The world of financial trading can be an intimidating landscape, especially for those unfamiliar with the intricacies of options. Among the various options contracts available, Euribor option trading holds a unique position due to its potential for substantial profits. However, mastery of this trading strategy requires a deep understanding of its underlying principles and trading nuances. Join us as we delve into the realm of Euribor option trading, equipping you with the knowledge and skills to navigate this lucrative market.

Image: www.spanishpropertyinsight.com

Understanding Euribor and its Role in Options Trading

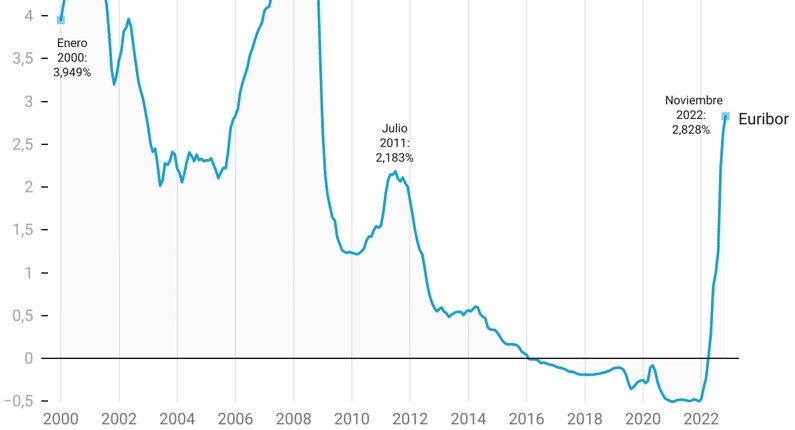

Euribor, short for Euro Interbank Offered Rate, serves as a benchmark interest rate for the eurozone. It represents the average interest rate at which banks offer unsecured overnight loans to each other. Euribor plays a crucial role in setting interest rates for loans, mortgages, and other financial instruments within the eurozone.

In options trading, Euribor options grant the holder the right, but not the obligation, to buy or sell a predefined amount of Euribor at a specified price (strike price) on or before a particular date (expiration date). Options traders can speculate on future movements in Euribor and position themselves to capitalize on favorable market conditions.

Mastering the Mechanics of Euribor Option Trading

Embarking on Euribor option trading requires a solid foundation in its mechanics. Traders must familiarize themselves with the different types of options available, including call options (giving the holder the right to buy) and put options (giving the holder the right to sell). Understanding the relationship between the strike price, expiration date, and market price of Euribor is paramount.

Additionally, the concept of option premiums and margin requirements deserves careful attention. Premiums represent the price paid for purchasing an option contract, and margin requirements ensure traders have sufficient funds to cover potential losses.

Time is of the Essence in Euribor Option Trading

Timing is a pivotal aspect of Euribor option trading, as the value of options contracts fluctuates with the remaining life before expiration. Options that expire soon (short-term options) are more sensitive to market movements and exhibit higher volatility. In contrast, longer-term options (long-term options) provide more time for the underlying Euribor to align with the trader’s predictions, albeit at the cost of potentially missing out on sudden market shifts.

Image: www.global-rates.com

Decoding the Language of Options Quotes

Interpreting options quotes is essential for making informed trading decisions. Quotes typically include the following components:

- Price: The current market price of the option contract.

- Bid: The highest price a buyer is willing to pay for the contract.

- Ask: The lowest price a seller is willing to accept for the contract.

- Spread: The difference between the bid and ask prices, indicating market liquidity.

A Journey into the Market with Expert Insights

Navigating the complexities of Euribor option trading requires guidance from seasoned professionals. Leading experts in the financial industry emphasize the importance of:

- Thorough research: Conducting in-depth analysis of historical data and market trends.

- Risk management: Establishing clear risk tolerance levels and employing protective strategies to mitigate potential losses.

- Sentiment analysis: Gauging market sentiment and identifying potential trading opportunities based on prevailing investor sentiment.

- Discipline: Adhering to a well-defined trading plan and avoiding emotional decision-making.

Euribor Option Trading Time

Image: futurfinances.com

Conclusion: Unlocking the Potential of Euribor Option Trading

The world of Euribor option trading presents a realm of opportunities for those who possess the knowledge and skills to navigate its complexities. By comprehending the fundamentals of the market, understanding option mechanics, mastering the art of timing, and seeking expert insights, traders can position themselves to maximize profits and make informed decisions. Remember, the journey of a successful trader requires continuous learning, adaptability, and a disciplined approach. Embrace the thrill of Euribor option trading and embark on a path to financial success.