Introduction

In the realm of finance, stock options have emerged as a potent investment tool with the allure of potentially substantial profits. Yet, many aspiring investors remain hesitant, uncertain about the actual earning potential this intricate market holds. If you find yourself among them, this comprehensive guide will unveil the answer, empowering you with the knowledge to navigate this dynamic arena with confidence.

Image: wallpapercave.com

Exploring the Anatomy of Stock Options

Stock options grant individuals the right, but not the obligation, to purchase or sell an underlying stock at a predetermined price (known as the strike price) within a set time frame. These contracts derive their value from the potential movement in the underlying stock’s price relative to the strike price.

The Elusive Question: How Much Can You Make?

The answer to this tantalizing question is not a simple one, as the potential returns on stock option trading hinge on a constellation of variables:

-

Underlying Stock Performance: The fate of your stock options is closely intertwined with the trajectory of the stock they represent. If the stock rises above the strike price, your options gain value, potentially leading to significant profits. Conversely, a decline in the stock price can lead to losses.

-

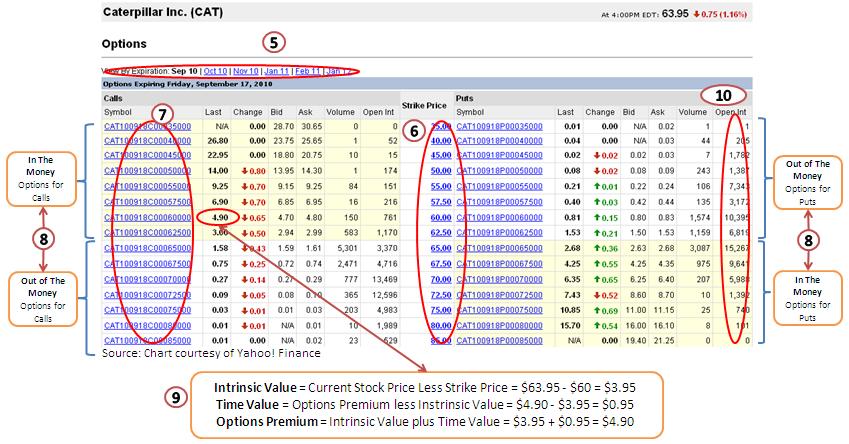

Option Type: Two primary types of stock options exist: calls and puts. Call options confer the right to buy the stock, while put options grant the right to sell it. The choice between the two depends on your market outlook.

-

Option Premium: When purchasing an option contract, you must pay an initial premium. This premium represents the cost of “control” over the underlying stock. The premium is influenced by various factors, including time to expiration and market volatility.

-

Time Value: Options have a finite lifespan, and their value gradually decays as time passes. The closer an option gets to its expiration date, the less time value it holds, except in the case of deep ITM options.

Mastering the Art of Stock Options

Unlocking the true potential of stock option trading requires a disciplined approach, informed by both theoretical knowledge and practical experience:

-

Understand the Risks: Options trading involves inherent risks, and it’s crucial to fully comprehend them before venturing into this market. Educate yourself on option terminology, strategies, and potential pitfalls.

-

Choose Your Weapons Wisely: Selecting the appropriate option type and strike price is paramount to your success. Consider your risk tolerance, investment horizon, and market outlook when making these crucial decisions.

-

Manage Your Risk: Implement well-defined risk management strategies. Employ stop-loss orders to limit potential losses and regularly monitor your portfolio’s performance.

-

Stay Informed: The stock market is a dynamic beast. Keep abreast of market trends, company news, and economic indicators that may affect your option positions.

Image: www.youtube.com

Real-World Success Stories

Throughout market history, savvy investors have amassed fortunes through stock options trading. Warren Buffett, the legendary investor, counts the correct allocation of capital to stock options among his most successful investment decisions. By aligning his choices with the market’s trajectory, he has generated extraordinary returns.

Embark on Your Stock Option Journey

If the allure of stock options has ignited a spark within you, remember the following:

-

Educate yourself: Attend workshops, seminars, or online courses to arm yourself with a solid foundation.

-

Practice with Paper Trading: Familiarize yourself with the nuances of option trading through simulated platforms before risking real capital.

-

Start Small: When you finally take the plunge, begin with small investments and gradually increase your exposure as you gain experience and confidence.

-

Seek Professional Guidance: If you desire personalized advice, consider consulting with a licensed financial advisor who specializes in options trading.

How Much Can You Make Trading Stock Options

Image: www.qarya.org

Conclusion

The world of stock options presents a compelling opportunity for savvy investors seeking potentially substantial returns. By understanding the intricacies of this market, mastering the art of option selection, and embracing a disciplined approach, you can unlock the door to financial success. Remember, the journey may be challenging, but the rewards can be immensely fulfilling.