Introduction

In the dynamic world of finance, options trading presents an exciting yet intricate arena. One intriguing strategy within this realm is fidelity options levels trading, a technique that empowers traders to adjust their risk-reward profiles while potentially enhancing their returns. This in-depth guide will unravel the complexities of fidelity options levels and roll trading, empowering readers to navigate this sophisticated strategy with confidence.

Image: www.fidelity.com

Understanding Fidelity Options Levels

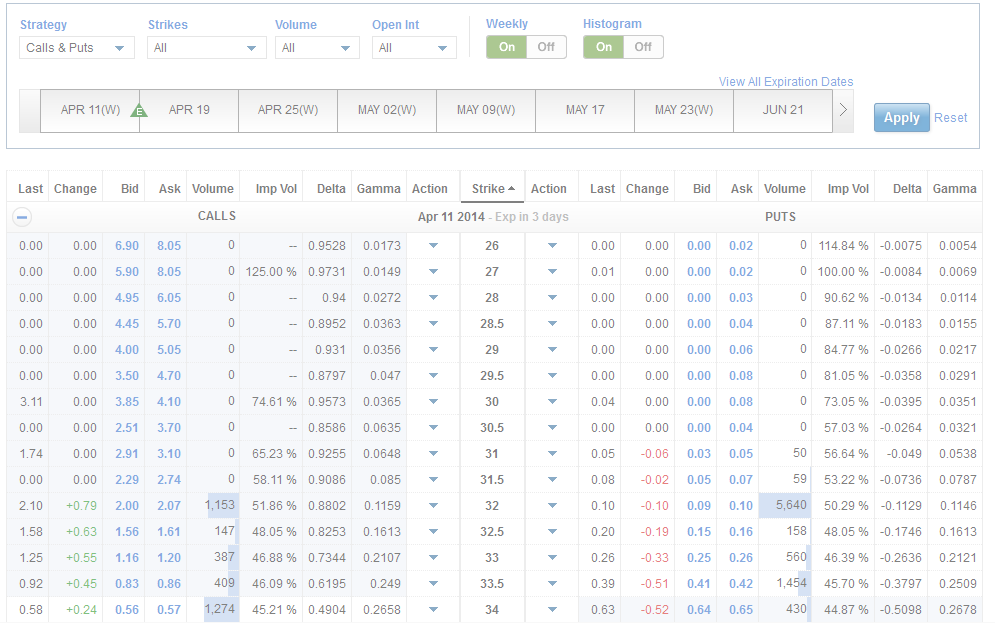

At the heart of fidelity options levels lies the concept of the “options chain.” Each stock has an associated options chain, which displays all available options contracts with varying strike prices and expiration dates. Fidelity options levels enable traders to focus on a specific price range within the chain, creating a tailored trading horizon. By selecting different levels, such as at-the-money (ATM), in-the-money (ITM), or out-of-the-money (OTM) options, traders can adjust the likelihood of option profitability and the potential volatility of their positions.

Roll Trading: Managing Risk and Positioning

Roll trading, an advanced technique employed by seasoned options traders, involves closing an existing options position and simultaneously opening a new one. This strategy allows traders to alter the strike price, expiration date, or both, reconfiguring their risk tolerance and profit potential. Roll trading offers several advantages:

-

Managing Risk: By rolling to a lower strike price, traders can reduce their maximum loss potential. Conversely, rolling to a higher strike price increases potential gains but also amplifies potential losses.

-

Adjusting Expiration: Extending the expiration date allows more time for the option to reach profitability, reducing the urgency of price fluctuations. Shortening the expiration enhances the potential for profit, but also introduces greater time decay risk.

-

Capture Volatility: Roll trading enables traders to capitalize on market volatility, shifting the options strike price to levels where greater price swings are anticipated.

Expert Insights: Navigating the Market

Renowned options expert, Dr. John Carter, emphasizes the importance of understanding the options chain and its relationship to underlying asset price action. He advises traders to “study the volume and open interest at each option strike price to gauge market sentiment and identify potential trading opportunities.”

Another renowned options strategist, Brian Overby, highlights the role of risk management in roll trading. “Careful consideration of profit targets, stop-loss levels, and position sizing is crucial to mitigate potential losses and maximize returns.”

Image: www.youtube.com

Actionable Tips for Success

-

Start with Small Positions: Gain experience in options trading gradually, starting with small positions to mitigate risk and build confidence.

-

Master Basic Options Concepts: Understand key concepts like intrinsic value, time value, and volatility before venturing into complex strategies.

-

Utilize Trading Platforms: Leverage advanced trading platforms that provide real-time data, option chain analysis tools, and backtesting capabilities.

-

Seek Professional Guidance: Consider consulting an experienced options trader or financial advisor to guide your trading decisions, especially when navigating complex roll trading strategies.

Fidelity Options Levels Roll Trading

Image: bdteletalk.com

Conclusion

The realm of fidelity options levels and roll trading offers a sophisticated yet rewarding opportunity for traders. By understanding the options chain, applying roll trading techniques, and adhering to expert advice, traders can potentially enhance their returns while managing risk. Remember to always approach trading with a measured mindset, seek continuous learning, and consult credible resources to make informed decisions. As you delve into this multifaceted strategy, may this guide serve as your compass, illuminating the path to successful options trading.