Title: Empowering Traders: Explore the Dynamic World of GDAX Options Trading

Image: www.youtube.com

Introduction:

In the ever-evolving financial landscape, options trading has emerged as a powerful tool for savvy investors seeking to navigate the volatility of markets. GDAX, a leading cryptocurrency exchange, has revolutionized this عرصه through its innovative options trading platform, empowering traders to harness the potential of cryptocurrencies with greater flexibility and precision. This article delves into the intricacies of GDAX options trading, providing a comprehensive guide for aspiring traders and seasoned investors alike.

Demystifying Options Trading:

Options contracts grant traders the right, but not the obligation, to buy (call option) or sell (put option) an underlying asset at a specified price on or before a predetermined date. Unlike futures contracts, options offer greater flexibility, allowing traders to customize their strategies based on market conditions and risk tolerance.

The GDAX Advantage:

GDAX’s options trading platform offers a multitude of benefits that set it apart in the industry:

- Liquidity: GDAX boasts one of the highest trading volumes in the crypto options market, ensuring ample liquidity for traders of all sizes.

- Competitive Fees: GDAX’s fee structure is highly competitive, making it cost-effective for traders to execute their strategies.

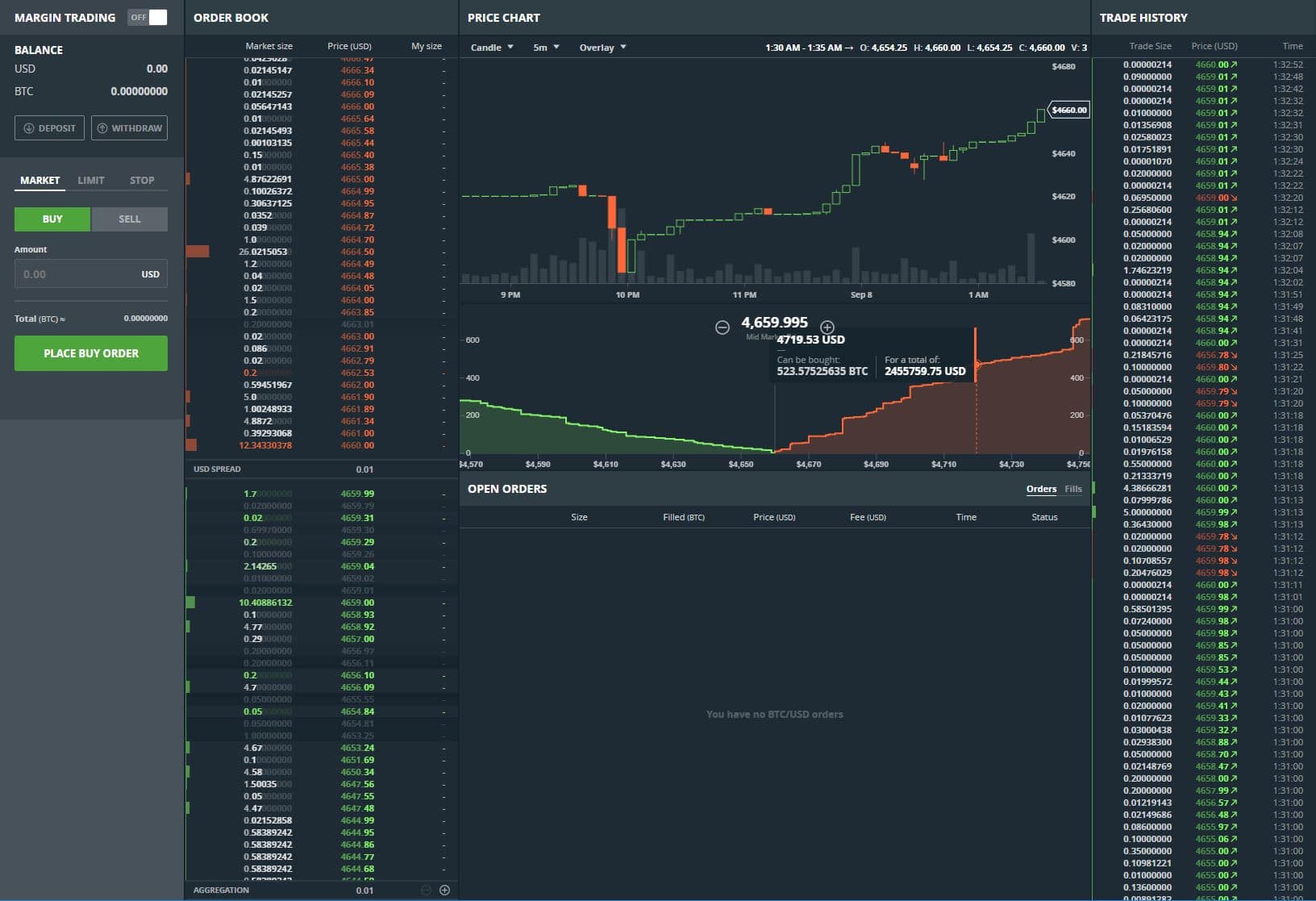

- User-Friendly Interface: The platform’s intuitive interface simplifies the complex world of options trading, making it accessible to both experienced and novice traders.

- Educational Resources: GDAX provides a wealth of educational content, including tutorials, articles, and webinars, empowering traders with the knowledge they need to succeed.

Navigating GDAX Options Trading:

To embark on your GDAX options trading journey, you’ll create an account on the platform and deposit funds. Once funded, you’ll navigate to the options trading section and select the underlying cryptocurrency you wish to trade.

Call and Put Options:

As mentioned earlier, call options give traders the right to buy the underlying cryptocurrency, while put options give them the right to sell it. The price at which the trader can execute the option is known as the strike price.

Timeline and Premiums:

Options contracts typically expire within a specified timeframe, ranging from one week to several months. The premium, or the cost of purchasing an option, is determined by factors such as the strike price, the time remaining until expiration, and the volatility of the underlying asset.

Hedging Strategies:

Options trading can be utilized for various purposes, one of which is hedging. For instance, traders can use put options to protect against potential losses on their cryptocurrency holdings. By purchasing a put option, they reserve the right to sell the cryptocurrency at a specific price, mitigating the risk of significant price fluctuations.

Margin Trading:

GDAX also offers margin trading for options, allowing traders to leverage their capital and potentially amplify their profits. However, it’s crucial to note that margin trading involves greater risk and should only be employed by experienced traders.

Conclusion:

GDAX options trading has opened up a world of opportunities for traders seeking to navigate the volatility of cryptocurrency markets. By understanding the concepts and mechanics of options trading, traders can harness the power of GDAX’s platform to refine their strategies, mitigate risks, and maximize their returns. Remember, the key to success lies in continuous learning, prudent risk management, and a deep understanding of the intricacies of the market.

Image: www.reddit.com

Gdax Options Trading

Image: coincentral.com