Embarking on the captivating journey of financial markets can be both daunting and exhilarating. Among the realm of investment options lies the intriguing world of option trading, where FedEx plays a pivotal role. This article aims to illuminate the intricacies of FedEx option trading, empowering you to navigate these financial waters with confidence.

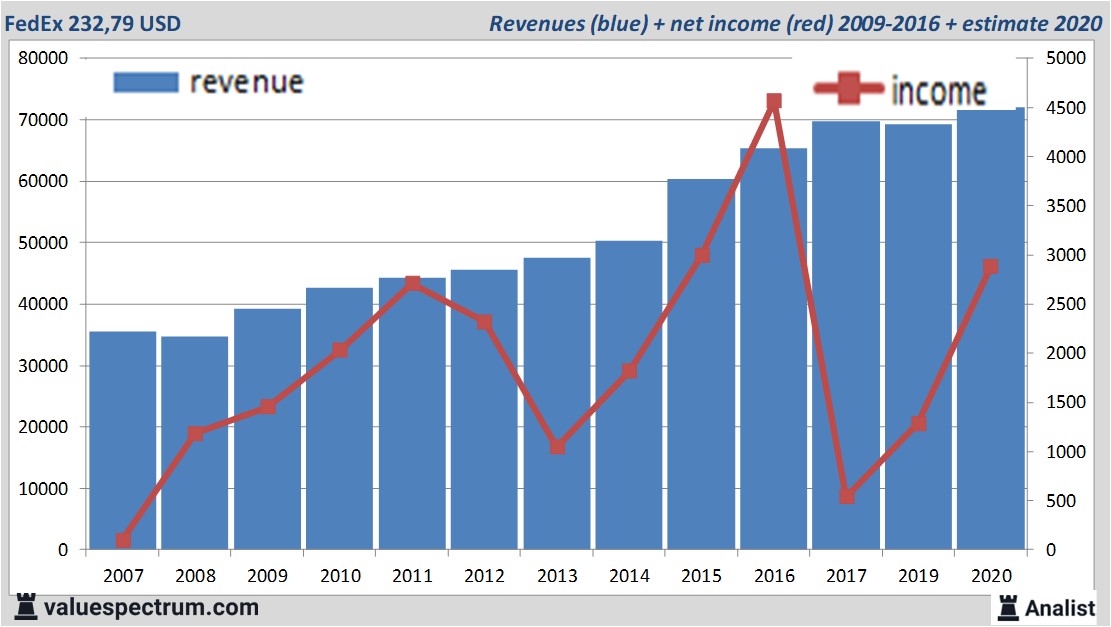

Image: www.valuespectrum.com

Understanding FedEx: A Global Logistics Titan

FedEx Corporation, the colossal multinational delivery behemoth, stands as a global leader in the transportation, e-commerce, and business services industries. Its unparalleled logistics network spans the globe, reaching far and wide, serving as a lifeline for businesses around the world. Through its strategic mergers and acquisitions, FedEx has consolidated its dominance, seamlessly connecting businesses and consumers with unmatched efficiency.

Decoding Option Trading: A Gateway to Market Volatility

In the ever-evolving financial landscape, options trading has emerged as a sophisticated instrument to harness the power of market volatility. Options are contracts that grant the buyer the right, but not the obligation, to buy or sell an underlying asset at a predetermined price and date. This versatile tool allows investors to mitigate risk, speculate on price movements, and generate income with relative flexibility.

FedEx Option Trading: Riding the Waves of Market Dynamics

FedEx option trading presents a unique avenue to capitalize on the market’s perception of this transportation giant. Traders can partake in option trading strategies, speculating on the future performance of FedEx’s stock. By analyzing market trends, economic indicators, and company-specific factors, investors can make informed decisions about buying or selling options.

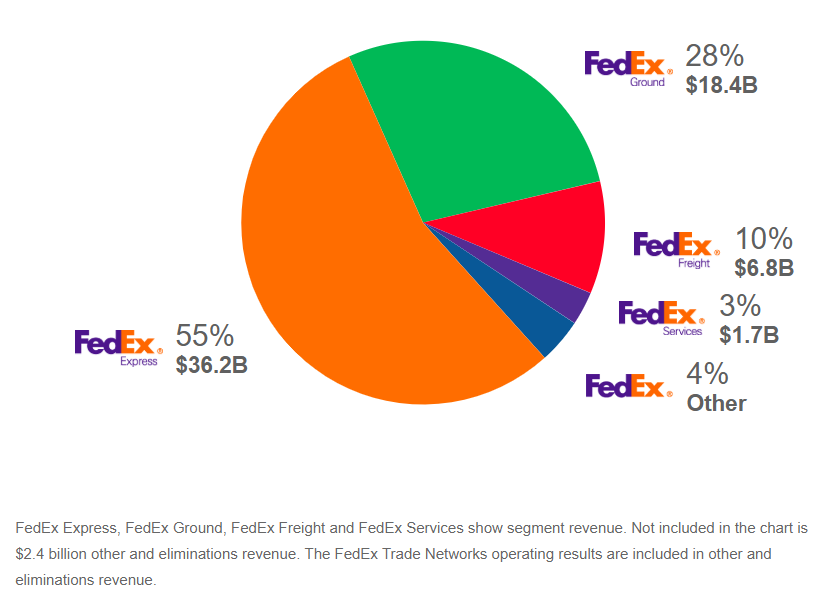

Image: www.forbes.com

Delving into the Mechanics of FedEx Option Trading

To navigate the intricacies of FedEx option trading, investors must first comprehend the fundamental workings of options. Each option contract comprises two essential elements: the strike price and the expiration date. The strike price represents the predetermined price at which the underlying asset can be bought or sold, while the expiration date signifies the deadline by which the contract must be executed. Options are either call options, which give the buyer the right to buy, or put options, which provide the right to sell.

Call Options: Betting on FedEx’s Rise

When traders anticipate an upward surge in FedEx’s stock price, they may purchase call options. If their prediction holds, they can exercise their right to buy shares at the predetermined strike price, leveraging the potential to profit from the stock’s appreciation. Conversely, if the stock price falters, the call options expire worthless, resulting in a loss of the premium paid for the contract.

Put Options: Hedging Against FedEx’s Decline

In scenarios where investors foresee a decline in FedEx’s stock price, they can opt for put options. These options grant the right to sell shares at the strike price, regardless of the actual market price. If the stock price indeed tumbles, put option holders can exercise their right to sell at a higher price than the market value, realizing a profit. However, if the stock price rises, the put options expire worthless, leading to the loss of the premium paid.

Navigating the Complexities of Option Pricing

The pricing of FedEx options is a nuanced blend of intrinsic value and extrinsic value. Intrinsic value, representing the immediate value of the option, is determined by the difference between the underlying stock price and the strike price. Extrinsic value, on the other hand, incorporates factors such as time to expiration, market volatility, and interest rates. Understanding the interplay of these variables is paramount for successful option trading.

Hedging with FedEx Options: Minimizing Risk

Beyond speculation, options can serve as a potent hedging tool. By taking calculated positions in FedEx options, investors can mitigate potential losses from adverse market movements. For example, investors holding a portfolio of FedEx stocks can purchase put options to create downside protection in case of a market downturn.

Unveiling Trading Strategies: Mastering the FedEx Option Landscape

The art of FedEx option trading encompasses a vast array of strategies, each tailored to specific market scenarios and risk appetites. Some popular strategies include:

- Covered Call: This strategy involves selling a call option while owning the corresponding number of shares of the underlying asset. It generates income through the option premium while limiting potential gains from stock appreciation.

- Protective Put: Here, investors buy a put option to protect against possible losses in their existing portfolio. The option’s cost acts as an insurance premium, mitigating potential downsides.

- Straddle: This strategy combines the purchase of both a call option and a put option with the same strike price and expiration date. It profits from significant market movements, regardless of the direction of price change.

Harnessing Technology: Catalyzing FedEx Option Trading

In the modern financial realm, technology plays a pivotal role in streamlining FedEx option trading. Online trading platforms and mobile apps provide real-time market data, advanced charting tools, and seamless order execution, empowering traders to make informed decisions and capitalize on market opportunities.

Venturing into the World of FedEx Option Trading

Embracing the world of FedEx option trading is an exciting but prudent endeavor. Before venturing into this realm, prospective traders are advised to:

- Educate Themselves: Acquiring a solid foundation in option trading concepts and FedEx-related market dynamics is indispensable. Books, online resources, and educational workshops can illuminate the complexities of this financial instrument.

- Practice with Caution: Employing a virtual trading platform or paper trading to gain hands-on experience without risking capital is a judicious approach. This preparatory step allows traders to sharpen their skills and confidence.

- Seek Professional Guidance: Consulting with experienced brokers or financial advisors can provide valuable insights, guidance, and tailored advice based on individual circumstances.

Fedex Option Trading

Image: seekingalpha.com

Conclusion

Unveiling the mysteries of FedEx option trading requires a fusion of knowledge, strategy, and prudent risk management. By delving into the inner workings of this financial instrument, investors can unlock opportunities to navigate market volatility, potentially generating income, enhancing portfolio resilience, and expanding their investment horizons. However, embarking on this path demands an unwavering commitment to education, diligent research, and judicious decision-making. Embrace the allure of FedEx option trading, but do so with the wisdom of a seasoned mariner navigating the vast financial seas.