In the ever-evolving world of financial markets, traders are constantly seeking innovative strategies to maximize their returns. One of the latest game-changers in this realm is the advent of future option trading hours. This groundbreaking shift has the potential to transform the way traders approach their strategies and unlock unprecedented opportunities for success.

Image: db-excel.com

Future option trading hours refer to the extended period during which traders can buy and sell future options contracts. Traditionally, these contracts had limited trading hours, often restricting access to key market moments. However, the expansion of trading hours has now provided traders with increased flexibility, allowing them to seize market opportunities throughout the day and night.

Key Advantages of Future Option Trading Hours

The extended trading hours for future options offer a host of benefits for traders:

-

Increased Market Access: With the extension of trading hours, traders can now participate in the market during more favorable market conditions, such as pre-market and post-market sessions. This enhanced access enables traders to capitalize on market movements that occur outside of regular trading hours, potentially increasing their earning potential.

-

Reduced Volatility: Typically, pre-market and post-market sessions experience lower volatility than regular trading hours. This reduced volatility can provide traders with opportunities to enter or exit positions with less risk, potentially enhancing their overall profitability.

-

Flexibility and Convenience: The expansion of trading hours accommodates the diverse schedules of modern traders. Traders can now trade at times that fit their availability, allowing them to balance their trading activities with other commitments.

Exploring Future Option Trading Strategies

The extended trading hours open up new possibilities for developing innovative trading strategies. Here are a few approaches to consider:

-

Pre-Market Trading: By entering positions before the opening bell, traders can capitalize on early market movements and identify potential breakout opportunities. This strategy can be particularly beneficial for day traders seeking quick profits.

-

Post-Market Trading: Post-market trading allows traders to extend their trading sessions beyond the market close. This can provide an advantage in capturing price discrepancies or reacting to news and events that occur after regular trading hours.

-

Overnight Trading: Overnight trading enables traders to maintain positions throughout market closure. This strategy is suited for longer-term traders who aim to capture overnight trends or protect their portfolios from adverse market fluctuations.

Image: yzyjifoh.web.fc2.com

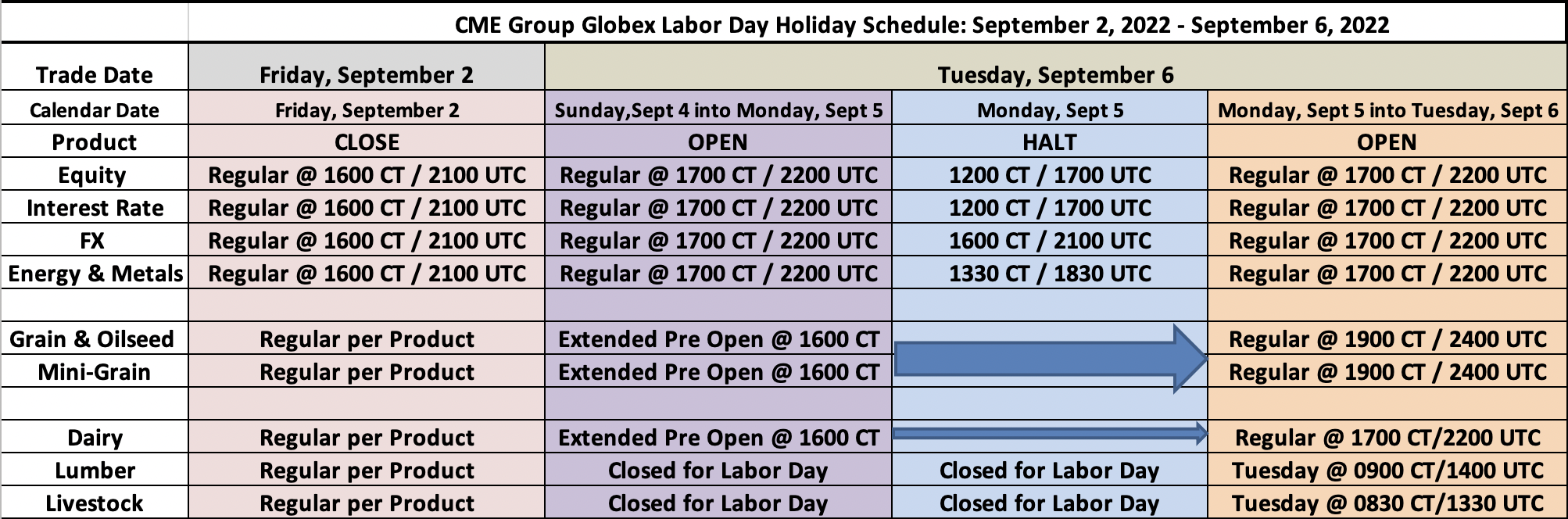

Future Option Trading Hours

Image: www.ampfutures.com

Empowering Traders with Future Option Trading Hours

The expanded trading hours for future options are more than just a change in market mechanics. They represent a profound shift that empowers traders with unprecedented flexibility and opportunities. By embracing these extended hours, traders can unlock new trading strategies, enhance their market access, and ultimately achieve greater financial success. As the future of option trading evolves, the extension of trading hours is poised to revolutionize the way traders operate in the financial markets.