In the frenetic world of finance, where lightning-fast trades and colossal sums of money dance in a delicate ballet, high-frequency trading (HFT) stands as a technological marvel. HFT options trading, a specialized niche within this realm, harnesses the unparalleled speed and precision of computers to navigate the complex and ever-fluctuating options market. With its ability to execute orders in milliseconds, this algorithmic trading strategy has revolutionized the financial landscape.

Image: www.fisdom.com

Options, as instruments of derivative value, grant buyers the right, but not the obligation, to buy or sell an underlying asset at a predetermined price and time. They are versatile financial tools that allow investors to tailor risk-reward profiles to their specific objectives. HFT options trading, by leveraging sophisticated algorithms and co-location strategies, captures fleeting market inefficiencies and arbitrages price disparities.

Delving into HFT Options Trading

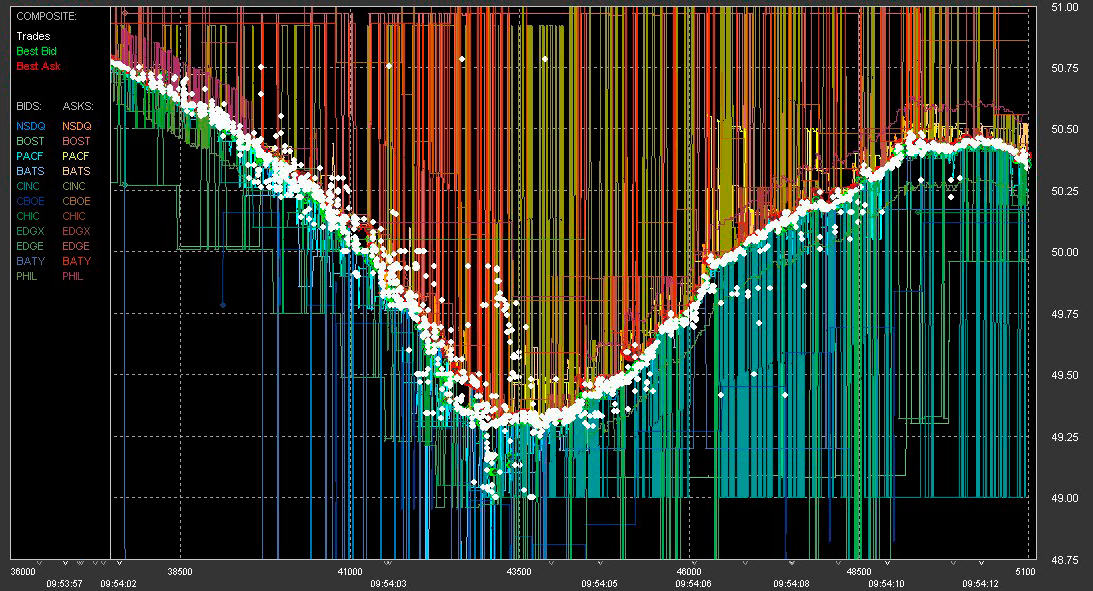

At its core, HFT options trading entails the use of high-powered computers and proprietary algorithms to analyze vast quantities of market data in real-time, identifying trading opportunities that human traders might miss. These algorithms dissect market microstructure, scrutinizing order flow, quote patterns, and liquidity dynamics to uncover potential profit-yielding situations. The algorithms then execute trades at blistering speeds, capitalizing on momentary imbalances that emerge in the market.

A key pillar of HFT options trading is co-location, a strategy that involves physically positioning servers in close proximity to exchange matching engines. By minimizing network latency, HFT firms gain a fractional advantage in accessing market data and executing orders, enabling them to exploit fleeting arbitrage opportunities before market inefficiencies vanish.

Expert Insights and Tips for HFT Options Trading

Navigating the treacherous waters of HFT options trading demands a deep understanding of market dynamics, quantitative analysis techniques, and algorithmic trading strategies. For aspiring HFT traders, the following expert tips can prove invaluable:

- Master Quantitative Analysis: Develop a solid foundation in statistics, probability theory, and econometrics. These disciplines provide the analytical bedrock for HFT algorithms.

- Embrace Statistical Modeling: Proficiency in statistical modeling techniques enables HFT traders to identify patterns, predict market behavior, and formulate effective trading strategies.

- Harness Algorithmic Programming: Cultivate expertise in programming languages like Python, R, or C++, essential for developing and implementing HFT algorithms.

- Monitor Market Microstructure: Pay meticulous attention to market microstructure, including order flow, quote patterns, and liquidity dynamics, as they provide invaluable insights for HFT strategies.

- Study High-Frequency Trading Techniques: Immerse yourself in the intricacies of HFT techniques such as co-location, latency arbitrage, and statistical arbitrage.

Frequently Asked Questions (FAQs) about HFT Options Trading

- What is the role of liquidity in HFT options trading?

Liquidity is crucial in HFT options trading, as it facilitates rapid execution of trades. HFT algorithms seek to identify and exploit market inefficiencies in highly liquid markets, where large volumes of options can be traded without significantly impacting market prices. - How does HFT options trading impact the broader market?

HFT options trading has been credited with improving market efficiency by reducing spreads and enhancing liquidity. However, concerns have also been raised about the potential for market manipulation and systemic risks associated with the high-speed nature of HFT. - What regulatory frameworks govern HFT options trading?

HFT options trading is subject to various regulatory frameworks aimed at ensuring market integrity and investor protection. These regulations include measures to prevent market manipulation, promote transparency, and address conflicts of interest.

Image: www.metatrader4indicators.com

Hft Options Trading

Image: westernpips.com

Conclusion

HFT options trading stands as a testament to the transformative power of technology in the financial realm. By harnessing sophisticated algorithms and lightning-fast execution capabilities, HFT traders navigate the turbulent waters of the options market, capturing fleeting trading opportunities that would elude human traders. While HFT options trading offers the potential for significant returns, it also demands a deep understanding of market dynamics, quantitative analysis techniques, and algorithmic programming. Aspiring HFT traders must embrace a commitment to continuous learning and innovation to thrive in this ever-evolving field.

Dear reader, are you intrigued by the intricacies of HFT options trading? Would you like to delve deeper into the world of high-speed algorithmic trading?