start trading options, it is important to do your research and understand how they work. By following the tips in this article, you can increase your chances of success when trading options.