What are High Risk Trading Options?

Trading options involves vast potential for significant financial gains, but it also carries substantial risks. High-risk trading options further elevate these risks, often alluring traders with the possibility of rapid wealth accumulation. However, understanding and mitigating the perils of such ventures is crucial before embarking on this volatile trading landscape. This comprehensive guide deciphers the intricacies of high-risk trading options, shedding light on their definitions, strategies, and inherent dangers.

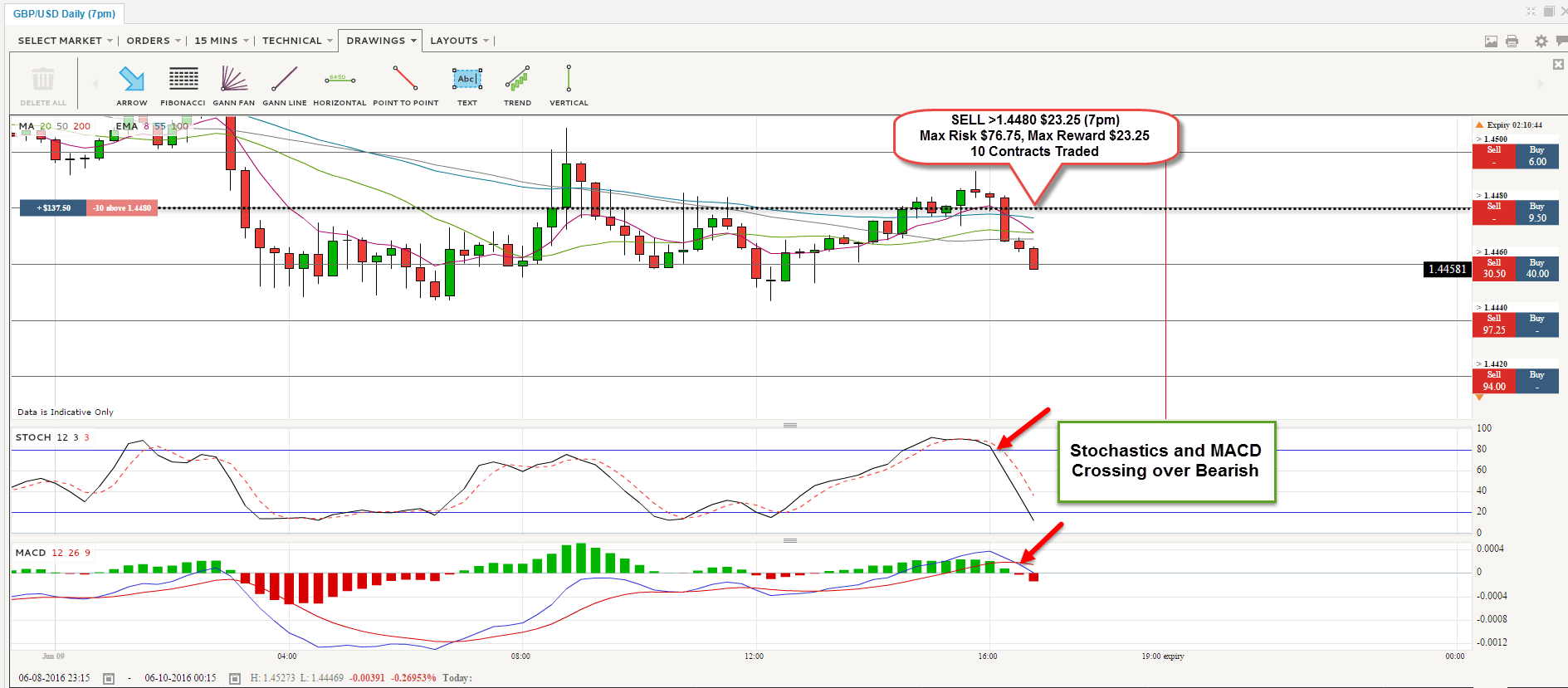

Image: brandfuge.com

The term “high-risk trading options” encompasses various speculative and complex trading strategies that amplify the potential risks associated with options trading. These approaches involve leveraging volatile underlying assets, shorting or selling options, engaging in naked option trading, or employing advanced trading techniques like spreads and strangles.

Types of High Risk Trading Options

High-risk trading options embrace an array of strategies that significantly elevate the potential risks involved:

- Leveraged Options Trading: Utilizes instruments like options on futures and leveraged ETFs to magnify both gains and losses.

- Shorting or Selling Options: Involves selling options contracts, obligating the trader to buy (in the case of short calls) or sell (in the case of short puts) the underlying asset at a specified price on a predetermined date.

- Naked Options Trading: Entails selling options without owning the underlying asset, exposing the trader to unlimited losses in the event of adverse price movements.

- Spreads and Strangles: Complex option strategies involving simultaneous buying and selling of multiple options contracts to create specific risk profiles and potential returns.

Benefits and Risks of High Risk Trading Options

While high-risk trading options present the tantalizing prospect of substantial profits, they also amplify the potential for catastrophic losses. Understanding the inherent risks is paramount:

Benefits:

- Potential for exponential gains

- Enhanced flexibility and control over trading outcomes

- Accessibility to advanced trading strategies

Risks:

- Unlimited potential for losses

- High levels of market volatility and unpredictability

- Requires substantial trading knowledge and experience

- Psychological strain and emotional toll

Mitigating the Risks of High Risk Trading Options

Venturing into high-risk trading options demands a prudent approach to risk management. Here are some strategies to mitigate potential losses:

- Risk Management Plan: Define clear entry and exit points, stop-loss levels, and position sizing strategies to manage risk proactively.

- Proper Education and Training: Acquire a thorough understanding of options trading concepts, strategies, and risk management techniques.

- Trading Experience and Discipline: Develop a consistent trading process, maintain emotional control, and avoid impulsive decision-making.

- Diversification: Spread investments across various assets and trading strategies to minimize concentrated riskExposure to News and Market Updates: Stay abreast of market news and updates that may impact trading decisions.

Image: www.psychological-consultancy.com

High Risk Trading Options

Image: decoqiw.web.fc2.com

Conclusion

High-risk trading options hold both immense potential and peril. Understanding the strategies involved and implementing appropriate risk management measures is crucial for those considering this challenging trading arena. By comprehending the benefits, risks, and mitigation techniques outlined in this guide, traders can navigate the volatile waters of high-risk trading options with greater confidence.

Would you like to discover the profound potential or navigate the inherent risks of High Risk Trading Options?